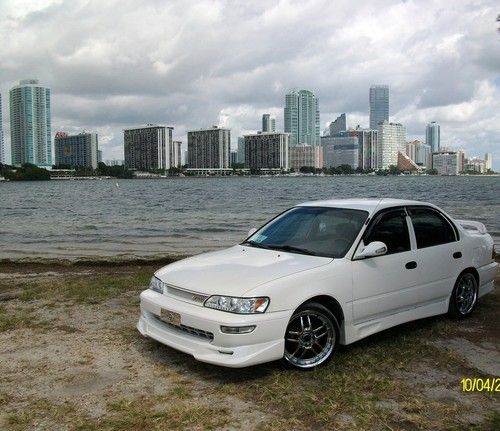

1997 Toyota Corolla In Excellent Condition With Only 88,500k 1 Family Owner! on 2040-cars

Bridgewater, Massachusetts, United States

Vehicle Title:Clear

Engine:4cyl

For Sale By:Private Seller

Interior Color: Blue

Make: Toyota

Number of Cylinders: 4

Model: Corolla

Trim: 4 door

Options: Sub s & Amp, CD Player

Drive Type: Auto

Safety Features: Driver Airbag, Passenger Airbag

Mileage: 88,500

Power Options: Air Conditioning, Power Locks, Power Windows

Sub Model: LX Gold

Exterior Color: White

SPECIFICATIONS

Year 1997

Make Toyota

Model Corolla DX

Miles 88,500K

Engine 1.8L

Transmission Automatic

Air Conditioner Yes

Airbags Driver/Passenger

Power Locks Yes

Power Windows Yes

Power Mirrors Yes

Tilt Steering Yes

Rear Defrost Yes

Rear Spoiler Yes

New Tires @ 60,500

New Front Brakes @ 64,000

Sound System Equipment

(2) Kickers™ 10” 300 Watt

Cobalt™ 500 Watt Amp

(2) Rear Alpine Speakers

CD/FM Radio with USB Outlet

Other

- 1 Family Owned

- Engine Clean, No viable leaks

- Clean Car Fax

- Has never had any paint touch-ups and/or bodywork

- Crease on Passenger side / Scratch on Frnt bumper (none accident related)

Toyota Corolla for Sale

2006 toyota corolla s sedan 4-door 1.8l excellent no reserve

2006 toyota corolla s sedan 4-door 1.8l excellent no reserve 1969, toyota, corolla, coup'e, oldtimer, collectible, red, low mileage

1969, toyota, corolla, coup'e, oldtimer, collectible, red, low mileage 2009 toyota corolla 4dr sdn we finance and accept trade(US $8,999.00)

2009 toyota corolla 4dr sdn we finance and accept trade(US $8,999.00) S premium new 1.8l cd heated front bucket seats 4-wheel disc brakes 6 speakers

S premium new 1.8l cd heated front bucket seats 4-wheel disc brakes 6 speakers Le eco plus new 1.8l cd fabric seat trim 6 speakers air conditioning spoiler

Le eco plus new 1.8l cd fabric seat trim 6 speakers air conditioning spoiler 1994 toyota corolla dx sedan 4-door 1.8l

1994 toyota corolla dx sedan 4-door 1.8l

Auto Services in Massachusetts

Woodlawn Autobody Inc ★★★★★

Tri-State Vinyl Repair ★★★★★

Tint King Inc. ★★★★★

Sturbridge Auto Body ★★★★★

Strojny Glass Co ★★★★★

Sonny Johnson Tire ★★★★★

Auto blog

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.

Japan may aid carmakers facing U.S. tariff threat

Wed, Sep 12 2018TOKYO — Japan is considering giving carmakers fiscal support including tax breaks to offset the impact from trade frictions with the United States and a sales-tax hike planned for next year, government sources told Reuters on Wednesday. Going into a second round of trade talks with the United States on Sept. 21, Japan is hoping to avert steep tariffs on its car exports and fend off U.S. demands for a bilateral free trade agreement that could put it under pressure to open politically sensitive markets, like agriculture. "If the trade talks pile pressure on Japan's car exports, we would need to consider measures to support the auto industry," a ruling party official said on condition of anonymity because of sensitivity of the matter. The auto industry accounts for about 20 percent of Japan's overall output and around 60-70 percent of the country's trade surplus with the United States, making it vulnerable to U.S. action against Japanese exports. Japan's biggest automakers and components suppliers fear they could take a significant hit if Washington follows through on proposals to hike tariffs on autos and auto parts to 25 percent. Policymakers also worry that an increase in the sales tax from 8 percent to 10 percent planned for October 2019, could cause a slump in sales of big-ticket items such as cars and home. Prime Minister Shinzo Abe has twice postponed the tax hike after the last increase from 5 percent in 2014 dealt a blow to private consumption, which accounts for about 60 percent of the economy. To prevent a pullback in demand after the tax hike, the government may consider large fiscal spending later when it draws up its budget for next year, government sources said. "One option may be to greatly reduce or abolish the automobile purchase tax," one of the government sources said. The government is also considering cuts in the automobile tax and automobile weight tax to help car buyers, the source added. Reporting by Izumi Nakagawa and Tetsushi KajimotoRelated Video: Image Credit: Getty Government/Legal Isuzu Mazda Mitsubishi Nissan Subaru Suzuki Toyota Trump Trump tariffs trade

Toyota will retrofit late-model cars with new technology

Fri, Jan 7 2022Toyota will inaugurate a service called Kinto Factory that will add modern features like electronic driving aids to select late-model cars. The program will launch in Japan in January 2022, and it aims to let motorists benefit from new technology without having to buy a new car. Kinto Factory will initially offer customers two basic services: upgrading and remodeling. Upgrading is defined as retrofitting safety and convenience functions, like emergency braking assist, a blind spot monitoring system with rear cross-traffic alert, and a hands-free tailgate or trunk lid. Remodeling involves replacing worn or damaged parts inside and out, such as the upholstery, the seat cushions, and the steering wheel. Personalization will join the list of services at a later date, partly because it involves gathering data on how drivers use their car. The list of cars eligible to receive a makeover from Kinto Factory include the Prius, the Prius c (which is called Aqua in Japan), the Prius V (known as the Prius ? in its home country), the Lexus UX (pictured), and the Lexus NX. Since the program is launching in Japan, Kinto Factory will also work on vehicles we've never seen on American roads, like the Vellfire (a big minivan) and its upscale Alphard derivative. Pricing information and availability will be announced closer to the program's launch. Toyota notes that each upgrade will be available individually, so customers will be able to select precisely what's added to their car, and that all of the parts will be backed by a warranty. As of writing, Toyota hasn't announced plans to bring the Kinto Factory program to the United States. However, it added that the upgrades detailed above represent the program's first step, and it clarified that it's open to the idea of expanding the service in overseas markets.