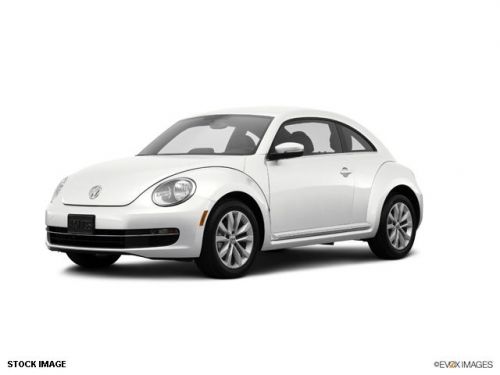

2014 Volkswagen Beetle 2.5l on 2040-cars

180 State Highway F, Branson, Missouri, United States

Engine:2.5L I5 20V MPFI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 3VWFP7AT4EM604983

Stock Num: P14515

Make: Volkswagen

Model: Beetle 2.5L

Year: 2014

Exterior Color: Candy White

Interior Color: Titan Black

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 5129

CLOTH...NEW TIRES....FWD...MPG...MPG....FUN TO DRIVE....NEW BODY STYLE...Take a close look at this beautiful vehicle, notice all of the features and the condition of it. Here at Trilakes motors we take pride in our quality inventory selection and you will love our customer service. We gladly offer a Carfax on all preowned vehicles. We are just a short drive from Springfield or Harrison. Take the short drive and experience a different way to buy your next vehicle. See you soon.... Call us at 866-413-5591 with any questions and to make sure this vehicle is still AVAILABLE. Tri-Lakes is a Franchise dealer for Ford, Chrysler, Dodge, Jeep, and Ram. This means we try to make sure our pre-owned vehicles in turn are in like new car shape and quality. Offer is not valid with any other offer. We take trade-ins and can finance almost anyone through our 14 lenders.

Volkswagen Beetle - Classic for Sale

2013 volkswagen beetle 2.5l(US $15,995.00)

2013 volkswagen beetle 2.5l(US $15,995.00) 2014 volkswagen beetle(US $17,995.00)

2014 volkswagen beetle(US $17,995.00) 2014 volkswagen beetle 2.5l(US $26,645.00)

2014 volkswagen beetle 2.5l(US $26,645.00) 2014 volkswagen beetle 2.0t r-line(US $29,815.00)

2014 volkswagen beetle 2.0t r-line(US $29,815.00) 2014 volkswagen beetle 2.0t r-line(US $35,845.00)

2014 volkswagen beetle 2.0t r-line(US $35,845.00) 2014 volkswagen beetle 2.5l

2014 volkswagen beetle 2.5l

Auto Services in Missouri

Yocum Automotive ★★★★★

Wright Automotive ★★★★★

Winchester Cleaners ★★★★★

Taylor`s Auto Salvage ★★★★★

STS Car Care & Towing ★★★★★

Stepney`s Towing ★★★★★

Auto blog

VW makes $9.2B offer for rest of truckmaker Scania

Sun, 23 Feb 2014Volkswagen owns or has controlling interests in three commercial truck operations: besides its own, VW began buying shares in Sweden's Scania in 2000 and now controls 89.2 percent of its shares and 62.6 percent of its capital, then bought into Germany's Man in 2006 - in order to prevent Man from trying to take over Scania - and now owns 75 percent of it. The car company has managed to work out 200 million euros in savings, but believes it can unlock a total of 650 million euros in savings if it takes outright control of Scania and can spread more common parts among the three divisions.

It has proposed a 6.7-billion-euro ($9.2 billion) buyout, but according to a Bloomberg report, Scania's minority investors don't appear inclined to the deal. Although effectively controlled by VW, Scania is an independently-listed Swedish company, and a profitable one at that: in the January-September 2013 period its operating profit was 9.4 percent compared to Man's 0.4 percent. Some of the other shareholders believe that Scania is better off on its own and will not approve the deal, some have asked an auditor to look into the potential conflict of interest between VW and Man, while some are willing to examine the deal and "make an evaluation based on what a long-term owner finds is good," which might not be just "the stock market price plus a few percent." The buyout will only be official assuming VW can reach the 90-percent share threshold that Swedish law mandates for a squeeze-out.

Many of the arguments against boil down to investors believing that Scania's Swedishness and unique offerings are what keep it profitable, and ownership by the German car company will kill that. (Have we heard that somewhere before?) If Volkswagen can buy that additional 0.8-percent share in Scania, perhaps its buyout wrangling with Man will give it an idea of what it's in for: "dozens" of minority investors in the German truckmaker have filed cases against VW, seeking higher prices for their shares. It is likely only to delay the inevitable, though. If VW is really going to compete with Daimler and Volvo in the truck market, it has to get the size, clout and savings to do so.

Matthias Muller officially named VW Group CEO

Fri, Sep 25 2015While the vast number of rumors made it seem like a foregone conclusion, Porsche boss Matthias Muller has officially been named Volkswagen Group CEO to replace the recently resigned Martin Winterkorn. His contract runs through the end of February 2020, and until a replacement is found, Muller also gets to hang onto his old job as chairman of Porsche. At the same time, the VW Group Supervisory Board is announcing a massive structural reorganization across the entire company, with the new management model in place by the beginning of 2016. Contrary to previous rumors, Michael Horn remains as President and CEO of VW Group of America. The board wants a greater emphasis on brands and regions going forward, and the scale of this shift can be seen in the US. On November 1, VW Group business in the US, Mexico, and Canada is being combined under the leadership of current Skoda chairman Winfried Vahland. However contrary to previous rumors, Michael Horn remains as President and CEO of VW Group of America. Other brands are also seeing some significant changes mechanically. Porsche, Bentley, and Bugatti now fall under the Group's "sportscar and mid-engine toolkit." This means that the brands will start sharing standardized technical parts. A Chief Technical Officer across all of the company's brands will also start working toward future innovations. The new brand-centric view means the end of a group-wide production department. "Going forward, the brands and regions will also have greater independence with regard to production. So it follows that they should also hold the responsibility for these activities," Berthold Huber, interim Chairman of the Supervisory Board, said in the announcement. In a statement with the press release about his promotion, Muller promised to turn the company around after such an international crisis. He said: "My most urgent task is to win back trust for the Volkswagen Group – by leaving no stone unturned and with maximum transparency, as well as drawing the right conclusions from the current situation. Under my leadership, Volkswagen will do everything it can to develop and implement the most stringent compliance and governance standards in our industry." Matthias Muller appointed CEO of the Volkswagen Group Muller remains Chairman of Porsche AG until a successor has been found Matthias Muller (62) has been appointed CEO of Volkswagen AG with immediate effect.

U.S. tariff threat hits European automakers' stocks

Thu, May 24 2018FRANKFURT, Germany — A U.S. warning that it may introduce tariffs on foreign auto imports hit shares in German carmakers BMW, Daimler and Volkswagen on Thursday, which together have a more than 90 percent share of North America's premium car market. Washington said on Wednesday it had launched an investigation into whether car and truck imports are a national security issue due to signs they had damaged the U.S. auto industry. That could lead to new U.S. tariffs — up to 25 percent — similar to those imposed on imported steel and aluminum in March. BMW and Daimler shares fell as much as 3.1 percent in early Thursday trading, while Volkswagen's dropped as much as 2.5 percent. "(U.S. President) Donald Trump is obviously not thinking about how to prevent a trade war. Import duties on cars would be a nightmare for the German auto industry and would lead to a massive sales impact," said Thomas Altmann at Frankfurt-based asset manager QC Partners. BMW on Thursday condemned the move to consider tariffs. "The BMW Group is committed to free trade worldwide. Barrier-free access to markets is therefore a key factor not only for our business model, but also for growth welfare and employment throughout the global economy," it said. Daimler, which makes Mercedes-Benz cars, and Volkswagen, which makes upmarket Audis and Porsches, were not immediately available for comment. German carmakers produced 804,000 cars at local factories in the United States and exported 657,000 German-made cars into North America last year, according to German auto industry association VDA. China took pains on Thursday to welcome German firms and investments, with Premier Li Keqiang talking up relations after a meeting with German Chancellor Angela Merkel. BMW and Mercedes have expanded production capacity in the United States, but BMW, Audi, Volkswagen and Daimler have also invested billions to build new factories in Mexico in the hope of selling locally produced cars into the United States. German carmakers hiked vehicle production in Mexico by 46 percent to 620,000 cars last year, while production levels inside the United States fell by 6 percent to 804,000 cars because of a shift to Mexico, according to the VDA. BMW has its biggest factory worldwide in Spartanburg, South Carolina, and is the largest vehicle exporter among all the carmakers in the United States measured by value of goods exported. More than 70 percent of BMW's U.S.-made cars are exported.