2016 Volkswagen Golf on 2040-cars

Middletown, Connecticut, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

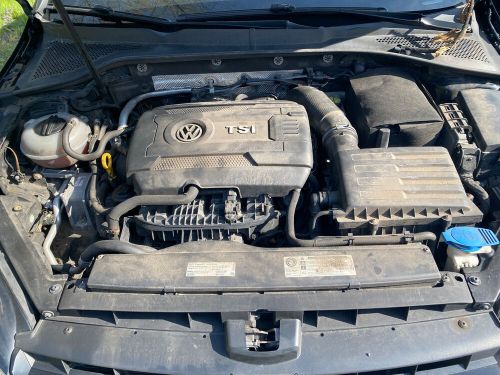

Engine:4 Cylinder

VIN (Vehicle Identification Number): 3VWC17AUXGM516679

Mileage: 150000

Make: Volkswagen

Model: Golf

Interior Color: Gray

Number of Seats: 5

Number of Previous Owners: 1

Number of Cylinders: 4

Drive Type: 2WD

Service History Available: Yes

Fuel Consumption Rate: 30 mpg

Safety Features: Anti-Lock Brakes, Back Seat Safety Belts, Driver Airbag, Electronic Stability Program (ESP), Passenger Airbag, Side Airbags, Traction Control

Drive Side: Left-Hand Drive

Engine Size: 1.8 L

Exterior Color: Black

Car Type: Modern Cars

Number of Doors: 4

Features: AM/FM Stereo, Air Conditioning, Alarm, Alloy Wheels, Automatic Wiper, Auxiliary heating, CD Player, Climate Control, Cloth seats, Cruise Control, DVD/CD Player, Electric Mirrors, Electronic Stability Control, Folding Mirrors, Independent and Adjustable Rear Seats, Power Locks, Power Seats, Power Steering, Power Windows, Tilt Steering Wheel

Volkswagen Golf for Sale

2018 volkswagen golf s(US $19,998.00)

2018 volkswagen golf s(US $19,998.00) 2019 volkswagen golf rabbit edition in rare cornflower blue(US $25,991.00)

2019 volkswagen golf rabbit edition in rare cornflower blue(US $25,991.00) 2019 volkswagen golf(US $33,500.00)

2019 volkswagen golf(US $33,500.00) 2020 volkswagen golf 2.0t se(US $21,950.00)

2020 volkswagen golf 2.0t se(US $21,950.00) 2009 volkswagen golf(US $1,500.00)

2009 volkswagen golf(US $1,500.00) 2003 volkswagen golf vr6(US $4,000.00)

2003 volkswagen golf vr6(US $4,000.00)

Auto Services in Connecticut

Wilton Auto Body Repair ★★★★★

Suburban Subaru ★★★★★

Stanley`s Auto Body ★★★★★

Shippan Auto Body ★★★★★

Safelite AutoGlass - North Haven ★★★★★

S & J Automotive ★★★★★

Auto blog

VW makes $23K on every Porsche sold, more than Bentley or Lamborghini

Fri, 14 Mar 2014It's a good time to be in the luxury car business. In Volkswagen Group's financial report for the 2013 fiscal year, it is revealed that that Porsche enjoyed an operating margin of 18 percent. That means the Stuttgart brand made on average about $23,200 per car sold, according to BusinessWeek. Bentley wasn't far behind, and Audi (which was combined with Lamborghini) posted a 10.1 percent margin. This compares to only around 2.9 percent for the Volkswagen brand.

"Luxury brands are on fire," said Dave Sullivan, an industry analyst at AutoPacific. He said that the average profit margin is between six and eight percent. Brands like Porsche and Bentley have the benefit of competing in rarefied markets. Buyers looking at one their vehicles have fewer models to shop against and don't care as much about price. They can also charge more for options, which further boosts income, according to BusinessWeek.

In a way, we should be more impressed by the continued success from Audi. Its models generally have direct competitors in every segment from the other premium automakers. Plus, their buyers aren't the captains of industry who are shopping for a Bentley. Still, the Four Rings is leading rivals in sales so far this year.

VW stock delisted from Dow Jones Sustainability Index

Thu, Oct 1 2015Because of the company's years-long diesel emissions evasions, Volkswagen AG is being removed from the Dow Jones Sustainability Indices effective October 6, according to a joint statement by S&P Dow Jones Indices LLC and RobecoSAM. After looking at reports of the automaker's cheating software, the DJSI has decided that the company shouldn't be part of the index anymore. According to The Detroit News, the DJSI is meant to track the top 10 percent of companies that are considered leaders environmentally and socially in each industry among the 2,500 largest companies in the S&P Global Broad Market Index. This de-listing means that VW is no longer considered an industry leader by this group for its economic, environmental and social performance. As of this writing, VW AG's stock price sits at 97.75 euros ($109.14), and the figure has been largely in freefall since the emissions evasions reports first surfaced. It was considered shocking on September 21 when the shares plunged almost 18 percent to end the day at 132.15 euros ($147.57). According to The Detroit News, the automaker has lost about $30.8 billion in value since the EPA put out its notice of violation on September 18. Related Video: Volkswagen AG to be Removed from the Dow Jones Sustainability Indices New York and Zurich, September 29, 2015 Effective October 6, 2015, Volkswagen AG (VW) will be removed from the Dow Jones Sustainability Indices (DJSI). A review of VW's standing in the DJSI was prompted by the recent revelations of manipulated emissions tests. Per the published and publicly available methodology for the DJSI, potential problematic issues relating to any DJSI component company automatically trigger a Media & Stakeholder Analysis (MSA), which examines the extent of the respective company's involvement and how it manages the issue. Following the MSA, the Dow Jones Sustainability Index Committee (DJSIC) reviews the issue and decides whether the company will remain in the index, based on DJSI Guidelines. In VW's case, the DJSIC reviewed the situation and ultimately decided to remove the Company from the DJSI World, the DJSI Europe, and all other DJSI indices. The stock will be removed after the close of trading in Frankfurt on October 5, 2015, thus making the removal effective on October 6, 2015. As a result, VW will no longer be identified as an Industry Group Leader in the "Automobiles & Components" industry group.

Former Porsche execs charged with stock manipulation in Germany

Wed, Aug 19 2015The ongoing indictment of top Porsche executives for alleged stock manipulation during the attempted takeover of Volkswagen has taken years to reach an actual decision, but a trial date has finally been set for October 22. In addition to former CEO Wendelin Wiedeking (pictured above) and ex-CFO Holger Haerter, prosecutors have also added Anton Hunger, who was communications boss at the time, to the list of those charged, according to Reuters. The men purportedly made false statements to investors about plans to acquire 75 percent of VW stock. The prosecutor also dropped charges against Ferdinand Piech and Wolfgang Porsche in the same case, Reuters reports. The two Porsche family members were on the company's board at the time, but investigators found that they had no role in making the false statements. If found guilty, the former Porsche execs could face up to five years in prison. As expected, lawyers for Wiedeking and Haerter have repeatedly denied any wrongdoing by their clients. The investigation into Porsche SE's actions during the failed VW takeover go back to at least 2009 when the firm's offices were raided. Wiedeking and Haerter were eventually indicted in 2012. A Stuttgart court initially dismissed the case for lack of evidence, but in 2014 that decision was reversed on appeal. At the same time, investors have brought multiple civil lawsuits against the company, but none of those cases have been successful.