2014 Volkswagen Passat 2.0l Tdi Se on 2040-cars

27850 U.S. 19 N, Clearwater, Florida, United States

Engine:2.0L I4 16V DDI DOHC Turbo Diesel

Transmission:6-Speed Automatic with Auto-Shift

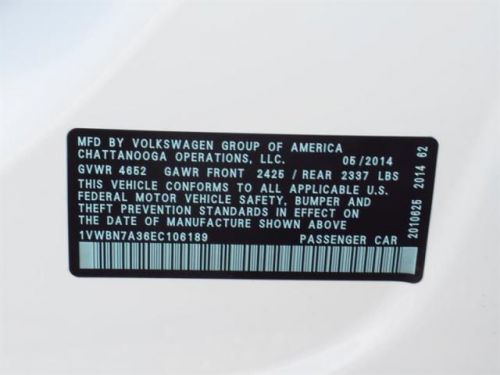

VIN (Vehicle Identification Number): 1VWBN7A36EC106189

Stock Num: V106189

Make: Volkswagen

Model: Passat 2.0L TDI SE

Year: 2014

Exterior Color: Candy White

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 10

Come experience Lokey Volkswagen today!! Lokey VW in Clearwater is the #1 Volume-Selling VW dealership in the region... Here are some great reasons why you should buy from Lokey VW in Clearwater, FL. - Over 60 Years of Excellence - Family Owned and Operated since 1952. -Tampa Bay's Largest selection of New and Used Cars - over 450 vehicles in-stock -Lifetime Oil Changes for as long as you own your car! - Shuttle Service and Alternate Transportation -Express Service Privilege -Free Car Wash with Service Visit ** No two offers can be combined. For details, call 888-475-0710 and ask to speak with our Customer Service Team for more information on the vehicle shown in this listing . Disclaimer -New Vehicle Retail Value includes the protection/appearance package. Appearance package includes Clear Door Edge Guards, Paint Sealant and Pruiden Nitrogen in all tires. Tax, tags, title and other dealer fees not included. Dealer not responsible for typographic errors. Please see Dealer for complete details and advertised special pricing.

Volkswagen Passat for Sale

2014 volkswagen passat 3.6 se(US $32,270.00)

2014 volkswagen passat 3.6 se(US $32,270.00) 2014 volkswagen passat 1.8t sel premium(US $34,355.00)

2014 volkswagen passat 1.8t sel premium(US $34,355.00) 2014 volkswagen passat 2.0l tdi sel premium(US $35,815.00)

2014 volkswagen passat 2.0l tdi sel premium(US $35,815.00) 2014 volkswagen passat 2.0l tdi sel premium(US $36,405.00)

2014 volkswagen passat 2.0l tdi sel premium(US $36,405.00) 2014 volkswagen passat 1.8t s(US $24,780.00)

2014 volkswagen passat 1.8t s(US $24,780.00) 2014 volkswagen passat 1.8t s(US $26,575.00)

2014 volkswagen passat 1.8t s(US $26,575.00)

Auto Services in Florida

Yesterday`s Speed & Custom ★★★★★

Wills Starter Svc ★★★★★

WestPalmTires.com ★★★★★

West Coast Wheel Alignment ★★★★★

Wagen Werks ★★★★★

Villafane Auto Body ★★★★★

Auto blog

Lamborghini has been developing an IPO strategy 'for a long time'

Mon, Nov 7 2022Porsche AG isn’t the only Volkswagen AG brand that has been quietly preparing for a potential initial public offering. Italian luxury-car maker Lamborghini has been developing a strategy how to present itself to stock-market investors since well before Volkswagen asked each of its brands to come up with virtual equity stories, according to the unitÂ’s Chief Executive Officer Stephan Winkelmann. “WeÂ’ve been working on this with other agencies in order to create clarity,” Winkelmann said. “As a brand, weÂ’ve done so for a long time, to show what worth, what value we have. Up until a little while ago, it wasnÂ’t so well known.” Porsche became EuropeÂ’s most valuable automaker last month, when its market capitalization overtook that of VW a week after its IPO in Frankfurt. The debut of the 911 maker was a bold move into public markets, which have been largely shut for most of the year. VW CEO Oliver Blume has said he sees the listing as a blueprint to unlock more value from the groupÂ’s brands that also include Audi and Bentley. “An IPO drill is exactly what you do to show the public how solid you are and what is in progress for the future,” Winkelmann said. “We have a clear story and strategy for that.” Audi, which oversees VWÂ’s premium brands, said last month there are no concrete plans for an IPO of Lamborghini. A previous push to potentially spin off the carmaker and motorcycle brand Ducati ran into opposition from labor leaders. Still, LamborghiniÂ’s recent profit gains -- including a 31.9% operating margin in the first half of this year -- make a solid case for a stock-market listing, said Michael Dean, an analyst at Bloomberg Intelligence. “An IPO is something that could potentially happen in the next 18 months, depending on market conditions,” Dean said. “A ˆ15 billion valuation is entirely justifiable and could be even higher, given the margin metrics.” LamborghiniÂ’s deliveries rose 8% to 7,430 vehicles in the first nine months of the year. Operating profit climbed 69% to ˆ570 million ($567 million). Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Lamborghini teases Huracan Sterrato tackling terrain

Audi spending an additional $2.5 billion on expansion through 2019

Thu, Jan 1 2015Every year, it seems the Volkswagen Group announces a new and larger spend to push growth and profit, with Audi a regular recipient of the moolah. That's reasonable, seeing as hauls in 40 percent of Group operating profits. In December last year Audi said it would spend an additional 100 million euros ($122M US) per year through 2018 to develop new models and expand production, targeting 60 models by 2020 and luxury sales leadership. This month Audi said it will boost that by another two billion euros ($2.5B US) over the next five years, for a total outlay of 24 billion euros from 2014 to 2019. Something like 70 percent of those billions will be spent on new models, technology like "connectivity and lightweight construction," and factory expansion at its plants in Ingolstadt and Neckarsulm. Most of the ten models that will plump the lineup to 60 cars will mainly be aimed at the C and D segments, as well as crossovers, the brand's burgeoning portfolio of PHEV models, and all-electric cars that will begin staking ground in the segment. The big spend comes at the same time as Audi is working hard to reduce costs by $2.5 billion to maintain profitability, part of a larger push by VW to cut costs by $6.1 billion by 2017. More than a billion euros will go to new factories in Mexico and Brazil. Work begins on the Mexico plant next year, and when it comes on-line in 2016, Audi's Q5 successor will roll out of its warehouse doors; Audi has already announced it will hire 850 more workers next year in Mexico. When that's done, Mexico's production of German luxury cars will only trail that of Germany, China and the US. The company's Brazil plant will produce the A3 and S3 starting next year, and the brand figures luxury car buying there will triple by 2017. News Source: Reuters Earnings/Financials Plants/Manufacturing Audi Volkswagen Luxury Mexico Brazil ulrich hackenberg

Recharge Wrap-up: Chevy bi-fuel Silverado 3500HD Chassis Cab, VW Car-Net works with Apple Watch

Fri, May 8 2015Volkswagen's Car-Net app will be compatible with the Apple Watch. Using the app, owners will be able to lock and unlock their car, check charging status or fuel level, locate their car, flash the lights, and honk the horn of their vehicle remotely from their wrist. E-Golf owners can begin or end charging or operate climate control through their Apple Watch. The app can also monitor other household drivers with speed and boundary alerts - perfect for the parent who lends their car to a teenager. Read more in the press release from Volkswagen. Chevrolet is launching the bi-fuel 2016 Silverado 3500HD Chassis Cab. The work truck will now offer a version that will run on both gasoline and compressed natural gas (CNG). "CNG burns cleaner and costs less at the pump than gasoline, making it an appealing option for fleets," says GM's Ed Peper. Companies like Southern California Gas Co. find that trucks like this meet their work needs and help them achieve their goals of greening up their fleets, GM says. Read more in the press release from GM. UPS has made a deal to buy renewable natural gas from Clean Energy Fuels. This make UPS the biggest user of natural gas in the shipping industry. Clean Energy Fuels, co-founded by T. Boone Pickens, will provide UPS with its Redeem brand natural gas, which uses methane captured from landfills. UPS hopes to log 1 billion miles with its alternative fuel and advanced technology fleet by 2020. "Our rolling laboratory approach provides a unique opportunity for UPS to test different fuels and technologies," says Mitch Nichols of UPS. "Today's RNG agreement will help mature the market for this promising alternative fuel." Read more in the press release below. UPS BECOMES NATION'S LARGEST USER OF RENEWABLE NATURAL GAS IN SHIPPING INDUSTRY New Agreement with Clean Energy Will Help Grow Market for Use of Methane Gas from Landfills as Fuel Atlanta, May 5, 2015 – UPS® (NYSE:UPS) today announced it has entered into an agreement to purchase renewable natural gas (RNG) for its delivery vehicle fleet from Clean Energy Fuels Corp. (NASDAQ: CLNE). The deal signifies UPS's plan to significantly expand its use of renewable natural gas for its alternative fuel and advanced technology fleet. The company has a goal of driving one billion miles using its alternative fuel and advanced technology fleet by the end of 2017. Clean Energy Fuels, co-founded by T.