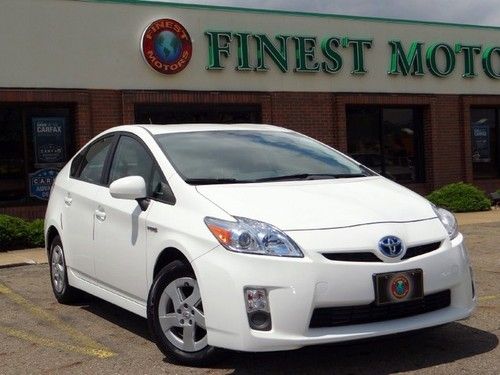

2010 Toyota Prius Hybrid Salvage Repairable Rebuilder Only 32k Miles Runs!!! on 2040-cars

Salt Lake City, Utah, United States

Body Type:Hatchback

Engine:4 Cylinder Engine

Vehicle Title:Salvage

Fuel Type:Hybrid-Electric

For Sale By:Dealer

Number of Cylinders: 4

Make: Toyota

Model: Prius

Trim: Base Hatchback 4-Door

Warranty: Unspecified

Drive Type: 2WD

Mileage: 32,392

Exterior Color: White

Disability Equipped: No

Interior Color: Tan

Toyota Prius for Sale

Toyota prius hybrid navigation leather bluetooth backup camera loaded no reserve

Toyota prius hybrid navigation leather bluetooth backup camera loaded no reserve 5-days *no reserve* '10 prius iv 51mpg navi jbl sound back-up leather warranty

5-days *no reserve* '10 prius iv 51mpg navi jbl sound back-up leather warranty 2006 toyota prius(US $9,999.00)

2006 toyota prius(US $9,999.00) 2011(11) toyota prius ii warranty white one owner we finance save huge!!!(US $18,995.00)

2011(11) toyota prius ii warranty white one owner we finance save huge!!!(US $18,995.00) 2012 toyota prius

2012 toyota prius 2010 toyota prius(US $22,999.00)

2010 toyota prius(US $22,999.00)

Auto Services in Utah

Washburn Motors ★★★★★

Utah Imports ★★★★★

Tuff Country Suspension ★★★★★

Tint Specialists Inc. ★★★★★

Superior Locksmith ★★★★★

Slick Willley`s II ★★★★★

Auto blog

Meet the Most Elegant Automobile, and it's for sale

Sat, 08 Jun 2013Alright, so maybe "most elegant" is a bit of a stretch, but we feel safe in calling the 1992 Toyota Paseo in the video below an "automobile." High praise, we know. Still, it's clear someone loves the awkward little coupe enough to produce a hilarious video to sell the thing. Henry Floyd worked up a quick parody of the over-the-top luxury car ads we all know and loathe, and while the finished product is a little skimpy on details like price or location, it certainly doesn't hold back on the exposition.

Hell, if we didn't already have a parade of horrible ideas floating around our collective driveways, we might even be convinced to give this little heap a new home. You can check out the ad for yourself below, just don't be surprised if you find yourself with a burning desire to own a Paseo.

Toyota Expands Airbag Recall To 2.2 Million Vehicles Worldwide

Wed, Jun 11 2014Was your Toyota inspected under the company's recall campaign for faulty airbag inflators last year? You might have another trip ahead to have it repaired again. The automotive giant says that it found "the involved serial numbers provided by the supplier were incomplete, and did not include all of the potentially involved inflators," according to its official announcement. That means more replacements are needed. Toyota's April 2013 inflator recall covered the Corolla, Matrix and Tundra from the 2003 and 2004 model years, the Sequoia from 2002 to 2004 and the Lexus SC 430 from 2002 to 2004. At the time, the company said it would need to inspect about 510,000 vehicles in the US but only expected to replace around 170,000 inflators. However, the latest announcement increases that figure to about 766,300 vehicles in the US. Toyota spokesperson Cindy Knight told Autoblog that the new amount is the combination of owners who need to have their vehicle looked at again and those who didn't come in for the initial recall. The company learned about the problem when Takata, the supplier, provided it with an improved list of the faulty part's serial numbers. According to The Detroit Free Press, the latest recall affects about 2.27 million vehicles from them worldwide. Knight said owners would receive notification of the problem around the end of the month but repairs would come in phases because the automaker doesn't have all of the necessary parts at the moment. The original problem occurred because the front passenger airbag inflator from Takata could have an improper propellant that could cause it to burst in an accident and not allow the airbag to deploy properly. Toyota inspected all the vehicles listed but only changed the inflators with specific serial numbers. Now, it's replacing them all. This wasn't just a problem for Toyota, though. Honda, Nissan and Mazda also used the faulty inflators and issued recalls at the same time. Autoblog has contacted the other Japanese automakers about whether similar campaigns are necessary for them. We will update this story, if we hear back from them. Scroll down to read Toyota's announcement. UPDATE: Honda spokesperson Jessica Howell sent along the following statement: Honda is aware that Toyota recently announced a recall of front passenger's airbag inflators. Honda is not aware of any incidents in our vehicles related to Toyota's action. We are currently investigating the potential implications to Honda vehicles.

Nearly 700,000 Toyotas and Lexuses named in fuel pump recall

Tue, Jan 14 2020In an announcement posted to its corporate press room, Toyota made known a voluntary safety recall on select 2018 and 2019 Toyota and Lexus models. The recall includes roughly 696,000 vehicles and deals with a fuel pump that might stop working. An internal investigation into the issue is under way. Affected rides include the Toyota 4Runner, Camry, Highlander, Land Cruiser, Sequoia, Sienna, Tacoma, Avalon, Corolla, and Tundra, as well as the Lexus LS 500, LC 500, RC 350, RC 300, GS 350, IS 300, ES 350, LX 570, GX 460, RX 350 NX 300, RX 350L, and GS 300. The Avalon, Corolla, NX 300, RX 350L, and GS 300 are restricted to 2019 model years, while the others are 2018 and 2019 model years. The potential danger in this issue is pretty obvious. Should the fuel pump stop, the vehicles could sputter, stall, and come to a stop, likely without the ability to restart the cars. Toyota notes warning lights and messages would display should this occur, but by then, it'd be too late. Although Toyota made the announcement this week, the investigation is not yet complete, and therefore, a fix has not yet been specified. The resolution, when determined, will come free of charge to affected customers. Toyota plans to send out notifications for affected vehicles in mid-March.