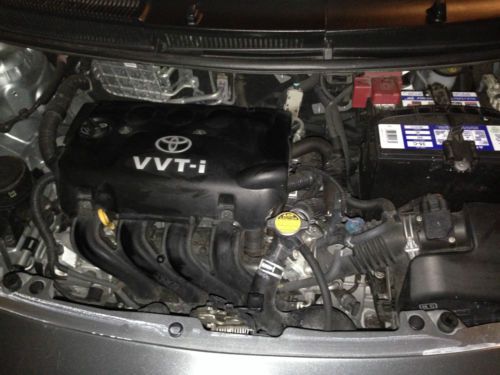

2008 Toyota Yaris Base Hatchback 2-door 1.5l on 2040-cars

Orlando, Florida, United States

|

2008 Toyota Yaris: Excellent running condition, one owner, no pets in car, no smoking in car, minor door dings and scratched rear bumper. Missing two plastic wheel covers. Ice cold AC.

Local translations only. Buyer will have to pick up at my location. |

Toyota Yaris for Sale

2007 toyota yaris base sedan 4-door 1.5l(US $7,980.00)

2007 toyota yaris base sedan 4-door 1.5l(US $7,980.00) Financing available automatic hatchback power windows power locks aux port cd ac(US $11,998.00)

Financing available automatic hatchback power windows power locks aux port cd ac(US $11,998.00) Sky blue, 3 door hatchback, low mileage, never been in an accident

Sky blue, 3 door hatchback, low mileage, never been in an accident 2007 toyota yaris base hatchback lowered tint runs great!

2007 toyota yaris base hatchback lowered tint runs great! 2010 toyota yaris base hatchback 2-door 1.5l(US $8,500.00)

2010 toyota yaris base hatchback 2-door 1.5l(US $8,500.00) 2010 toyota yaris * 5dr * 1.5l i4 16v * automatic * fwd * hatchback(US $8,000.00)

2010 toyota yaris * 5dr * 1.5l i4 16v * automatic * fwd * hatchback(US $8,000.00)

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

Toyota's Euro Aygo spied in prototype form

Thu, 22 Aug 2013The five-door version of the next-generation Toyota Aygo, a Euro offering cloned by the Peugeot 107 and Citroën C1, has been caught out on the town wearing all black. Facelifted early last year, predictions are that the next version of the city car will be slightly lower and wider than the current car, with improved ergonomics and materials. Based on what little can be seen for now, a new intake and headlight treatment should be on the menu in front, with taillights placed higher on its backside.

A three-door version is expected, but a gasoline-hybrid model is also rumored, along with power and fuel economy improvements to the three-cylinder engine that presently puts out 67 horsepower and 69 pound-feet of torque.

We should see it next year, along with the new Citroën C1 and Peugeot 108.

Toyota headed to New York with 2014 Highlander, revised Scion tC

Thu, 21 Mar 2013Toyota has given us a look at what the company will bring to the 2013 New York Auto Show. Visitors will get to set their eyes upon the all-new 2014 Highlander, and while the automaker isn't saying much in the way of details, we do get the teaser you see above (click to enlarge) to ponder on until next week. The image shows little more than a headlamp and a bit of grille, but gives us the flavor of what the crossover will bring to the table.

Scion, meanwhile, says it plans to dust off the "new 2014 tC sports coupe." While we don't imagine the two door will have undergone a major surgery, we're interested to see what the automaker has cooked up. The tC last endured a redesign in 2011. Check out the brief press release below and look for the vehicles to bow on March 28.Y

Recharge Wrap-up: Toyota FCV Rally Car To Compete, Barra bullish on Chevy Volt

Fri, Oct 31 2014The Toyota FCV will compete in the last stage of the 2014 Japanese Rally Championship. The sport-tuned hydrogen-powered car will tackle the 177-mile Shinshiro Rally on November 1 and 2, emitting no greenhouse gases in the process. The rally course will help prove the safety of the vehicle before it goes on sale in Japan in the next several months. The Toyota FCV, rumored to be called "Mirai" in Japan, will begin sales there before April, according to Toyota, and in the summer in the US and Europe. Read more in the press release below. Carsharing is becoming more popular, and more visible, throughout the world, including the US. According to WardsAuto columnist John McElroy, 18 percent of US drivers have used some sort of carsharing service. Additionally, he says 60 percent of Americans are familiar with Zipcar and Uber. Mercedes' Harald Kroeger says promotions like free parking for carshares in Stuttgart are encouraging growth for Daimler's carsharing service, Car2go. Read more at WardsAuto. Ethanol is being help up by rail transport, according to ethanol producer Green Plains. More and more stations are carrying E15 blend gasoline, but grain producers have complained that crude oil is given higher priority by the rail lines shipping it, which rail companies deny. Union Pacific and BNSF Railway say they are stepping up service to make sure that ethanol can be shipped reliably to customers. Read more at Omaha World-Herald. General Motors "has placed a significant bet [on] the electrification of the automobile," says CEO Mary Barra. In a speech to the Detroit Economic Club this week, she spoke about the Chevrolet Volt, and its importance to GM's future. While Barra admits the Volt's success has been "not everything we wanted," it has provided experience, and shows that EVs have "an important role in the future of GM." The new Volt is more refined, stores more energy, has longer range, uses less fuel and is a big investment for Michigan. She announced that the new Volt's electric drive system will be built in Warren, and that all of its major components will be made in Michigan. "Silicon Valley doesn't have a corner on the market for innovation, creativity and drive," says Barra. "These qualities exist here – in this region – as well." See the speech's highlight video and read more in the transcript below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.