1970 Volvo 144 Sedan on 2040-cars

Syosset, New York, United States

|

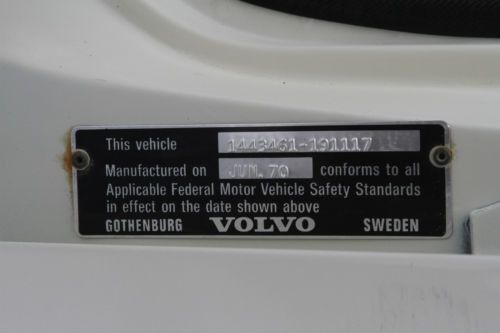

VIN: 1443461191117

1970 Volvo 144 Sedan Exotic Classics presents this 1970 Series 144 finished in Cascade White / Ivory with a Blue Cloth Interior. This Volvo has only 52,503 original miles. The exterior of the car presents well and is ALL ORIGINAL. A number of chips have been touched up and a couple small scratches are present. The vibrant blue interior is in very nice condition with no rips or tears. This 144 has a 118 horsepower 4 cylinder engine that runs and drives well. It has an automatic transmission and does not have air conditioning. The stereo system has been upgraded however the original radio will come with the car! Questions/concerns please call/text 516-655-0940 |

Volvo 940 for Sale

2007 volvo xc90 silver(US $9,800.00)

2007 volvo xc90 silver(US $9,800.00) 2010 volvo s40 2.4i sunroof leather alloy wheels 55k mi texas direct auto(US $16,980.00)

2010 volvo s40 2.4i sunroof leather alloy wheels 55k mi texas direct auto(US $16,980.00) 2014 volvo s60 t5 premier sunroof htd leather 4k miles texas direct auto(US $29,980.00)

2014 volvo s60 t5 premier sunroof htd leather 4k miles texas direct auto(US $29,980.00) 11 volvo xc90 4x2, 3.2l i6, auto, leather, sunroof, clean car fax.

11 volvo xc90 4x2, 3.2l i6, auto, leather, sunroof, clean car fax. Volvo v70 t5 wagon 3rd row leather heated auto sunroof autocheck no reserve

Volvo v70 t5 wagon 3rd row leather heated auto sunroof autocheck no reserve 2012 volvo xc60 3.2 premier plus climate pkg pano roof texas direct auto(US $27,980.00)

2012 volvo xc60 3.2 premier plus climate pkg pano roof texas direct auto(US $27,980.00)

Auto Services in New York

Zona Automotive ★★★★★

Zima Tire Supply ★★★★★

Worlds Best Auto, Inc ★★★★★

Vip Honda ★★★★★

VIP Auto Group ★★★★★

Village Line Auto Body ★★★★★

Auto blog

Volvo Polestar reveals new V8 Supercars engine

Mon, 09 Dec 2013Volvo may be better known for turbo fives and inline fours, but in 2005 it launched the XC90 with a new eight-cylinder engine built for it by Yamaha. Fast forward to this past June when Volvo announced its intention to enter Australia's V8 Supercars series, where it would compete with the likes of Ford, Holden, Nissan and Mercedes-AMG. This is the engine with which it intends to do so.

Revealed this weekend at the Sydney 500, this competition-spec powerplant is based on the same B8444S that powered the XC90 and S80 (not to mention the Noble M600), but tuned for racing duty to be shoehorned into the new S60 touring car. The 60-degree aluminum block has been bored out from 4.4 liters to 5.0, its compression ratio boosted to 10:1, modified to run on E85 bio-ethanol and its redline increased to 7500 rpm. Volvo also promises a unique engine note from its new racers.

While Volvo and its racing partner Polestar haven't released official output numbers, regulations call for outputs between 620 and 650 horsepower - in any event, a whole lot more than the 311 hp it produces in stock form. (Noble managed to squeeze that much out of the same block, but that required twin turbochargers while this unit remains naturally aspirated.) Scope out the details in the press release below and the photos from the reveal in the gallery above.

Polestar looking to tune Volvo CUVs

Sun, 19 Oct 2014Volvo is getting serious about emerging from the fringes and into the mainstream of the luxury automobile market. But if it's going to challenge the Germans, it's going to need a performance line. And that's just what it's developing with Polestar.

Building on the motorsport partnership that has seen Polestar represent Volvo in the Scandinavian Touring Car Championship, World Touring Car Championship and V8 Supercars series, Polestar has been charged with developing road-going performance Volvos as well. It currently offers comprehensively tuned versions of the S60 and V60, as well as engine upgrades for other models, but the latest word has it that Polestar will turn its attention next to tuning Volvo crossovers like the XC60 and the new XC90, pictured above in top-spec R-Design trim.

Details on how Volvo would modify those models remain to be determined, but it wouldn't be much of a stretch to imagine the XC60 outfitted with similar enhancements to those offered on its sedan and wagon stablemates to mount a challenge to the Audi SQ5. As for the larger XC90, it seems Volvo is already squeezing as much out of its new 2.0-liter triple-charged inline-four as it can, but more aggressive handling, aero and brakes could stand to transform the flagship crossover in pursuit of performance utes like the Mercedes ML63 AMG and BMW X5 M, even if it couldn't quite match their impressive horsepower outputs.

Volvo racks up the most IIHS Top Safety Pick+ awards of any 2022 carmaker

Fri, Apr 8 2022It should not come as any surprise, but Volvo has won the most IIHS Top Safety Pick+ awards of any automaker in 2022. Top Safety Pick+ is the Insurance Institute of Highway Safety's top prize. Volvo has accumulated 13 of the awards, spanning its entire lineup. IIHS and Volvo separates models between gasoline and electrified versions of the same car, even though the tests may have been conducted only on one variant. For example, the XC60 Recharge earns an TSP+ even though tests were conducted using gasoline-powered XC60 T5 and T6 models. Similarly, a C40 Recharge gets the award even though the actual test was conducted on a similar XC40 Recharge. Also, as with Mazda's lineup TSP+ rankings from earlier this year, some are carried over to 2022 model year cars from tests on previous model year cars. This is only when the model has not changed significantly. For example, the XC60's 2022 ranking was based on a 2018 model year's crash test. The IIHS conducts six tests on each car — a moderate overlap front crash, two small overlap front crashes for both driver and passenger, a side impact crash, a roof strength crush evaluation, and a head restraint test using just the car seat. The results are ranked out of four levels, with a green "Good" marker indicating the top tier. Beyond the crashes, Volvo earned top marks for standard safety features such as forward collision warning, automatic emergency braking, and pedestrian and cyclist detection. It should be noted that most Volvo models earned an "Acceptable" rating for ease of use of the LATCH safety seats. This is the second best rating, but does not affect crash worthiness, and won't matter if you don't use child seats. XC40 models received a "Poor" rating for its safety belt reminders, which IIHS deemed not loud or long enough. Some models like the S90 and XC60 received "Acceptable" ratings on headlights, with IIHS wishing the beams were brighter on turns. Despite these minor quibbles, the overall ratings are still very impressive. It should be noted that even the V60 and V90 wagons, which are (achingly beautiful but tragically) discontinued in America, also got TSP+ ratings though were not included in the 13-model 2022 count. Related Video This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Volvo XC90 Earns IIHS Top Safety Pick+ Crash Test Rating