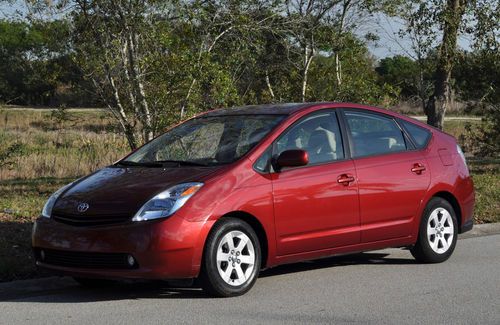

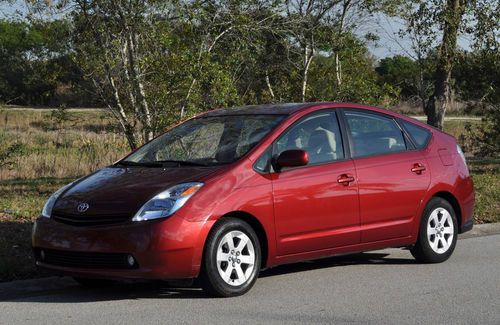

2005 Toyota Prius Hatchback 4-door 1.5l 52kmil. Low Mileage Loaded Navigattioin on 2040-cars

Clearwater, Florida, United States

Vehicle Title:Clear

Transmission:Automatic

Body Type:Hatchback

Fuel Type:ELECTRIC/GAS

For Sale By:Dealer

Make: Toyota

Model: Prius

Trim: Base Hatchback 4-Door

Mileage: 52,000

Exterior Color: Burgundy

Drive Type: FWD

Interior Color: Tan

Number of Cylinders: 4

Options: CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Number of Doors: 4

Toyota Prius for Sale

Free shipping 50mpg xtra clean nav loded newer tires non smoker/pet detailed 4 u(US $8,999.00)

Free shipping 50mpg xtra clean nav loded newer tires non smoker/pet detailed 4 u(US $8,999.00) 2005 toyota prius 52kmil. low mileage - power - loaded - cd - navigation(US $11,500.00)

2005 toyota prius 52kmil. low mileage - power - loaded - cd - navigation(US $11,500.00) 2002 toyota prius 4 dr sedan low 74k miles, hybrid engine

2002 toyota prius 4 dr sedan low 74k miles, hybrid engine 2003 prius sedan *hybrid**navi*cruise*white*no reserve!!

2003 prius sedan *hybrid**navi*cruise*white*no reserve!! 2010 toyota prius excellent condition only 25k miles

2010 toyota prius excellent condition only 25k miles 2005 toyota prius hatchback 4-door 1.5l; navigation; no reserve!

2005 toyota prius hatchback 4-door 1.5l; navigation; no reserve!

Auto Services in Florida

Z Tech ★★★★★

Vu Auto Body ★★★★★

Vertex Automotive ★★★★★

Velocity Factor ★★★★★

USA Automotive ★★★★★

Tropic Tint 3M Window Tinting ★★★★★

Auto blog

Toyota JPN Taxi Concept is a Japanese riff on an English classic

Wed, 20 Nov 2013As far as beasts of burden go, New York City's new - and much maligned - Nissan NV200 "Taxi of Tomorrow" isn't a bad one. It's space efficient, reasonably economical, and its simple construction should mean it's pretty robust over the long haul, too. But it lacks panache and a sense of occasion - let alone a sense of humor - three things this this Toyota JPN Taxi Concept we found at the Tokyo Motor Show has in spades.

Unfortunately, that's about all the information we have on this cheeky London-taxi-inspired showcar. Toyota hasn't provided much in the way of details, other than to proclaim that the five-seat JPN was "created with Japanese hospitality in mind" and it "aims to enliven city streets." Japan's livery landscape has long been occupied by traditional three-box sedans - models like the Toyota Crown and Nissan Cedric. The JPN Taxi at just over 171 inches would appear to offer both a tighter footprint and added whimsy, both of which are in the automaker's favor; we hear it hopes this concept will one day become the country's own version of America's yellow Crown Vic cab.

Toyota isn't providing powertrain specifications, but we like the airy feeling of the interior (Japanese cabs typically don't have cumbersome partitions between cabbie and passengers), the minimalist driver area with three screens, and the widescreen overhead video system for passengers that bookends the panoramic moonroof. Check it out in our gallery of live shots and let us know what you think in Comments.

Illinois’ pro-union stance kills bid for Toyota-Mazda plant, report says

Thu, Oct 19 2017Mazda and Toyota are fielding bids from states eager to land its new prize: an all-new $1.6 billion U.S. plant where the Japanese automakers would jointly build electric vehicles and employ around 4,000 workers. Now we can apparently scratch Illinois off the list of contenders. According to Automotive News, the Land of Lincoln has been disqualified due to a lack of shovel-ready sites and the state's lack of a right-to-work law curtailing union membership. Mark Peterson, the president and CEO of economic development agency Intersect Illinois, told the publication he's been informed Illinois is not among the three or four finalists for the facility. It's believed those finalists are all in the South. Peterson said that "many national site consultants charged with making recommendations for corporate relocations and expansions will not even consider a state that is not a right-to-work state. In this case, the three states I am told are still in the running are all right-to-work states." The Midwest may be the ancestral home of U.S. automotive manufacturing, but the South has made major inroads in recent decades, with the likes of Honda, Mercedes-Benz, Nissan and Toyota all opening plants there, among others, thanks to lucrative tax incentives and the absence of labor unions. Recent years have also seen so-called right-to-work laws, which prohibit union dues and membership as a condition of employment in organized workplaces, spread to traditional labor strongholds such as Michigan and Wisconsin. The new joint venture plant, which would start operating in 2021, would be capable of producing 300,000 vehicles a year, with production divided between the two automakers. Mazda and Toyota would also take small stakes in one another as part of the deal. It's expected that at least 15 states have submitted proposals to attract the plant. Expect the Illinois news to trigger a new round of debate over the role of organized labor in the modern economy.Related Video: Image Credit: Reuters Green Plants/Manufacturing Mazda Toyota

Welcome Audi RS6 Avant, goodbye Lincoln Continental | Autoblog Podcast #592

Fri, Aug 23 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and Assistant Editor Zac Palmer. Our editors cover a lot this week, starting with the news. They geek out over the Audi RS6 Avant coming to America, and mourn the loss of the Lincoln Continental. They address rumors of the Toyota Land Cruiser's demise, and analyze spy photos of the Ford Mach E electric crossover. They also honor the memory of the godfather of spy photography, Jim Dunne. Finally, they talk about driving the BMW Z4, Ram 1500 EcoDiesel, and another diesel, the diesel-powered Mazda CX-5 Skyactiv-D. Autoblog Podcast #592 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Audi RS6 Avant headed to U.S. Lincoln Continental discontinued Rumor: Toyota Land Cruiser to be canceled Ford Mach E spied RIP spy photographer Jim Dunne Cars we're driving: 2019 BMW Z4 sDrive30i 2020 Ram 1500 EcoDiesel 2019 Mazda CX-5 Diesel Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:   Â