2014 Volvo S60 Carfax Certified Free Shipping No Dealer Fees on 2040-cars

Hollywood, Florida, United States

Engine:5 Cylinder Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:Automatic

For Sale By:Dealer

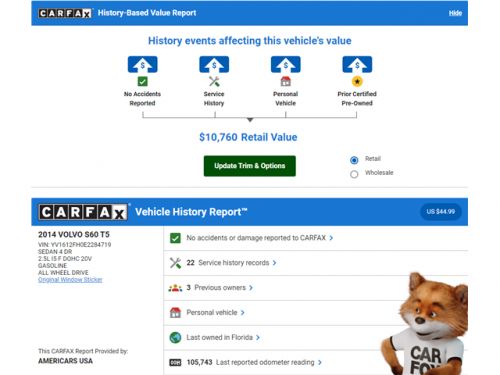

VIN (Vehicle Identification Number): YV1612FH0E2284719

Mileage: 105746

Make: Volvo

Trim: Carfax certified Free shipping No dealer fees

Drive Type: AWD

Horsepower Value: 250

Horsepower RPM: 5400

Net Torque Value: 266

Net Torque RPM: 1800

Style ID: 360080

Features: --

Power Options: Hydraulic Power-Assist Steering

Exterior Color: Silver

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Model: S60

Volvo S60 for Sale

2020 volvo s60 t5 momentum(US $9,321.00)

2020 volvo s60 t5 momentum(US $9,321.00) 2012 volvo s60 t5 salvage rebuildable repairable(US $3,995.00)

2012 volvo s60 t5 salvage rebuildable repairable(US $3,995.00) 2024 volvo s60 b5 awd ultimate dark theme(US $51,595.00)

2024 volvo s60 b5 awd ultimate dark theme(US $51,595.00) 2024 volvo s60 b5 plus black edition(US $48,545.00)

2024 volvo s60 b5 plus black edition(US $48,545.00) 2024 volvo s60 b5 plus dark theme(US $49,575.00)

2024 volvo s60 b5 plus dark theme(US $49,575.00) 2024 volvo s60 b5 awd core dark theme(US $47,495.00)

2024 volvo s60 b5 awd core dark theme(US $47,495.00)

Auto Services in Florida

Xtreme Auto Upholstery ★★★★★

Volvo Of Tampa ★★★★★

Value Tire Loxahatchee ★★★★★

Upholstery Solutions ★★★★★

Transmission Physician ★★★★★

Town & Country Golf Cars ★★★★★

Auto blog

2022 Volvo C40 Recharge priced, goes on sale late 2021

Mon, Jul 19 2021Pricing for the 2022 Volvo C40 Recharge is out, and in consistent coupe crossover fashion, itís a little more expensive than the traditionally-styled XC40 Recharge. The starting price is $59,845, including the $1,095 destination charge. That¬ís $4,760 more than a base 2022 XC40 Recharge. It¬íll be limited to just a single fully-loaded trim called ¬ďUltimate¬Ē initially ¬ó there will be no additional options, Volvo says. Volvo lets you choose a lower ¬ďPlus¬Ē trim with the standard XC40 Recharge, but the cheaper starting price also carries less standard equipment. Sweetening the deal for C40 customers is an Electrify America partnership that starts all owners off with 250 kWh of complimentary charging. This comes with the regular XC40 Recharge, too, but it must be a 2022 model year vehicle. One should also take into account any federal or state tax incentives on offer when running the number ¬ó Volvo is still eligible for the full $7,500 federal tax credit, so your effective net price could be closer to $50,000 depending on your location. Unfortunately, EPA-rated electric range on a full charge was not included in this announcement. Volvo announced the C40 with a 260-mile range estimate, but the real EPA number will surely fall below that figure. The XC40 Recharge, which the C40 shares all of its vital parts with, is EPA-rated for 208 miles on a full charge. Deliveries are scheduled to start in the fourth quarter this year for folks who pre-ordered the C40 online in March. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2024 Volvo C40 Recharge and XC40 Recharge add RWD, bigger battery pack

Tue, May 2 2023Volvo revealed rear-wheel-drive versions of its C40 Recharge and XC40 Recharge for Europe a few months ago, but mum was the word on U.S. availability. That changes today, as Volvo just debuted a host of updates and changes coming to the electric SUVs sold here. The big, new offering is that both the 2024 C40 Recharge and 2024 XC40 Recharge will be available in entry-level rear-wheel-drive models. Volvo developed a new and more efficient 248 horsepower electric motor that will sit on the rear axle for these models. The battery pack is also updated to be more energy dense, so itís now an 82 kilowatt-hour pack instead of a 78 kWh pack. Combine the more efficient motor with the bigger battery pack, and range skyrockets past the old AWD models. In this RWD configuration, the 2024 C40 Recharge is EPA-rated for 297 miles of range, and the XC40 Recharge at 293 miles.¬† Additionally, the charging experience should be greatly improved, as Volvo says it¬ís upgraded the maximum charge speed to 200 kW instead of the 150 kW it could manage previously. A 10-80% charge should now take approximately 28 minutes instead of the 40 minutes Volvo estimated previously. That¬ís going to make a big difference if you¬íre road tripping with multiple stops. The dual-motor AWD version of both cars are getting some updates, too. Instead of the identical motors on the front and rear axle, Volvo is putting its new 248 horsepower motor on the rear and a lower power 147 horsepower motor on the front axle. That front motor is only engaged when it¬ís needed, so Volvo says this updated AWD model will be more efficient than before. Unfortunately, both the C40 and XC40 Recharge AWD models will retain the old 78 kWh battery pack. This also means they¬íre saddled with the slower 150 kW charge speed. That said, the efficiency improvements from the new electric motor setup means range increases anyway. It goes up by 31 miles for the C40 Recharge to 257 miles, and by 21 miles for the XC40 Recharge to 254 miles. Other updates to the C40 Recharge and XC40 Recharge models include a new 19-inch aero wheel option, more paint colors and additional exterior themes to choose from. Updated pricing is not yet available. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2025 Volvo EX90 now $3,300 more expensive thanks to materials costs

Sun, Aug 11 2024Without any fanfare, and with sharp surprise to some dealerships and reservation holders, Automotive News reports Volvo upped the price on all EX90 trims by $3,300. The automaker told the outlet that it raised prices on May 1, a month before the EX90 entered production after almost a year of delays. Volvo said it told its dealer body and reservation holders about the increase on June 26, the same day it informed reservation holders that the electric SUV would miss certain features on delivery and be programmed with workarounds for some unsolved issues like battery drainage when parked. The omissions include at least one of the lidar-centric safety systems that Volvo touted as putting the EX90 ahead of the competition when the car launched. The company told one reservation holder the software gaps would be filled in sometime in the "early ownership" phase, the only rational kind of non-answer available to automakers working through EV bugs. We couldn't find any active EX90 forum threads about the price increase, a strange absence for an anticipated vehicle with more than 10,000 preorders. In a Reddit thread from June 27, a commenter writes, "Just got my [EX90] customization email and the price has indeed increased to $79,995 + $1,295 destination fee," making it sound like being surprised by the automaker instead of being informed, such surprise matching a story another potential buyer told AN. And now a note on the EX90 configurator warns shoppers that "Ventilated Nordico is expected to be delivered towards the latter part of the estimated delivery time above." Since there are no delivery times yet, that means no ventilated seats for U.S. buyers for an unknown amount of time.  The new MSRPs figures for EX90 in base Twin Motor form after the $1,295 destination charge are:  Plus 7-seater: $81,290  Plus 6-seater: $81,790  Ultra 7-seater: $85,640  Ultra 6-seater: $86,140  Add $5,000 to these prices to for the Twin Motor Performance drivetrain. Both versions run off a 111-kWh battery from CATL. The first provides a total of 402 horsepower and 568 pound-feet of torque, and a 0-60 time of 5.7 seconds. The performance version is good for 496 horsepower and 671 pound-feet of torque, shrinking the 0-60 time to 4.7 seconds. A company spokesperson named rising materials costs as the culprit.