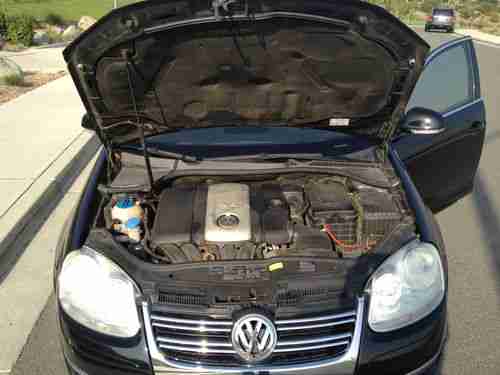

2005 Volkswagen Jetta 2.5 Sedan Black On Tan Clean Title Great Package L@@k on 2040-cars

Corona, CA, United States

Vehicle Title:Clear

Fuel Type:GAS

Engine:2.5L 5 Cylinder Gasoline Fuel

Make: Volkswagen

Warranty: Vehicle does NOT have an existing warranty

Model: Jetta

Trim: 2.5 Sedan 4-Door

Number of Doors: 4

Drive Type: FWD

Mileage: 84,500

Exterior Color: Black

Interior Color: Tan

Number of Cylinders: 5

Volkswagen Jetta for Sale

2001 volkswagen vw jetta 1.8t turbo gls sedan red 5 speed(US $4,900.00)

2001 volkswagen vw jetta 1.8t turbo gls sedan red 5 speed(US $4,900.00) 2001 jetta vw tdi tdi manual tranny no reserve diesel

2001 jetta vw tdi tdi manual tranny no reserve diesel 2012 volkswagen jetta turbo diesel tdi premium low miles!!!!(US $21,955.00)

2012 volkswagen jetta turbo diesel tdi premium low miles!!!!(US $21,955.00) 1985 vw jetta diesel

1985 vw jetta diesel 2011 volkswagen jetta tdi(US $21,988.00)

2011 volkswagen jetta tdi(US $21,988.00) Tdi diesel navigation black wheels pano 6 speed htd seats 2012 vw sportswagen 9k(US $24,900.00)

Tdi diesel navigation black wheels pano 6 speed htd seats 2012 vw sportswagen 9k(US $24,900.00)

Auto Services in California

Zip Auto Glass Repair ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Repair Shop ★★★★★

Westside Body & Paint ★★★★★

Westcoast Autobahn ★★★★★

Westcoast Auto Sales ★★★★★

Auto blog

Carmakers say they 'can't meet' Euro 6 emissions targets

Sun, Oct 4 2015UPDATE: A previous version of this story listed Euro 6 requirements in kilograms per kilometer. This was incorrect. The correct unit is grams of NOx per kilometer, or g/km. The story has been edited accordingly. Well, the timing of this is not good. In the midst of Volkswagen's emissions cheating scandal, the European Automobile Manufacturers Association (ACEA) is claiming it won't be able to hit the stringent Euro 6 nitrogen oxide standards currently slated for the end of the decade. Currently, European legislators are set to begin requiring tougher emissions standards by 2017. Standards would be ramped up until 2020, when all new cars sold across the pond would be required to emit just 0.080 kilograms of nitrogen oxide per kilometer. That's too tough for automakers, though. Citing an "EU insider," AutoExpress reports that automakers are asking for conformity factors, which is a fancy way of saying they want easier standards. The automakers are requesting a conformity factor of 2.75 from 2017 to 2020, and a factor of 1.7 in 2020. What that means is that by 2020, new diesels would be allowed to emit 1.7 times the 0.080 g/km standard, or 0.136 g/km. While that might not be all that bad, if automakers were granted the 2.75 conformity factor, new diesels from 2017 wouldn't even be eligible for today's Euro 5 classification, AE claims. Far and away the most astonishing thing here though, is the way the ACEA is viewing the VW diesel scandal. According to AE, the EU insider said automakers across the pond think there's "a US conspiracy against European diesels." Yep. Volkswagen installed software on millions of vehicles to cheat emissions tests and it's somehow an American conspiracy. That makes loads of sense. To put it simply, automakers don't think their diesels will be able to hit European standards, so they're asking for a break. Whether European legislators go along with it remains to be seen. Related Video:

TRANSLOGIC 150: Volkswagen XL1

Mon, Feb 24 2014How do you build the world's most fuel-efficient production car? Start with the world's most aerodynamic design. The Volkswagen XL1 is capable of 261 miles per gallon thanks to its sleek shape and ultra efficient plug-in diesel hybrid powertrain. The downside is that only 250 will be made and none will be sold stateside. That didn't stop us from taking our turn behind the wheel of this truly revolutionary ride.

Regulators consider adding more carmakers to Takata recall

Tue, Sep 29 2015Volkswagen's diesel emissions scandal has been getting a lot of press recently, but the Takata airbag inflator affair could be grabbing headlines again soon. According to Bloomberg, the National Highway Traffic Safety Administration is contemplating an expansion to the campaign that could add seven automakers to the 12 already affected. They are Jaguar Land Rover, Mercedes-Benz, Spartan Motors, Suzuki, Tesla, Volvo Trucks, and VW Group. To be clear, there's no recall for any of these automakers, yet. The government is simply asking for a full list of vehicles that each of them have with Takata-supplied inflators containing ammonium nitrate propellant. The agency is concerned this substance could play a roll in the ruptures. "NHTSA is considering not only whether to issue an administrative order that would coordinate the remedy programs associated with the current Takata recalls, but also whether such an order should include expansion of the current recalls," the letters say. All seven can be viewed, here. From a report supplied by Takata, the government already knows that the company supplied 887,055 inflators with ammonium-nitrate propellant to VW and 184,926 of them to Tesla. In an incident during the summer, a side airbag allegedly burst in a 2015 VW Tiguan. In early September, NHTSA put out a revised report that there were 23.4 million inflators to be replaced in 19.2 million vehicles in the US. An earlier accounting from the agency had about 34 million of the parts in 30 million cars. High humidity is still believed to be among the biggest risk factors for the ruptures. Although, if ammonium nitrate also gets the blame, some already recalled models might need to be repaired again. Related Video: