2022 Tesla Model Y Performance Dual Motor All-wheel Drive on 2040-cars

Tomball, Texas, United States

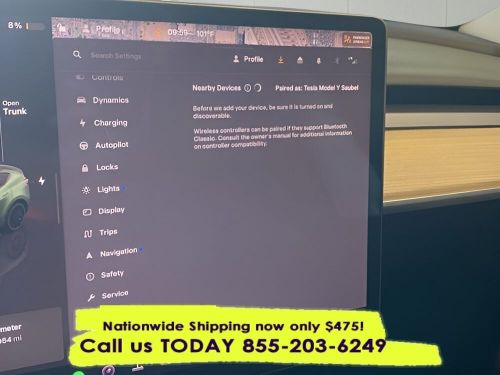

Engine:Electric Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

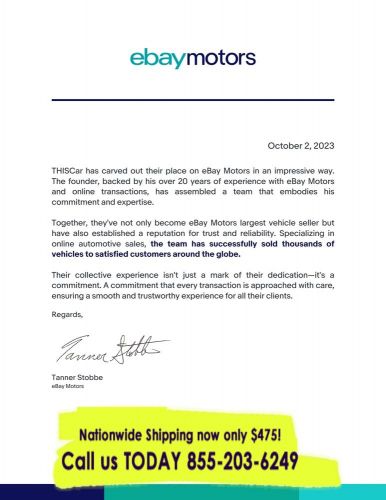

For Sale By:Dealer

VIN (Vehicle Identification Number): 7SAYGDEF7NF397365

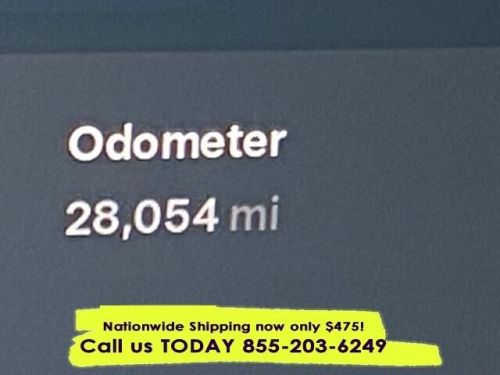

Mileage: 28054

Make: Tesla

Model: Model Y

Trim: Performance Dual Motor All-Wheel Drive

Drive Type: AWD

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Tesla Model Y for Sale

2023 tesla model y long range sport utility 4d(US $40,495.00)

2023 tesla model y long range sport utility 4d(US $40,495.00) 2021 tesla model y performance(US $35,119.00)

2021 tesla model y performance(US $35,119.00) 2021 tesla model y performance(US $35,500.00)

2021 tesla model y performance(US $35,500.00) 2021 tesla model y performance awd! ** free delivery **(US $26,500.00)

2021 tesla model y performance awd! ** free delivery **(US $26,500.00) 2023 tesla model y long range(US $38,199.00)

2023 tesla model y long range(US $38,199.00) 2023 tesla model y long range(US $39,728.00)

2023 tesla model y long range(US $39,728.00)

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Everyone but VW and Tesla has recalled their Takata airbags

Thu, Aug 20 2015Takata's massive airbag inflator recall affected over 32 million vehicles from 11 automakers in the US, but two companies buying the supplier's parts haven't been affected so far: Volkswagen and Tesla. There are 887,055 VWs and 184,926 Teslas using Takata's inflators with ammonium-nitrate propellant, a new accounting shows, according to Automotive News. That doesn't necessarily mean the models need to be recalled. These figures came from a report that Takata prepared for the National Highway Traffic Safety Administration, which listed all of the vehicles it supplied with ammonium nitrate-fueled inflators. The substance is believed to be linked with the components' rupturing, along with manufacturing defects and humidity. "We're not asking because we've got reports of problems; we just need to figure out what the universe is," NHTSA spokesman Gordon Trowbridge said to Automotive News. Takata reportedly told Tesla that the inflators in its EVs are not affected with these problems, and VW is investigating a case in June where a side airbag allegedly burst in a 2015 Tiguan, Automotive News reports. The government is also still researching the precise cause of the parts' ruptures. If the investigation finds ammonium nitrate to be a factor, the vehicles could need recalled. During a Congressional hearing Takata vice president Kevin Kennedy admitted that ammonium nitrate could be among the factors of the ruptures, but the company has continued to use the chemical in its inflators. Takata is now working to transition to a different propellant. Related Video:

Pennsylvania, Tesla approach five-store compromise [UPDATE]

Fri, Jun 27 2014In the Keystone State, the compromise number between zero and unlimited is five, apparently. Pennsylvania's Senate applied that math in an attempt to resolve the issue of allowing Tesla Motors to operate company-owned stores in the state. The senate this week unanimously voted for a bill that will allow Tesla's operations, but placed a limit on the number of stores at five. The bill will now go to the state's House for approval, according to Automotive News. Earlier this month, trade group the Alliance of Automobile Manufacturers went on record against the lack of limits on Tesla-owned stores in Pennsylvania. While the group was neutral on the issue of whether Tesla could work around the traditional third-party dealership network to sell its electric vehicles, the group said allowing Tesla to own an unlimited number of stores in the state created an unfair advantage for the California-based automaker. The trade group is now on board with bill as currently drafted because the store limit is similar to that of nearby states such as Ohio and New York. Tesla has one store in King of Prussia, Pennsylvania, with another slated for Devon. *UPDATE: Diarmuid O'Connell, Tesla's vice president of corporate and business development, wrote in an e-mail to AutoblogGreen that the company was "pleased" with the Pennsylvania's senate vote, and that the state's bill "serves the interests of Pennsylvania's consumers while enabling all parties, including lawmakers and auto dealers, to avoid unnecessary and potentially protracted conflict."

Battery-pack production for plug-ins, hybrids, triples in three years

Thu, May 15 2014Panasonic's standing in the plug-in and hybrid battery production industry has zoomed ahead like a Tesla Model S taking off from a standstill. That's appropriate because the Japanese company's relationship with the California-based automaker has been the primary reason for its growth, which looks like it will continue to be rapid. According to new numbers from Lux Research, battery manufacturers are producing 1.4 gigawatt-hours worth of batteries for plug-in and pure battery-electric vehicles per quarter, up from under 200 MWh in early 2011. Lithium-ion batteries account for 68 percent of the current total, while nickel-metal hydride batteries (like the one used in the non-plug-in Toyota Prius) account for 28 percent. The rest are made up of small numbers of things like solid-state batteries. Panasonic has been the primary beneficiary of electric vehicle growth (click on chart to enlarge). The company has a 39percent market share for plug-in and hybrid batteries, while NEC has 27 percent and LG Chem has 9 percent. As for demand, Toyota, Tesla and Renault-Nissan account for about three-quarters of all batteries used for plug-in and hybrid vehicles. Panasonic expanded its battery-production deal with Tesla last October. There are more details in the Lux Research press release below. Panasonic Has 39% Share of Plug-In Vehicle Batteries, Thanks to Its Deal With Tesla Batteries for Plug-Ins and Hybrids Were a $660 Million Market in Q1 2014, Led by U.S. Demand, According to Lux Research's New Automotive Battery Tracker BOSTON, MA--(Marketwired - May 6, 2014) - Batteries for hybrids and plug-in vehicles are growing fast, more than tripling over the past three years to reach 1.4 GWh per quarter, according to the Automotive Battery Tracker from Lux Research. Panasonic has emerged as the leader thanks to its partnership with Tesla, capturing 39% of the plug-in vehicle battery market, overtaking NEC (27% market share) and LG Chem (9%) in 2013. "Even at relatively low volumes -- less than 1% of all cars sold -- plug-in vehicles are driving remarkable energy storage revenues for a few developers, like Panasonic and NEC, that struck the right automotive partnerships," said Cosmin Laslau, Lux Research Analyst and the lead author of the new Lux Research Automotive Battery Tracker.