Brazilian Title on 2040-cars

Curitiba, Texas, United States

Location : Brazil

Condition : very good

Stock : #4967

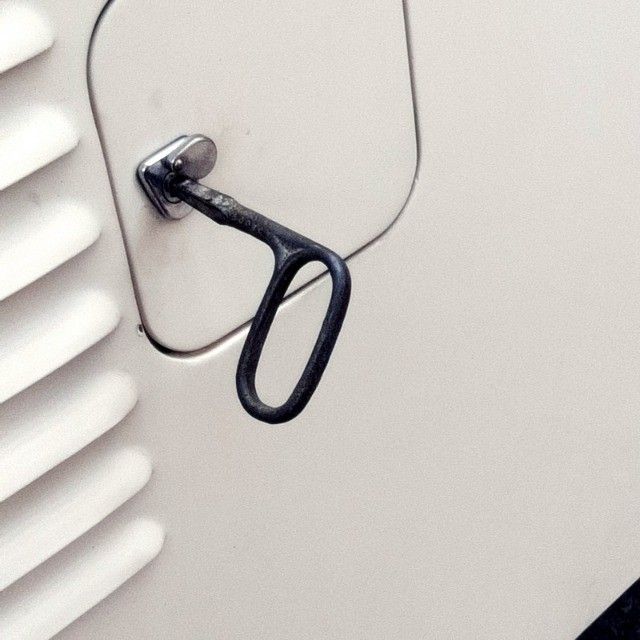

YEAR : 1961

Body Style : T1 split window bus

Ext Color : white

Additional Info : 42.000Km, 11 windows bus

https://www.brazilianclassiccars.com/store/p/1961vwt111windowsbus

For export from Brazil.

100's of cars exported by our company.

Contact us today.

Volkswagen Bus/Vanagon for Sale

1972 volkswagen busvanagon(US $15,820.00)

1972 volkswagen busvanagon(US $15,820.00) 1969 volkswagen bus/vanagon(US $13,000.00)

1969 volkswagen bus/vanagon(US $13,000.00) 1977 volkswagen busvanagon camper(US $16,800.00)

1977 volkswagen busvanagon camper(US $16,800.00) 1977 volkswagen busvanagon camper(US $16,800.00)

1977 volkswagen busvanagon camper(US $16,800.00) 1968 volkswagen kombi 23-window(US $17,000.00)

1968 volkswagen kombi 23-window(US $17,000.00) 1978 volkswagen bus type 2(US $16,000.00)

1978 volkswagen bus type 2(US $16,000.00)

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

German authorities investigate Winterkorn

Tue, Sep 29 2015Former Volkswagen CEO Martin Winterkorn is potentially walking away from the embattled automaker with a $32-million pension, but his retirement might not be quite so relaxed because German prosecutors in the city of Braunschweig (also called Brunswick) are now investigating his role in VW's diesel emissions evasion. The lawyers want to know whether he committed fraud, and a conviction could mean up to 10 years in prison, according to the Associated Press. However, this process is still in its earliest stages, and Winterkorn is long way from sitting in a courtroom. With other high-profile corporate cases in Germany as a guide, a trial could be years away. Lawyers haven't even questioned the former CEO, yet. In Germany, people are free to file criminal complaints, and prosecutors then decide whether a full investigation is necessary. According to the AP, Braunschweig has received about 12 grievances so far, including one from Volkswagen. The law in the country also doesn't allow charging businesses with wrongdoing, only people. Winterkorn resigned from his role at the top of VW last week, just a day after issuing a video apology for the automaker's actions. Former Porsche boss Matthias Muller has succeeded him. Along with having a new person in charge, the automaker's Supervisory Board instituted a thorough corporate reshuffle to put more focus on various regions and give brands additional power by early next year. Related Video:

Which will Dieselgate hurt more, Volkswagen or US diesels?

Tue, Sep 22 2015The most damning response to the news Volkswagen skirted emissions regulations for its diesel models may have actually come from the Los Angeles Times. On Saturday, the Times published an editorial titled "Did Volkswagen cheat?" The answer was undoubtedly yes. When you can't drive down Santa Monica Boulevard without seeing an average of one VW TDI per block, the following words are pretty striking: "... Americans should be outraged at the company's cynical and deliberate efforts to violate one of this country's most important environmental laws." VW has successfully cultivated a strong, environmentally conscious reputation for its TDI Clean Diesel technology, especially in states where emissions are strictly controlled. A statement like that is like blood all over the opinion section of the Sunday paper. The effect on VW's business, even Germany's financial health, was already felt Monday when the company's shares plummeted 23 percent in morning trading. The statement on Sunday from VW CEO Dr. Martin Winterkorn says "trust" three times. That probably wasn't enough in nine sentences. Writers over the weekend have compared VW's crisis to one at General Motors 30 years ago, when it was the largest seller of diesel-powered passenger cars until warranty claims over an inadequate design and ill-informed technicians effectively pulled the plug on the technology at GM. In a sense, VW is in the same boat as GM because it has fired a huge blow into its own reputation and that of diesels in passenger cars. And just as automakers like Jaguar Land Rover, BMW and, ironically, GM, were getting comfortable with it again in the US. VW of America was already knee-deep in its other problems this year. Its core Jetta and Passat models are aging and it needs to wait more than a year for competitive SUVs that American buyers want. The TDIs were the only continuous bright spot in the line and on the sales charts. Even as fuel prices fell and buyers shunned hybrids, VW managed to succeed with diesels and show that Americans actually care about and accept the technology again. Fervent TDI supporters might actually lobby for that maximum $18 billion fine to VW. I've personally convinced a number of people to look at a TDI instead of a hybrid. Perhaps not so much for stop-and-go traffic, but I know buyers who liked the idea that a TDI drove like a normal car and wasn't packed with batteries.

Scott Pruitt unfiltered: EPA administrator talks climate science, car emissions

Tue, Jul 18 2017U.S. Environmental Protection Agency Administrator Scott Pruitt gave Reuters a wide-ranging interview on Monday at his office in Washington, discussing issues from climate science to automobile emissions. The following is a full transcript of the interview: REUTERS: You have said the EPA will focus on a "Back to Basics" approach under your leadership. What does this mean for how EPA enforces polluters? You have been critical of the idea of regulation by enforcement. PRUITT: I think what I'm speaking about, there is a consent decree approach to enforcement, where you use judicial proceedings to actually engage in regulation. Enforcement should be about existing regulations that you're actually enforcing against someone who may be violating that, very much in the prosecutorial manner. As attorney general [in Oklahoma], I lived that. There was a grand jury that I led. Being a prosecutor, I understand very much the importance of prioritization, of enforcing the rule of law, of addressing bad actors. That's something we are going to do in a meaningful way across the broad spectrum of cases, whether it is in the office of air or the Superfund area, or otherwise. REUTERS: Do you want to see states play a bigger role in enforcing polluters, even though some have less of a capacity to do so – financially and personnel wise? PRUITT: I think the state's role is really, when you look at this office working with states, it should be how do we assist, how do we engage in compliance and assistance with states. The office [at EPA that deals with enforcement] is called OECA, the Office of Enforcement, Compliance and Assistance, so those are the tools we have in the toolbox to achieve better outcomes. So what we ought to be doing is working proactively with state DEQs [Departments of Environmental Quality] to get their state implementation plans [for federal regulations] timely submitted, provide assistance and technical support, drive a draft of state implementation plans, and then actually work with them on how to achieve through those plans better outcomes and air and water quality. As far as enforcement is concerned, we will actually work with states. We actually did that recently with Colorado. There was an oil and gas company that was emitting some 3,000 tons, is that what it was, it was quite a bit of ... it was an ozone case. In any event, we joined with Colorado in that prosecution. So sometimes states will do it, sometimes we will join with them.