2005 4x4 4wd Silver V8 Automatic Sunroof Miles:77k on 2040-cars

Phoenix, Arizona, United States

Vehicle Title:Clear

Engine:4.2L 4172CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

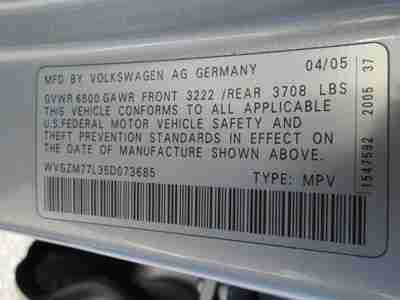

Make: Volkswagen

Warranty: Vehicle does NOT have an existing warranty

Model: Touareg

Trim: Base Sport Utility 4-Door

Options: Sunroof

Safety Features: Anti-Lock Brakes

Drive Type: AWD

Power Options: Power Locks

Mileage: 77,857

Sub Model: SUV

Exterior Color: Silver

Number of Cylinders: 8

Interior Color: Gray

Volkswagen Touareg for Sale

V8 air susp suv 4.2l anti-theft alarm & immobilizer iii theft deterrent

V8 air susp suv 4.2l anti-theft alarm & immobilizer iii theft deterrent 2004 v6 used 3.2l v6 24v automatic 4wd suv premium(US $10,995.00)

2004 v6 used 3.2l v6 24v automatic 4wd suv premium(US $10,995.00) We finance!! 2004 volkswagen touareg 4wd bixenonlights moonroof woodgraintrim(US $7,600.00)

We finance!! 2004 volkswagen touareg 4wd bixenonlights moonroof woodgraintrim(US $7,600.00) 2004 volkswagen touareg v10 tdi very rare 5.0l diesel suv loaded

2004 volkswagen touareg v10 tdi very rare 5.0l diesel suv loaded 2011 vw touareg tdi sport awd navigation 17k miles excellent!(US $42,995.00)

2011 vw touareg tdi sport awd navigation 17k miles excellent!(US $42,995.00) 1 owner touareg v6 luxury pano roof nav rear camera white over saddle pristine!!(US $35,900.00)

1 owner touareg v6 luxury pano roof nav rear camera white over saddle pristine!!(US $35,900.00)

Auto Services in Arizona

Vince`s Automotive Repair ★★★★★

Ultimate Imports ★★★★★

Tire & Auto Service Center ★★★★★

The Ding Doctor ★★★★★

Team Ramco ★★★★★

Stockton Hill Tire ★★★★★

Auto blog

New investor allows Suzuki to fend off VW

Tue, Aug 4 2015After years of legal wrangling, the long-soured partnership between Volkswagen and Suzuki looks finally to be coming out of arbitration, according to Bloomberg. As a sign of the Japanese brand's improved fortunes, hedge fund Third Point LLC recently bought an undisclosed stake in the company. The investor reported seeing a major opportunity in the successful Maruti Suzuki business in India. As an investment, the only major problem that Third Point found with Suzuki was its legal battle with VW. "The company's greatest asset is its low-cost manufacturing process for vehicles for the emerging market consumer," the fund said in a letter, according to Bloomberg. Third Point reportedly also wants a seat on Suzuki's board, despite being a minority shareholder. The alliance between Suzuki and VW goes back to late 2009. In the deal, the Japanese brand was meant to get access to cutting-edge tech, and the German firm got a helping hand towards better establishing itself in India and Southeast Asia. Things didn't go as planned, though. Less than two years later, Suzuki's boss publicly derided the deal. Eventually, the allegations started going back and forth, and the two have been working out a way to untangle practically ever since. Among the biggest issue has been how to get back the 19.9 percent stake that VW purchased. According to Bloomberg, the arbitration is now technically over. With the divorce nearly final, the two sides are just waiting on a decision on how to split things up. Suzuki may even just buy VW's stake to get the shares back.

The Civic goes hybrid, driving the Nissan Z Nismo and more | Autoblog Podcast #833

Thu, May 23 2024In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. They discuss the refreshed 2025 Honda Civic and its new hybrid powertrain, a possible Ford Maverick sport truck, rumblings of a new Mitsubishi Delica, the continued growth of hybrid sales, the UAW's loss in Mercedes' Alabama plant, the VW ID.7 being delayed, Tesla Semi news and the BYD Shark headed to Mexico. They chat about Formula 1 for a moment before hopping into the reviews section. Zac's been driving the new 2024 Nissan Z Nismo, and Greg's been spending a bunch of time in the long-term 2024 Mazda CX-90 PHEV. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #833 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News 2025 Honda Civic Hybrid refresh Maverick sport truck on the way? Is Mitsubishi bringing a new Delica to North America? Hybrid sales are booming The UAW loses in Mercedes vote Volkswagen ID.7 delayed in North America Tesla Semi picks up more steam BYD Shark is headed to Mexico as a mid-size pickup Formula 1 catch-up Cars we're driving: 2024 Nissan Z Nismo 2024 Mazda CX-90 PHEV Long-Termer Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Government/Legal Green Motorsports Podcasts Ford Honda Mazda Mercedes-Benz Mitsubishi Nissan Toyota Volkswagen Truck Crossover Hatchback SUV Electric Hybrid Luxury Off-Road Vehicles Performance Sedan Podcasts

Next VW Camper van concept to be electric

Sun, Apr 5 2015The next-generation Volkswagen Transporter workhorse van (teased above) debuts on April 15, but VW is also working on a more retro-inspired van concept that would be motivated by electric power. Dr. Heinz-Jakob Neusser, Volkswagen development boss on the automotive giant's board of management, described the upcoming Camper concept to Autocar at the New York Auto Show. On the outside, the model would feature a wide D-pillar, boxy design and small front overhang to maintain a classic look. "The distance from the A-pillar to the front end must be very short," he said to Autocar. For power, an electric motor would spin the front axle, and the batteries would be located under the floor. Dr. Neusser was clear that the electric van was just a concept but didn't say when it might debut. He also didn't indicate if the vehicle shared a platform with the new T6 or some over model in the company's lineup. VW has been toying with building a retro-style van for over a decade. In 2001, it showed the Microbus concept, and a decade later there was the Bulli. Neither of them ever actually saw production.