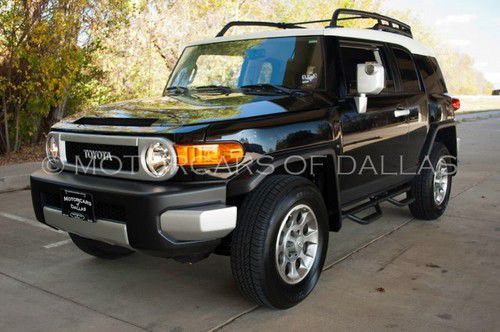

2011 Toyota Fj Cruiser 4x4 1 Owner Bluetooth Satellite Radio Back Up Camera on 2040-cars

Carrollton, Texas, United States

For Sale By:Dealer

Engine:4.0L 3956CC 241Cu. In. V6 GAS DOHC Naturally Aspirated

Body Type:Sport Utility

Transmission:Automatic

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Toyota

Warranty: Vehicle has an existing warranty

Model: FJ Cruiser

Trim: Base Sport Utility 4-Door

Disability Equipped: No

Drive Type: 4WD

Doors: 4

Mileage: 21,937

Drive Train: Four Wheel Drive

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 6

Toyota FJ Cruiser for Sale

Leather seats+upgrade pkg 2+bal of warranties

Leather seats+upgrade pkg 2+bal of warranties We finance!!! 2010 toyota fj cruiser 4x4 automatic rr diff lock rsca cd 1 owner(US $27,998.00)

We finance!!! 2010 toyota fj cruiser 4x4 automatic rr diff lock rsca cd 1 owner(US $27,998.00) 2007 toyota fj cruiser 4.0l v6 leather roof rack 48k mi texas direct auto(US $22,480.00)

2007 toyota fj cruiser 4.0l v6 leather roof rack 48k mi texas direct auto(US $22,480.00) 2007 toyota fj cruiser 4x4 4.0l v6 automatic alloys 78k texas direct auto(US $17,980.00)

2007 toyota fj cruiser 4x4 4.0l v6 automatic alloys 78k texas direct auto(US $17,980.00) 4wd trd lifted rearcam metal tech bumper engo winch 2010 toyota fj cruiser 47k(US $29,400.00)

4wd trd lifted rearcam metal tech bumper engo winch 2010 toyota fj cruiser 47k(US $29,400.00) 2008 toyota fj roof rack park assist tow pkg 47k miles texas direct auto(US $21,480.00)

2008 toyota fj roof rack park assist tow pkg 47k miles texas direct auto(US $21,480.00)

Auto Services in Texas

Wynn`s Automotive Service ★★★★★

Westside Trim & Glass ★★★★★

Wash Me Car Salon ★★★★★

Vernon & Fletcher Automotive ★★★★★

Vehicle Inspections By Mogo ★★★★★

Two Brothers Auto Body ★★★★★

Auto blog

China sticking to its guns on EVs for the future

Mon, Apr 27 2015Automakers are obviously free to develop whatever next-gen, zero-emissions tech that they want. However, if a company wants to get on the good side of the Chinese government, that strategy better include some plug-in vehicles. The authorities there are lending major support to plug-ins at the moment, and its forcing the auto industry to play along. According to Bloomberg, Toyota, Volkswagen, Hyundai, and BMW are all launching dedicated EV brands with their joint venture partners, and as many as 40 electric models could hit the Chinese market this year alone. However, analysts don't think the vehicles are going to sell well. Instead, the launches are essentially a way for companies to play nice with the government and help get the approval to build factories in the country. Take Toyota as an example. The company is pushing the future of hydrogen hard with promotional films for the Mirai and engineers talking down fast-charging EVs. Still, the Japanese automaker is getting ready to launch two EV brands in China with its joint venture partners, according to Bloomberg. China's push for alternative fuels has been happening for a while, but it really kicked into high gear last year. The government has set a goal to improve fleet-wide economy by 40 percent by the end of the decade in order to spend less importing oil and for the population's health. The plan has shown some success so far with hybrid and EV sales growing early in 2015. Related Video: News Source: BloombergImage Credit: Kin Cheung / AP Photo Government/Legal Green BMW Hyundai Toyota Volkswagen Green Culture Technology Electric tax incentives chinese government

Scion rules out roadster, turbo versions of FR-S

Tue, Nov 25 2014Ever since Toyota and Subaru released the sports car alternatively known as the GT86, 86, BRZ and Scion FR-S a couple of years ago, rumors have circulated that even more exciting variants could be in store. But at least as far as Scion is concerned, those rumors are apparently nothing more than wishful thinking. Speaking with WardsAuto at the LA Auto Show last week, Scion chief Doug Murtha said that the prospect of an FR-S roadster has been taken off the table entirely. Apparently Scion lobbied parent company Toyota to produce just such a model, but after failing to find other markets interested enough in the model to put it into production, corporate HQ said no. "I think we were pretty aggressive on our (submitted plan), but we looked at what we would have conceivably lost on the product and said, 'We're not going to even push it further,'" Murtha said, going on to note, "Nobody was more disappointed than we were." Murtha further shot down the idea of a turbo version of the FR-S, dismissing it as a prospect the blogosphere (that's us) wanted to happen but "that's not something that's coming." Either variant might have helped Scion and Toyota boost sales of the model (which are predictably dropping after their first two years on the market), but the investment also might not have paid off their development, tooling and marketing costs. Of course, Murtha can only speak for Toyota, but we'd be surprised to see Subaru go it alone on either model, as costs would be that much more prohibitive without a partner. Bummer.

Toyota confirms 2016 Tacoma for Detroit

Wed, Dec 10 2014A week on from an announcement by Toyota's Bob Carter, the Japanese marque has formally announced that the 2016 Toyota Tacoma will make its global debut next month at the 2015 North American International Auto Show. Not only that, but the company has given us a very minute (and very muddy) teaser image, showing the truck's tailgate and driver's side taillight. Like its big brother, the Tundra, the 2016 Tacoma will feature its name embossed on its tailgate. Beyond that, though, there's really not much to be gleaned from this sole teaser shot. Of course, we'll have much, much more on the next-generation Taco when it arrives in a month's time. Until then, check out Toyota's hilariously brief and to-the-point press release, available below. Tacoma. Detroit. January 12. It's on. December 10, 2014 Toyota's rolling out the all-new 2016 Tacoma at the 2015 North American International Auto Show in Detroit on Jan. 12.