2015 Ram Promaster City Slt on 2040-cars

Granite City, Illinois, United States

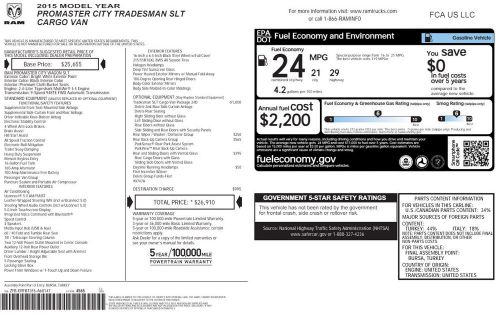

Engine:2.4L 4 Cylinder

Fuel Type:Gasoline

Body Type:--

Transmission:--

For Sale By:Dealer

VIN (Vehicle Identification Number): ZFBERFBT3F6A68147

Mileage: 168660

Make: Ram

Model: Promaster City SLT

Transmission Type: Automatic

Features: --

Power Options: --

Exterior Color: White

Interior Color: n/a

Warranty: Vehicle does NOT have an existing warranty

Auto Services in Illinois

Youngbloods RV Center ★★★★★

Village Garage & Tire ★★★★★

Villa Park Auto Clinic ★★★★★

Vfc Engineering ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Muffler & Brake ★★★★★

Auto blog

Pickup sales may hit 2M units for first time since 2007

Sat, 21 Sep 2013Even as fuel prices creep back up, trucks are still a hot item among new-vehicle shoppers. To see how popular pickup trucks still are, you don't have to look any further than how much effort automakers put into the continual one-upmanship of their trucks. Backing this fact up, USA Today is reporting that the segment could top two million sales this year - a total not matched since 2007, though still far from the pre-recession, three-million-unit levels.

Through August, the Ford F-Series continues to be the segment leader with almost 500,000 units sold, but the Chevy Silverado (328,269), Ram 1500 (234,642), GMC Sierra (122,232) and Toyota Tacoma (110,293) are all seeing at least 20-percent sales increases, helping to account for around 1.44 million truck sales so far this year - not including possible outliers like the Suzuki Equator and Chevy Avalanche.

This year alone, General Motors has completely redesigned its fullsize trucks, Ram and Toyota have significantly updated their offerings, the next-gen Ford F-150 will be out next year and Nissan is promising an all-new Titan around the same time with an eventual Cummins diesel under the hood. It would seem, then, that truck sales are poised to continue their upward trend.

Winnebago Trend, Travato are first ProMaster-based RVs

Wed, 02 Oct 2013While Ford has been the dominant supplier of chassis, engines and platforms for the recreational vehicle industry in modern times, its market share has been eroded by the increased availability of new commercial vehicles on the market. In the days of Daimler-Chrysler, the Sprinter was Chrysler's alternative to the Ford E-Series as a basis for Class B and C motor homes. But then Daimler split and the Sprinter went back to being a Mercedes product in the US, though it still continued currying favor in the RV world by offering diesel power with a smaller footprint. With the marriage of Chrysler and Fiat, though, the Pentastar brand once again has a foreign-sourced commercial van alternative - the Ram ProMaster - and Winnebago is the first RV manufacture to make it into a motor home.

Actually, Winnebago has unveiled a pair of ProMaster-based RVs: the Trend and Travato. The Trend is a Class C motor home, which generally means it's based on the chassis cab version of a van and features a bed over the cab and larger body for living space behind the B-pillars. Available in a tidy 24-foot length, the Trend can be had with two floor plans, both of which include large sleeping areas, a bathroom, kitchen and a dinette. The Trend also has some unique touches, including seats in the cab that swivel around to face the rear and three-point seat belts for the dinette.

The second ProMaster-based Winnie is the Travato, a Class B motor home, which is basically the full van model with as many amenities for living crammed into its quarters as will fit. The Travato measures in at just under 21 feet in length, but packs the full RV experience into the ProMaster's tall body, including a double bed, full bath, kitchen and dinette. The rear bed can even flip up and out of the way, allowing stowage of larger things likes bikes through the van's rear double doors.

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.