2023 Tesla Model Y Long Range on 2040-cars

Engine:Electric Motor

Fuel Type:Electric

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

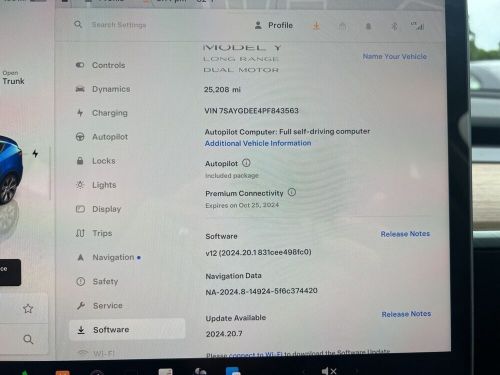

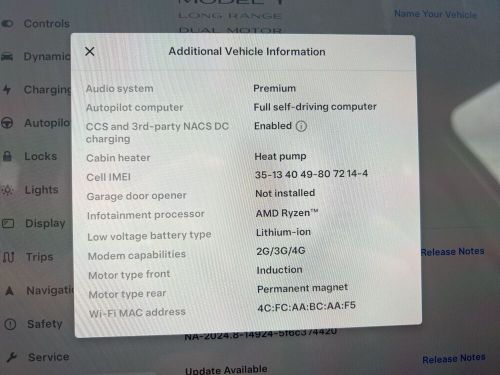

VIN (Vehicle Identification Number): 7SAYGDEE4PF843563

Mileage: 25207

Make: Tesla

Model: Model Y

Trim: Long Range

Features: --

Power Options: --

Exterior Color: Blue

Interior Color: --

Warranty: Unspecified

Tesla Model Y for Sale

2021 tesla model y long range(US $32,400.00)

2021 tesla model y long range(US $32,400.00) 2023 tesla model y performance(US $37,800.00)

2023 tesla model y performance(US $37,800.00) 2022 tesla model y long range(US $37,901.00)

2022 tesla model y long range(US $37,901.00) 2023 tesla model y long range sport utility 4d(US $38,599.00)

2023 tesla model y long range sport utility 4d(US $38,599.00) 2023 tesla model y long range(US $38,900.00)

2023 tesla model y long range(US $38,900.00) 2022 tesla model y long range dual motor all-wheel drive(US $36,373.00)

2022 tesla model y long range dual motor all-wheel drive(US $36,373.00)

Auto blog

Most American Cars | Honda Makes the Top 10 List

Thu, Oct 14 2021The car built with the most American/Canadian parts content is the 2021 Ford Mustang GT – with the manual transmission, specifically, no less – giving Ford a second consecutive year atop the American University Kogod Business School annual "Made in America Auto Index. We already knew that it doesn't get much more American than a V8 pony car, but now we've got the numbers to prove it. Ford's iconic coupe takes the number one slot pretty convincingly this year, with 88.5% of its components coming from U.S. or Canadian sources. Appropriately, though perhaps confusingly, 21 models made the top 10 list in 2021. As you may have surmised, this is the result of multiple ties. Note also that many models appear more than once to account for variants built with parts from different sources. The top-ranked Mustang is a perfect example; The automatic drops into into a tie for 10th, right next to the EcoBoost model and Ram's 1500 Classic with the 3.6L V6. The "America" theme runs pretty strongly through the top "10," with the Chevrolet Corvette sitting pretty in second place, followed by all three variants of Tesla's Model 3 electric car. Honda also makes several appearances thanks to its rather significant U.S. manufacturing footprint. Here are the 21 vehicles that make up the top 10 this year – don't worry, it feels just as weird to type as it does to read. Last year's winner, the midsize Ford Ranger pickup, cratered to 16th place, dropping from 70% American parts content to just 45%. Keep in mind, however, that the pandemic has forced automakers to source parts outside of their normal supply chains, and such drops should be taken with a grain of salt. Kogod noted that the overall proportions of content between manufacturers remained relatively unchanged despite what appear to be significant shake-ups such as this one. "While the trend TDC for cars assembled in the US is consistent over time, both Daimler and Subaru saw significant drops in their average US content," the summary said. "This may be the result of US shortages of parts and components as the impacts of the covid pandemic created significant disruptions in automotive supply chains." Watch Ford Build a Bronco: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Tesla's new $408 per month business lease deal for Model S reminds us of last 'revolutionay' deal

Tue, Apr 8 2014Almost exactly a year ago, Tesla Motors announced what it called a "revolutionary" lease deal for the Model S. Since the electric automaker used some unusual assumptions in its calculations to get to a headline-worthy $500-a-month "true cost of ownership," the company had to quickly change its tune. Some of the same assumptions are back in a business lease deal from new subsidiary, Tesla Finance, for $408 a month (sort of) that was announced today. Tesla is touting the easy-to-understand lease agreement, which takes all of three pages and is "written in plain language." The agreement can also be signed digitally on the car's touchscreen when the car arrives. That, plus the low cost, is the good news. The business lease program is currently only available in ten states. The estimated effective cost of $408 a month sure sounds great but, just as with the first consumer lease plan for the Model S, there are a lot of caveats to be aware of. For one thing, the actual monthly payment is $1,012, well over twice the $408 number. Tesla estimates that you'll save $261 a month in gasoline costs and $343 a month in business tax benefits (with Tesla calculating a 40 percent effective tax rate and 70 percent business use). Those gas savings, "are calculated assuming $0.11 per kilowatt hour compared to paying $4.90 per gallon for premium gasoline with a fuel efficiency of 20 miles per gallon," so if your business already runs a fleet of Toyota Priuses, you can forget the $408 number. Oh, and the business lease program is currently only available in ten states - CA, CO, CT, FL, IL, MA, MD, NY, TX, and WA. Yes, that list includes Texas, where you can't officially buy a Model S. Tesla spokeswoman Shanna Hendriks told AutoblogGreen that the company has a lessor's license in the state of Texas, which allows it to offer the business leasing deal there. The dealership license, which the company can't get in Texas, is the thing that is preventing sales. No matter which of the ten business lease states you're in, the first vehicles under this program have an estimated delivery date of June 2014. Read more below. Tesla Business Leasing By The Tesla Motors Team April 8, 2014 A year ago, Tesla introduced a Resale Value Guarantee that gives customers the option to return their Model S after three years for a known value.

Aston Martin CEO calls Tesla Model S 'Ludicrous' mode stupid

Sat, Aug 22 2015To be fair, some would say paying as much as a quarter-million dollars for a car in itself qualifies as "ludicrous." But the CEO of Aston Martin, a company that is readying a pricier electric-vehicle competitor to the Tesla Model S, didn't mince words in discussing Tesla's newest gizmo that can propel the sedan from 0 to 60 miles per hour in less than three seconds. In fact, Andy Palmer, Aston's CEO, prefers a slightly more balanced approach. Palmer was quoted in Automotive News as saying that Tesla's Ludicrous Mode was "stupid." He added that he'd rather have an electric vehicle that could last "a few laps of a decent race course" instead of one that does its best imitation of a Dodge Challenger Hellcat. Palmer also took to his Twitter account to note, among other things, that the Aston's "insane mode comes as standard - no button required." Aston Martin said earlier this week that it planned to make a battery-electric variant of its Rapide Sedan. That model will have 800 horsepower as well as a 200-mile single-charge range. The car will also cost between $200,000 and $250,000, or about twice the cost of a top-of-the-line Model S. As for the Tesla, its Ludicrous mode was announced last month for the Model S and it will eventually be added to the Model X for those who are big on flipping SUVs. Tesla said that the feature cuts the sedan's 0-60 mpg time to a tidy 2.8 seconds, though the option does cost about $10,000. Which is probably about the price of an Aston Martin door handle. Featured Gallery 2015 Aston Martin Rapide S View 32 Photos News Source: Automotive News (subs req'd) Green Aston Martin Tesla Electric ludicrous mode