2008 Volkswagen Rabbit Candy White With Black Accents on 2040-cars

Lannon, Wisconsin, United States

Body Type:Hatchback

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Engine:2.5

Make: Volkswagen

Model: Rabbit

Trim: S Hatchback 2-Door

Options: CD Player

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag

Mileage: 52,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Heated Mirrors, IPod/MP3 Input, Keyless Entry, Alarm, TWIN CITY KIT

Exterior Color: White

Interior Color: Black

Number of Cylinders: 4

2008 Volkswagen Rabbit white with FUEL EFFICIENT 29 MPG Hwy/22 MPG City! CARFAX 1-Owner, Excellent Condition, ONLY 51,000 Miles. KEY FEATURES INCLUDE-Heated Mirrors, iPod/MP3 Input, CD Player MP3 Player, Keyless Entry, Child Safety Locks, Alarm, Traction Control. TWIN CITY KIT: dark tail lamps, twin exhaust tips, roof spoiler, 18" silver "Goal" alloy wheels, PROTECTION KIT: (4) rubber mats, trunk liner, (4) splash guards. S with Candy White exterior and Anthracite interior features a 5 Cylinder Engine with 170 HP*. Non-Smoker vehicle.

Volkswagen Rabbit for Sale

1983 vw rabbit convertible **as is** for parts

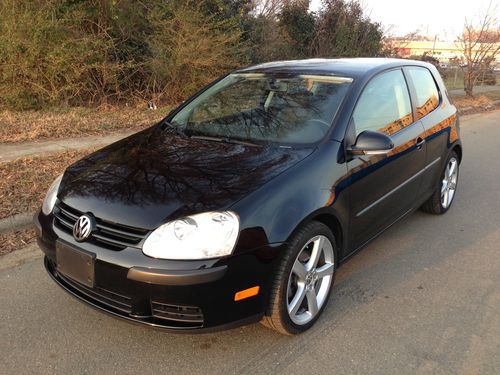

1983 vw rabbit convertible **as is** for parts 2008 vw rabbit auto sharp black with 18`` wheels looks runs n drives like new!!!(US $7,300.00)

2008 vw rabbit auto sharp black with 18`` wheels looks runs n drives like new!!!(US $7,300.00) 1984 volkswagon rabbit classic deisel

1984 volkswagon rabbit classic deisel 1981 volkswagen rabbit - diesel ls(US $3,500.00)

1981 volkswagen rabbit - diesel ls(US $3,500.00) Volkswagen rabbit pickup

Volkswagen rabbit pickup 1981 volkswagon diesel rabbit pickup(US $2,475.00)

1981 volkswagon diesel rabbit pickup(US $2,475.00)

Auto Services in Wisconsin

WE Recycle Auto Parts ★★★★★

Vande Hey Brantmeier Central Garage ★★★★★

Two Guys Automotive ★★★★★

Tool Shed Inc ★★★★★

Tilsner Collision Center ★★★★★

Suamico Garage ★★★★★

Auto blog

Volkswagen formally introduces super-efficient XL1

Mon, 04 Mar 2013Lightweight and low drag are hallmarks of great sportscar design. But when paired with a super-efficient, hybrid powertrain, you have the Volkswagen's XL1 that has been formally introduced in Geneva today.

When the 1,700-lb, carbon-fiber-bodied two-seater hits the road, its claimed 261 miles per gallon will make it the world's most-fuel-efficient production car. Though "production car" might be a stretch since VW said in a February press release that the XL1 would be built using "handcrafting-like production methods." We translate that to mean you won't be seeing many of these cars on the road. Though no one at VW has mentioned pricing yet, early rumors suggested a six-figure price tag.

That's supercar budget for a vehicle that has a 47-horsepower, two-cylinder diesel engine and a 27hp electric motor. With numbers like that, owners can expect 0-62 mph times of 12.7 seconds and top speed near 100 mph.

VW has received several tentative bids for Ducati

Thu, Jul 20 2017Italy's Benetton family is vying with motorbike firms and buyout funds for control of Italian motorcycle brand Ducati, which is being sold by Germany's Volkswagen, sources involved in the process told Reuters. Volkswagen, whose Audi division controls Ducati, has received several tentative bids with the Benetton family's investment vehicle Edizione Holding valuing the Monster motorbike maker at $1.2 billion, one of the sources said. As well as Edizione Holding, U.S. buyout fund Bain Capital, which owns a stake in Ski-Doo snowmobiles maker BRB, and two Indian motorbike firms, Eicher Motors and Bajaj Auto, have also bid for Ducati, the sources said. Indian carmaker Eicher controls Royal Enfield, a motorcycle brand established in 1893 which ranks as one of the oldest. Strategic bidders also include U.S. automotive firm Polaris Industries, which earlier this year said it would wind down its struggling Victory Motorcycle brand. A shortlist of bidders for a second stage of the auction could be selected as soon as Saturday, two of the sources said. Volkswagen adviser Evercore has a long list of bidders including private equity funds such as Ducati's previous owner Investindustrial, CVC Capital Partners, Advent and PAI, all hoping to outbid industry players, the sources said. If it gets to the second round, Edizione Holding could seek to form a consortium with a financial investor, two of the sources said, in a bid to secure control of Ducati, whose racers have won the Superbike world championship 14 times, with Carl Fogarty and Troy Bayliss its most successful riders. Audi, Edizione Holding, Investindustrial, Advent and PAI declined to comment, while the other interested groups were not immediately available for comment. PRICING CHALLENGES For some buyout funds, Ducati's valuation of up to $1.4 billion – which sources said is based on a multiple of more than 10 times its core earnings of roughly 100 million euros – is a tall order as they lack the synergies that some motorbike makers could achieve. But Investindustrial founder Andrea Bonomi, who sold Ducati to Audi for about 860 million euros in 2012, is serious about a comeback, one of the sources said. China's Loncin Motor was among a group of industry players that initially showed interest in Ducati, alongside Harley-Davidson. The latter has, however, decided against making a bid due to Ducati's price tag, while it could not be established if Loncin Motor had carried on bidding.

Porsche board members facing another ˆ1.8B lawsuit over VW takeover bid

Mon, 03 Feb 2014Back in 2008, Porsche got the bright idea that it could take over Volkswagen in the midst of the worst economic slump since the Great Depression. Ignoring that this was a catastrophic move for the Stuttgart sports car manufacturer that that eventually resulted in it nearly going bankrupt and eventually being taken over by the same company it sought to control, the aftermath has left Porsche Chairman Wolfgang Porsche and board member Ferdinand Piëch in the crosshairs of seven hedge funds that lost out during the takeover and are now seeking €1.8 billion - $2.43 billion US - in damages from the two execs, according to the BBC.

See, investors bet on Volkswagen's share price going down, partially because Porsche said it wasn't going to attempt a takeover. But Porsche was attempting to take over VW, having bought up nearly 75-percent of VW's publicly traded shares. When word broke that Porsche owned nearly three-quarters of VW (which indicated an imminent takeover attempt), rather than go down like the hedge funds bet it would, VW's share price skyrocketed to over 1,000 euros per share, according to Reuters.

Naturally, when you bet that a company's share price is going to drop and it in turn (temporarily) becomes the world's most valuable company, you lose a lot of money, unless you're able to buy up shares before prices jump too much. This led to a squeeze on the stock, which the hedge funds accuse Porsche and Piëch (who are both members of the Porsche family and supervisory board) of organizing.