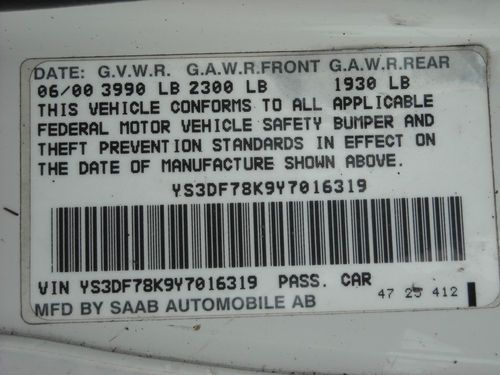

2000 Saab 9-3 Se Convertible 2-door 2.0l on 2040-cars

Essington, Pennsylvania, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.0L 1985CC l4 GAS DOHC Turbocharged

Fuel Type:GAS

For Sale By:Private Seller

Make: Saab

Model: 9-3

Warranty: Vehicle does NOT have an existing warranty

Trim: SE Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 211,532

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

Sub Model: SE

Exterior Color: White

Interior Color: Dark Gray

Number of Doors: 2

Number of Cylinders: 4

Saab 9-3 for Sale

2002 saab 9-3 se 5 speed manual low miles lqqk(US $5,999.00)

2002 saab 9-3 se 5 speed manual low miles lqqk(US $5,999.00) 2005 saab 9-3 convertible 5-speed manual clean carfax certified low miles rare!(US $8,800.00)

2005 saab 9-3 convertible 5-speed manual clean carfax certified low miles rare!(US $8,800.00) 2001 saab 9-3 2.0 turbo runs great

2001 saab 9-3 2.0 turbo runs great 2002 saab se

2002 saab se 2003 saab 9-3 linear sedan 4-door 2.0l

2003 saab 9-3 linear sedan 4-door 2.0l 2003 saab 9-3 vector 6 speed manual 78k miles sunroof 3 owner carfax clean(US $6,995.00)

2003 saab 9-3 vector 6 speed manual 78k miles sunroof 3 owner carfax clean(US $6,995.00)

Auto Services in Pennsylvania

Yardy`s Auto Body ★★★★★

Xtreme Auto Collision ★★★★★

Warwick Auto Park ★★★★★

Walter`s General Repair ★★★★★

Tire Consultants Inc ★★★★★

Tim`s Auto ★★★★★

Auto blog

Celebrate Volvo's 89th birthday with some neat facts

Thu, Apr 14 2016Volvo, arguably Sweden's best-known non-ABBA export, will celebrate the big 9-0 next year. The company has always operated somewhat under the radar, but it has its share of stories to tell despite an image formed by decades of solid, safe, and sensible cars. To celebrate the occasion, here are five lesser-known facts about Sweden's last remaining car brand. 1. It opened North America's first foreign car plant. Idyllic Halifax was a small fishing city of about a quarter-million in the early 1960s when Volvo arrived and became the first import brand to build cars en masse in North America. American consumers on the East Coast developed a fondness for the Volvo Amazon line in the late 1950s, leading Volvo to seek out a plant in the Americas. Halifax ponied up incentives, allowing Volvo to take advantage of a pact eliminating tariffs on cars built and exported between the United States and Canada. Volvo built cars there until the end of 1998, when it said its facility was no longer viable compared to larger factories in Europe. That brings us to The Netherlands, where Volvo bought a quirky, innovative automaker that once sold a car called the Daffodil (which was actually its luxury model). 2. You can thank Volvo for CVTs – even though it doesn't use them. Volvo wasn't interested in picking flowers. It wanted the automotive arm of truck manufacturer DAF, which would include its assembly plant, its Renault engines, and the first mainstream application of the CVT gearbox. Volvo acquired DAF's car business over the course of a few years in the early 1970s and, in typical Volvo safety-oriented style, it slapped big bumpers and head restraints on the little DAF 66 and rebadged it as the Volvo 66. The Dutch assembly plant would grow to include a partnership with Mitsubishi in the early '90s. Today, it operates as NedCar and builds Mini Coopers for BMW. Volvo is no longer involved in NedCar or DAF (which sold its CVT division to Bosch, by the way), but its acquisition of DAF helped ensure the success of CVTs. Ironically, even though Volvo's investment helped make CVTs mainstream, the Swedish automaker's affair with them was brief, and today it utilizes only conventional automatics. 3. The Swedish carmakers were pals. Over its 89 years, Volvo has been closely connected to a number of automakers – most notably Ford, which ran the company for a decade, and its current owner Geely. But Volvo is most closely linked to its longtime competitor, Saab.

What brands have Saab owners defected to? Polk investigates

Sun, 02 Sep 2012When a brand goes belly-up, it's natural for analysts to wonder where that brand's consumers will turn. General Motors has mothballed more car brands the last decade than most other automakers' have in their entire portfolios, so "Where did [insert brand here] buyers go?" has been a common question asked of The General. According to reports, it didn't do so well at retaining Oldsmobile owners (who supposedly went to Hyundai), or Hummer and Saturn buyers, but did get some return love from Pontiac owners.

A consultant with Polk has turned the loyalty lens on Saab. The Polk Disposal Loyalty Methodology tracks owners selling vehicles within six months of buying a new one. In 2010 and 2011, Polk found that when Saab died, owners went right up the middle of the mainstream to Honda. It was close, though, with just 0.2 percent separating Honda from number two Volkswagen. Audi comes in third.

After that it's back to the masses with Toyota, Chevrolet and Ford trumping import luxury brands. And if you combine all of the General Motors brands that Saab owners have migrated to, GM more than doubles Honda with a 15.2-percent share, so all the love is not lost.

Petrolicious keeps our love of the Saab Sonett aflame

Wed, 19 Mar 2014German auto designs lean toward function and purpose. Italian designers deliver passion and beauty. The Brits, majesty. American cars, brashness and authority. If you want a funky design, though, you go to Sweden. The land of cheap, do-it-yourself furniture and delicious meatballs knows a thing or six about style and design, and while that character is only now reemerging thanks to a certain string of Volvo concepts, it use to be that Saab was the authority on penning some of the industry's more unique designs.

Take the beautiful Sonett for example - a small coupe whose appearance is a funky mishmash of a Porsche 911 and a Bugeyed Sprite with just a hint of a Citroën DS (it's that convex rear window). It's a positively striking car, made more unique by its two-stroke, three-cylinder powertrain and four-on-the-tree manual transmission. With just 70 horsepower hauling about 1,500 pounds of Swedish style, the Sonett strikes us as an ideal alternative to some of the English sports cars of its day, particularly for those that are looking for something beyond your average MG or Triumph.

For Glenn Roberts, the Sonett was a part of his childhood. His family owned example was originally a special-order item by his parents in 1967. He bought the car from them 13 years later and has never looked back, completing a restoration in 2004. With a story like that, it's not surprising that Roberts and his silver Sonett are the most recent pairing to get some attention from Petrolicious.