2022 Tesla Model 3 on 2040-cars

Oceanside, California, United States

Transmission:Automatic

Vehicle Title:Clean

Engine:Electric

Fuel Type:Electric

Year: 2022

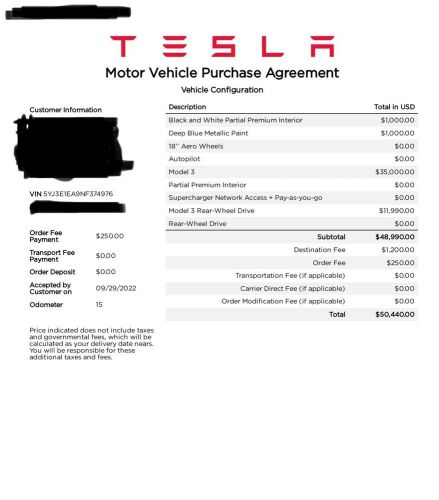

VIN (Vehicle Identification Number): 5YJ3E1EA9NF374976

Mileage: 21500

Model: Model 3

Exterior Color: Blue

Make: Tesla

Drive Type: RWD

Tesla Model 3 for Sale

2020 tesla model 3(US $19,900.00)

2020 tesla model 3(US $19,900.00) 2022 tesla model 3 rwd(US $19,850.00)

2022 tesla model 3 rwd(US $19,850.00) 2023 tesla model 3(US $23,900.00)

2023 tesla model 3(US $23,900.00) 2019 tesla model 3 long range(US $19,995.00)

2019 tesla model 3 long range(US $19,995.00) 2019 tesla model 3(US $20,000.00)

2019 tesla model 3(US $20,000.00) 2020 tesla model 3(US $14,000.00)

2020 tesla model 3(US $14,000.00)

Auto Services in California

Z Best Body & Paint ★★★★★

Woodman & Oxnard 76 ★★★★★

Windshield Repair Pro ★★★★★

Wholesale Tube Bending ★★★★★

Whitney Auto Service ★★★★★

Wheel Enhancement ★★★★★

Auto blog

Tesla Model 3: Finding perspective

Sat, Apr 2 2016The reveal of the Tesla Model 3 this week was one of the biggest automotive events of the year. The car attracted 180,000 pre-orders in just 24 hours, gave the company's stock a jolt, and set Tesla on a more ambitious growth path for the rest of the decade. It's a staggering feat considering the Model 3 is one car, from one company that's just 13 years old. It begs the question: Is all of this attention warranted? Barclays analyst Brian Johnson urged investors to "take a deep breath," and be mindful that the Model 3 won't likely arrive in "significant volume" until possibly 2019. Though Tesla promises the car will launch in 2017, Johnson points to the slow rollouts of the Model S sedan and Model X crossover as cautionary notes. The potential extended wait didn't temper the enthusiasm of Tesla's faithful, and many put down deposits before they had even seen the car. Johnson compared the hype to a "Black Friday atmosphere," saying the social media buzz went from "insane mode to ludicrous mode," in a riff on Tesla's driving features. Still, the Barclays analyst was admittedly "curmudgeonly" when it came to Tesla's stock price. In comparison, Morgan Stanley called Tesla's shares undervalued, and expects the Model 3 to be the start of cataclysmic changes in the industry. "We have said for some time that, despite its many worthy accomplishments, Tesla had not yet truly disrupted the auto industry," according to a report led by Adam Jonas. "We are now getting a feeling that this may be starting to change." The Model 3 offers a range of 215 miles on a single charge, can sprint to 60 miles per hour in less than six seconds, and has room for five. It will also be capable of charging on Tesla's supercharging network and features the company's autonomous technology. With a starting price of $35,000 before incentives, it's arguably the most futuristic car that's attainable for a wide swatch of American buyers, though the Chevy Bolt EV is comparable (200-plus-mile range, $37,500 MSRP before incentives) in many ways. The Model 3's attainability is what partially drove the hype. It was like Elon was whispering: Y ou can own the future. The question is now: Can Tesla deliver? If it does, this early fanfare will be richly deserved. News & Analysis News: Top Gear appears to be in turmoil as Chris Evans works four hours a day. Analysis: Is this a soap opera or a car show?

Tesla stock drops on fear that comes with low gas prices [w/video]

Wed, Dec 10 2014Tesla's stock price was down to around $206 earlier today, but it's back up to over $216 now. Friday, it closed at over $223. Some stock blogs are saying the price could go as low as $165 in the not-too-distant future. What's behind these wild swings that CNBC's Phil LeBeau calls, "the worst seven-day trading period ever for shares of Tesla"? One potential culprit is today's low gas prices. Those prices – currently hovering at around $2.65 a gallon in the US, the lowest in about four years – are affecting the cars people buy (sorry, hybrids), so it's not a huge leap to think they'll affect high-end electric cars, as well. A $50 drop in share price is pretty dramatic, and Bloomberg and others point the finger at gas prices. Ben Kallo, an analyst with Robert W. Baird & Co., wrote that, "We believe the recent decline in TSLA shares is largely driven by the concern low gasoline prices could impact demand if sustained for the long term." But there are other ideas, too. Since we don't always comprehend analyst-ese, we're not sure if Zev Spiro at Orips Research thinks gas prices are to blame, but it doesn't sound like it: A negative signal developed yesterday as a high volume break occurred below the slightly upward slanted neckline of the topping pattern, in the $219.20 area. The break below the neckline signaled a trigger of the bearish pattern and indicated a downtrend with a minimum expected price objective in the $165 area. In addition, yesterday's bearish trigger may result in downward momentum in the near term. Indicators are generally negative, adding to the overall bearish tone. Kallo remains positive, though, saying that, "We believe demand for TSLA's vehicles will remain strong." This makes sense to us, since TSLA has weathered drops before, only to climb to record highs afterwards. Watch a CNBC video report on all of this below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Recharge Wrap-up: Road-tripping in a Tesla Model S, Big Oil's tax advantage

Mon, Aug 4 2014Zap is poising itself to take advantage of China's extension of its electric vehicle incentive program. The government will be offering rebates on EVs, forgiving sales taxes and licensing fees, installing EV charging infrastructure and other measures to encourage adoption of zero-emission vehicles beyond 2015, through the year 2020. In response, electric vehicle company Zap and its partner Jonway Autos are decreasing production of gasoline-powered vehicles to make more EVs. It plans to increase production of its two EV production lines from 50 to 100 vehicles per day each, as well as positioning certain models for larger-scale production. Zap hopes customers will make use of rebates of up to $20,000 from the central government, plus local EV incentives. In October, Zap and Jonway will unveil new SUV and minivans that they intend to offer as less-than-gasoline- and zero-ownership-cost and vehicles under the umbrella of China's incentives. Read more in the press release below. Tesla Model S owner David Zygmont shares tips for taking cross-country road trips in an electric vehicle in a two-part podcast. David talks about his two-week road trip in his Tesla, and how he managed to make the most of charging his vehicle. One of his tools is the site EV Trip Planner. He also shares advice on overnight charging while staying at hotels. If you're thinking of going on an adventure in your EV, you should check this out to gain some valuable insights into the experience. Listen to part one of the podcast at EV Parade, and part two at Teslarati. Oil companies paid federal income taxes of just 11.7 percent over the last five years, according to a new report from Taxpayers for Common Sense. Oil companies reported a pre-tax income of $133.3 billion, and paid just $15.6 billion in federal income taxes. Some of the smaller oil companies paid much less than average, or about 3.7 percent. Oil companies enjoy many tax provisions that aren't available to other taxpayers, and the companies are able to defer taxes year after year, without paying any interest on it. Read more in the press release from Americans United for Change below.