2021 Tesla Model Y Long Range on 2040-cars

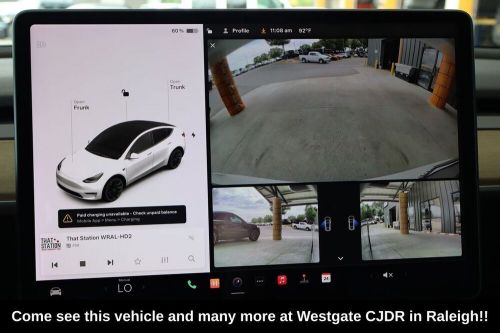

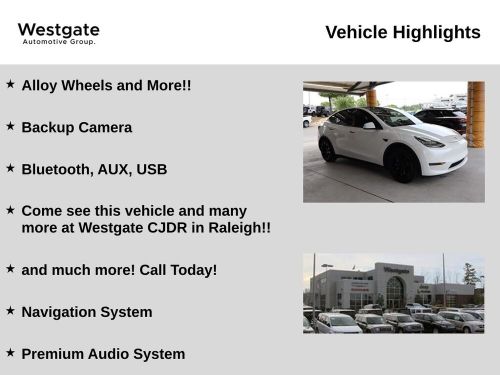

Engine:Electric Motor

Fuel Type:Electric

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5YJYGDEE8MF068970

Mileage: 35017

Make: Tesla

Model: Model Y

Trim: Long Range

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Tesla Model Y for Sale

2020 model y 2020 long range awd fsd autopilot pano accel boost(US $26,995.00)

2020 model y 2020 long range awd fsd autopilot pano accel boost(US $26,995.00) 2021 tesla model y long range sport utility 4d(US $31,998.00)

2021 tesla model y long range sport utility 4d(US $31,998.00) 2021 tesla model y performance awd 4dr crossover(US $38,550.00)

2021 tesla model y performance awd 4dr crossover(US $38,550.00) 2021 tesla model y long range(US $31,995.00)

2021 tesla model y long range(US $31,995.00) 2023 tesla model y long range(US $38,200.00)

2023 tesla model y long range(US $38,200.00) 2023 tesla model y long range(US $35,963.00)

2023 tesla model y long range(US $35,963.00)

Auto blog

Kia EV6, Nissan Frontier, Range Rover and VW Taos | Autoblog Podcast #738

Fri, Jul 15 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined byYahoo Finance Senior Reporter Pras Subramanian. First, they discuss the cars they've been driving, including the Kia EV6, Nissan Frontier, Land Rover Range Rover and Volkswagen Taos. Then they discuss the state of certain brands like Bentley, Ferrari and Polestar. They also talk about the most recent quarterly sales updates, including what's going on with Tesla in China. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #738 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: 2022 Kia EV6 2022 Nissan Frontier 2022 Land Rover Range Rover 2022 Volkswagen Taos The state of Bentley, Ferrari and Polestar Q2 sales trends Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: 2022 Kia EV6 walkaround at the 2021 Chicago Auto Show

Getting ready for the Tesla D tonight means reading some tea leaves

Thu, Oct 9 2014Today is D-day. We will know all of the details about the Tesla D and the mysterious "one other thing" – well, all the details that Tesla is willing to give – later tonight, but for now we're going to try and piece the story together based on whatever rumors and hints we can find. We've already speculated that the D stands for an all-wheel drive version of the Model S, which is an update that CEO Elon Musk has long talked about. But what else could be announced tonight, since the 'one other thing' apparently won't be the reveal of the production Model X? Could it be the first prototype of the Model 3? That's one rumor. Vanity Fair got to ask Musk directly, since the magazine invited him to its New Establishment Summit. While Musk didn't exactly spill the beans, he did give us a little something to chew on. "One of the things is already there, and people just don't realize it," he said (see video below). When pressed for more details, all Musk said was: "The Internet is very good at guessing these things. [They're] directionally connect, but the magnitude is not appreciated yet." Could he be talking about better driver assistance features? Some sources say that's exactly what he's hinting at, with the D standing for Driver or something else that means autopilot. There's also an unconfirmed report out there that the AWD Model S, which might be called the P85D, will be noticeably quicker – with a 0-60 time of under three seconds, compared to 4.2 for the current quickest model – but this sort of thing has been suggested and then denied before. So, any other guesses? This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2021 BMW M3/M4 and Volkswagen ID.4 revealed | Autoblog Podcast #646

Fri, Sep 25 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick. Together, they tackle a week's worth of big news, including the reveals of the BMW M3 and M4 and Volkswagen ID.4, as well as Tesla's Battery Day. Greg's been driving the long-term Subaru Forester, and gives us an update on that, while James discusses the current state and direction of Cadillac after driving the CT5. Then, the two dads talk about child seat safety, as well as random things they've learned from having children of their own. Autoblog Podcast #646 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2021 BMW M3 and M4 revealed with a standard manual and up to 503 horsepower 2021 Volkswagen ID.4 breaks cover with 250-mile range Why the Volkswagen ID.4 is a Very Big Deal Elon Musk promises $25,000 car, EV battery cell that costs half — but not soon 2022 Tesla Model S Plaid coming with three motors and more than 1,100 horsepower Cars we're driving: Long-term 2019 Subaru Forester 2020 Cadillac CT5 A conversation on child car seats Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Green Podcasts BMW Cadillac Subaru Tesla Volkswagen Safety Coupe Crossover Electric Luxury Performance Sedan