2004 California One Owner Saab 9-3 Linear Sedan 4-door 2.0lturbo 70k on 2040-cars

Malibu, California, United States

Body Type:Sedan

Engine:2.0L 1985CC l4 GAS DOHC Turbocharged

Fuel Type:GAS

Vehicle Title:Clear

Number of Cylinders: 4

Make: Saab

Model: 9-3

Trim: Linear Sedan 4-Door

Options: Sunroof, Cassette Player, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 70,541

Exterior Color: Black

Number of Doors: 4

Interior Color: Tan

2004 SAAB 9-3 LINEAR

4 Cyl 2.0 liter turbo, automatic transmission, traction control, fully loaded ,power windows, power locks, tilt wheel, cruise control, beautiful non smoker full leather interior, factory am/fm stereo cd changer, factory moon roof, super nice body and paint, this vehicle runs and drives in excellent condition, remote enrty, factory sport alloy wheels, orig window sticker of over 32k, premium package, all routine maint up to date, dont miss this one owner california saab, please email or more info..

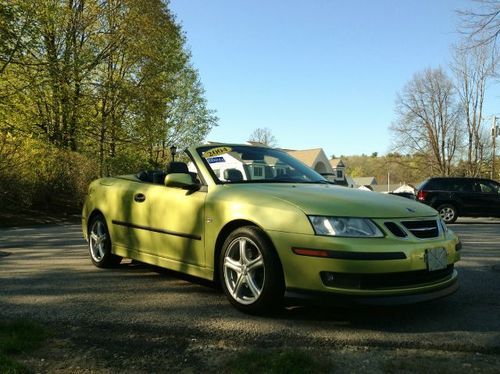

Saab 9-3 for Sale

2004 saab 9-3 turbo.

2004 saab 9-3 turbo. Navy blue with navy blue roof 72k highway mileage average condition

Navy blue with navy blue roof 72k highway mileage average condition 2006 saab 9-3 aero r2.8l turbo navigation sunroof(US $8,900.00)

2006 saab 9-3 aero r2.8l turbo navigation sunroof(US $8,900.00) 1999 saab 9-3 base convertible--only 97k miles

1999 saab 9-3 base convertible--only 97k miles 2004 saab 9-3(US $10,655.00)

2004 saab 9-3(US $10,655.00) 2007 saab 9-3 loaded roof,leather seat's, bose sorund stereo system low miles

2007 saab 9-3 loaded roof,leather seat's, bose sorund stereo system low miles

Auto Services in California

ZD Autobody ★★★★★

Z Benz Company Inc ★★★★★

Www.Bumperking.Net ★★★★★

Working Class Auto ★★★★★

Whittier Collision Center #2 ★★★★★

West Tow & Roadside Servce ★★★★★

Auto blog

Turkey buys rights to Saab 9-3 for domestic car

Mon, Oct 19 2015Just in time for Halloween, a Saab is rising from the dead. National Electric Vehicle Sweden, which controls the Swedish automaker, is selling the intellectual property rights for the second-generation 9-3 to the Scientific and Technological Research Council of Turkey (TUBITAK). This government-supported agency intends to turn the sedan into the "Turkish National Car," according to NEVS. Using the aging 9-3 as a backbone, Turkey intends to strengthen the nation's auto industry by producing an extended-range electric vehicle by 2020, Daily Sabah reports. The goal is for 85-90 percent of the components to come from the country. "From design to production, Turkey will be the center for all parts and processes regarding the first domestically produced car," Interim Science, Industry and Technology Minister Fikri Isik said to Daily Sabah. TUBITAK considered developing its own vehicle from scratch but calculated at least $1 billion in costs. Without going into specific detail, Isik said that buying the rights to the existing Saab turned out to be a better option. Despite having sold the 9-3 IP, NEVS is signing on to help with a business plan and to create the necessary supply and distribution chains for the EV. NEVS previously tried to revive the 9-3 itself by briefly continuing production and attempting to launch an electric version. Earlier this year, it partnered with Dongfeng to develop green vehicles. The company has been beset with financial problems, embroiled in a seemingly interminable post-bankruptcy reorganization progress. NEVS has been chosen by TUBITAK as its partner for developing a Turkish National Car TUBITAK, (the Scientific and Technological Research Council of Turkey) which has been assigned to develop "Turkish National Car" and realize this important mission, has chosen National Electric Vehicle Sweden AB, Nevs, as the industrial partner for the project. The cooperation has started in June 2015 between Nevs and TUBITAK and future industrial synergies in terms of development and manufacturing shall be generated with this cooperation. In the short term perspective this cooperation shall put Nevs' assets to work and shall give Turkey quick access to extensive automotive knowledge and experience. Nevs shall also provide its know-how in the developing of the business plan and establishing of the supply and distribution chains to TUBITAK.

Why won't automakers slap on a turbo badge anymore?

Thu, Sep 10 2015Where have all the turbos gone? Not the actual pieces that go in the engine, mind you, those are everywhere these days as automakers downsize cylinder counts and boost efficiency and CO2 claims. But the turbo badges and fanfare are missing. Back when turbos were something to get excited about there was "turbo-driven," "turbonium," and "The Turbo Zone," among other silly lines. But now that basically every car is getting some sort of boost even on the lowliest trims, automakers are almost sliding in the turbos under the radar. Or if you look at some of the nomenclature, pretending they don't exist at all. The 911 Turbo badge shows where the car goes from being sane to lunatic. It's an important border. The latest automaker to hide that it has boosted the turbo presence is Porsche with the 2017 911 lineup. Even the standard Carrera models now get turbocharged flat-six engines, meaning the 911 Turbo models aren't quite as special as they once were. Porsche is in a sticky situation with this. The 911 Turbo, after all, signifies where the 911 family takes off from being a sports car and becomes the Ferrari fighter. The 911 Turbo badge shows where the car goes from being sane to lunatic. It's an important border, but now Porsche has crossed it and is trying to downplay the fact. There are a lot of exaggerations with displacement badges today, with claims the 2.0-liter turbo four in a Mercedes C Class equates to a naturally aspirated 3.0-liter six to make a C300. Volvo is pretty far up there, too, saying an XC90 T8 means V8 power, even though it's a 2.0-liter turbocharged and supercharged four with electric assist. I don't know why BMW can't just call the car a 330i Turbo, rather than inflating the numbers up to 340i. Saab tried all of this back in the '90s when it decided to turbocharge its entire lineup, from light pressure units all the way up to models actually called "Saab 9-3 HOT" (for high-output turbo). But then the brand deleted any external reference to the turbo under the hood and people wondered why they were buying a $42,000 four-cylinder convertible. And that didn't turn out well. Even though these turbo replacements often make more power than their naturally aspirated predecessors, they're very different engines. People knew something changed when they exchanged their leased 328i with a 3.0-liter six for a 328i with a 2.0-liter turbo four.

What car brand should come back?

Fri, Apr 7 2017Congratulations, wishful thinker! You've been granted one wish by the automotive genie or wizard or leprechaun or whoever has been gifted with that magical ability. You get to pick one expired, retired or fired automotive brand and resurrect it from its heavenly peace! But which one? That's a tough decision and not one to be made lightly. As we know from car history, the landscape is littered with failed brands that just didn't have what it took to cut it in the dog-eat-dog world of vehicle design, engineering and marketing. So many to choose from! Because I am not a car historian, I'll leave it to a real expert to present a complete list of history's automotive misses from which you can choose, if you're a stickler about that sort of thing. And since I'm most familiar with post-World War II cars and brands, that's what I'm going to stick to (although Maxwell, Cord and some others could make strong arguments). So, with the parameters established, let's get started, shall we? Hudson: I admit, I really don't know a lot about Hudson, except that stock car drivers apparently did pretty well with them back in the day, and Paul Newman played one in the first Cars movie. But really, isn't that enough to warrant consideration? Frankly, I think the Paul Newman connection is reason enough. What other actor who drove race cars was cooler? James Dean? Steve McQueen? James Garner? Paul Walker? But, I digress. That's a story for another day. Plymouth: As the scion of a Dodge family (my grandfather had a Dodge truck, and my mom had not one, but two Dodge Darts – the rear-wheel-drive ones with slant sixes in them, not the other one they don't make any more), I tend to think of Plymouth as the "poor man's Dodge." But then you have to consider the many Hemi-powered muscle cars sold under the Plymouth brand, such as the Road Runner, the GTX, the Barracuda, and so on. Was there a more affordable muscle car than Plymouth? When you place it in the context of "affordable muscle," Plymouth makes a pretty strong argument for reanimation. Oldsmobile: When I was a teenager, all the cool kids had Oldsmobile Cutlasses, the downsized ones that came out in 1978. At one point, the Olds Cutlass was the hottest selling car in the land, if you can believe that. Then everybody started buying Honda Civics and Accords and Toyota Corollas and Camrys, and you know the rest. But going back farther, there's the 442 – perhaps Olds' finest hour when it came to muscle cars.