2019 Model 3 2019 Fsd Autopilot Nav Pano Blind on 2040-cars

Vehicle Title:Clean

Body Type:Sedan

Engine:Electric 283hp 317ft. lbs.

Transmission:Automatic

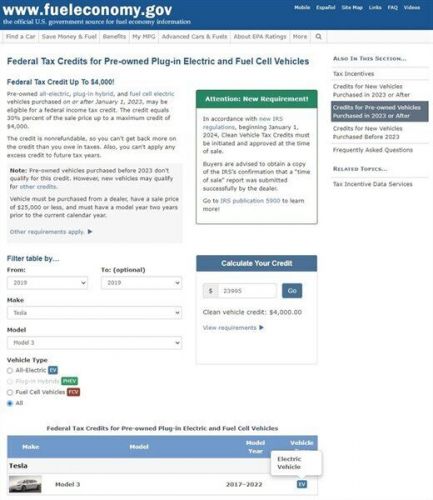

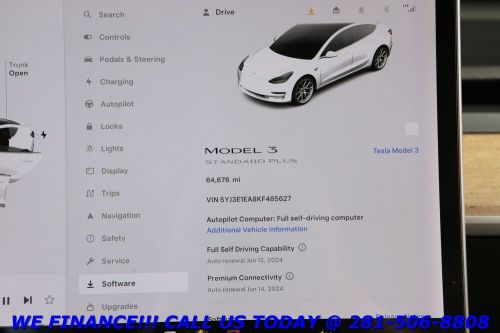

VIN (Vehicle Identification Number): 5YJ3E1EA8KF485627

Mileage: 64676

Warranty: No

Model: Model 3

Fuel: Electric

Drivetrain: RWD

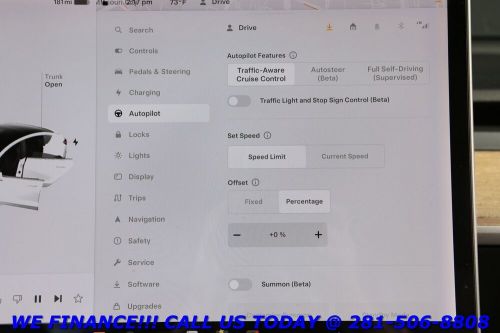

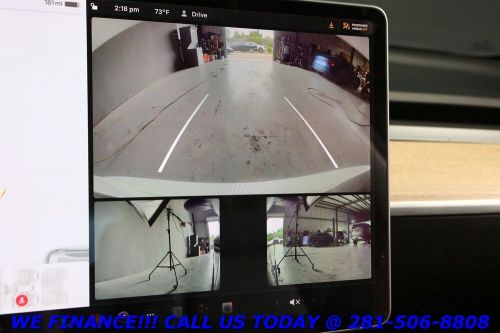

Sub Model: 2019 FSD AUTOPILOT NAV PANO BLIND

Trim: 2019 FSD AUTOPILOT NAV PANO BLIND

Doors: 4

Exterior Color: Pearl White Multi-Coat

Interior Color: Black

Make: Tesla

Tesla Model 3 for Sale

2021 model 3 2021 fsd autopilot nav pano blind 19k(US $26,495.00)

2021 model 3 2021 fsd autopilot nav pano blind 19k(US $26,495.00) 2018 model 3 2018 long range fsd autopilot nav pano blind 52k(US $23,995.00)

2018 model 3 2018 long range fsd autopilot nav pano blind 52k(US $23,995.00) 2021 model 3 2021 fsd autopilot nav pano blind 19k(US $26,495.00)

2021 model 3 2021 fsd autopilot nav pano blind 19k(US $26,495.00) 2021 model 3 2021 fsd autopilot nav pano blnd 25k(US $25,995.00)

2021 model 3 2021 fsd autopilot nav pano blnd 25k(US $25,995.00) 2021 model 3 2021 long range awd autopilot nav pano blind 38k(US $28,995.00)

2021 model 3 2021 long range awd autopilot nav pano blind 38k(US $28,995.00) 2020 model 3 2020 long range awd fsd accel autopilot a pano 40k(US $25,995.00)

2020 model 3 2020 long range awd fsd accel autopilot a pano 40k(US $25,995.00)

Auto blog

This anti-Tesla conspiracy theory isn't nearly as creative as it could be

Tue, Aug 19 2014Here we go again. Remember the anti-Tesla "truther" leaflets that were going around San Francisco a few months ago? There's another bit anti-Tesla message making the rounds, but this time we just don't find the same level of creative detail. As published on Gas 2.0 and copied for your reading pleasure below, the screed claims that a number of Senators and White House staffers were bribed to allow the "toxic tesla crime-mobile" on the street. You know, the one that "is full of lies and cancer causing material." And there's also this bombshell: "Some of the people involved have worked at Tesla and claim to have witnessed: 'Organized crime on a first hand basis.'" Well, then, let's call the cops right this moment. But wait, the conspiracy runs deep, apparently, "Members found out that major media outlet owners (Engadget, Google, AUTOBLOG GREEN [sic], Gizmodo, Jalopnik, etc.) had stock in the Tesla and battery cartels and, thus, covered up the first investigation results." For the record, none of us here at AutoblogGreen have or are allowed to have Tesla stock, so we can knock that rumor down right now. But let's not let the facts get in the way of a good story. All in all, this little tirade isn't nearly as good as the last one, but we'll take this sort of creative fiction any day. The truth is out there. THIS IS YOUR TESLA MOTORS INTERVENTION: BORN IN BRIBES AND CORRUPTION, FORGED IN FIRES, AND MORE FIRES, AND STILL MORE FIRES AND SOME EXPLOSIONS, THE TOXIC TESLA CRIME-MOBILE THAT YOU ARE DRIVING IS FULL OF LIES AND CANCER CAUSING MATERIAL. WE WANTED YOU TO KNOW THAT THE LOOK ON PEOPLE'S FACES, WHEN YOU DRIVE BY, MAY NOT BE ENVY BUT, RATHER: DISGUST! BRIBED: 5 Senators, 8 Senior Agency Staff and 2 White House Staff. Why do "YOU" want to be a part of that? Let's examine the facts and details ... ... Some of the people involved have worked at Tesla and claim to have witnessed: "Organized crime on a first hand basis." Two members have subscriptions to the Axciom Privacy Abuse database. They thought: "hmmm, why not use something evil for good purposes by helping to inform, and save, hapless Tesla owners who got screwed during the information Green-wash!" Members found out that major media outlet owners (Engadget, Google, AUTOBLOG GREEN, Gizmodo, Jalopnik, etc.) had stock in the Tesla and battery cartels and, thus, covered up the first investigation results. They want to clean the market more completely than an email "accident" on an IRS Hard Drive.

Tesla completes cross-country Supercharger drive in Model S EVs

Tue, Feb 4 2014It wasn't without problems, but Tesla's record-setting electric drive attempt has crossed the finish line. The pair of Tesla Model S EVs that left Los Angeles late last week has made it to New York City using nothing but Supercharger power. Last week, Tesla said the cars would be trying to set a Guinness World Record prize for the "lowest charge time for an electric vehicle traveling across the United States." According to Tesla, the Guinness team is now looking at the data to assess if that record was actually set. We don't know how much time was spent charging during the drive, but Tesla said that the two cars each put on 3,464.5 miles and used a total of 1,197.8 kWh. The entire drive took 76.5 hours. Tesla CEO Elon Musk told CBS that the trip was an "important, historic milestone." The weather wasn't exactly forgiving during that time, but the 15-person team made it safely to NYC in the early morning hours yesterday. The biggest problem was when one vehicle broke down near Mitchell, SD. Fortunately for the record attempt, it was not one of the Model S EVs, but one of the gas-powered support vehicles. This hampered the rotation system the drivers had: eight-hour drive shifts, eight-hour navigator shifts, eight-hour sleep shifts in one of two support vans. Tesla quickly bought plane tickets for the drivers left behind, and you can read details about this and more in the official blog posts here. Related Gallery Tesla Supercharger News Source: Tesla Motors, CBS Green Tesla Electric

Revozport ready for Tesla Model S with R-Zentric line of mods [w/video]

Fri, Dec 5 2014If you're going to drop $15 grand or so boosting your Tesla Model S's output to 691 horsepower (as if the all-electric sedan doesn't have enough guts as it is), what's another $6,000 to blow on a really cool spoiler kit. Because you do want to keep that car as low to the ground as possible, right? Hong Kong aftermarket specialist Revozport, which has worked with McLaren, Lamborghini and Nissan on various aftermarket kits, is offering drivers of the Model S its so-called R-Zentric product line to sport things up further with touches such as side skirts, front splitters and trunk-lip spoilers. Prices start at $765 for the trunk spoiler and work their way up to $5,690 for the "complete aerokit." Then, there's the option of blowing $11,000 for Klassen 22-inch forged wheels. Sporty. Take a closer look at the Tesla options here and see an animated video (no shots of the car in action, sadly) below. We last reported on Revozport in 2012 with its Mini Targa Raze, which, depending on the option, tuned up the little droptop's motor by 69 horsepower to 250 horsepower while pulling 66 pounds off the little car thanks to kevlar and carbon parts. The company has also worked on customization kits for the Volkswagen Golf GTI. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.