2022 Ram 3500 Laramie on 2040-cars

Engine:I6

Fuel Type:Diesel

Body Type:4D Mega Cab

Transmission:Automatic

For Sale By:Dealer

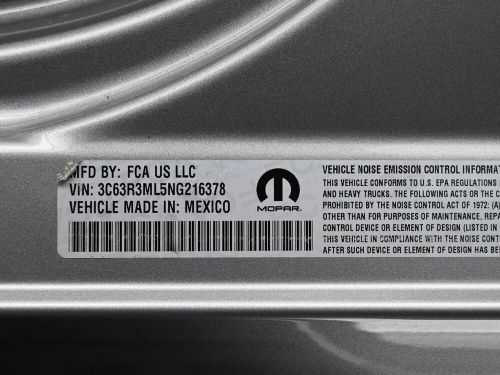

VIN (Vehicle Identification Number): 3C63R3ML5NG216378

Mileage: 31411

Make: Ram

Trim: Laramie

Features: --

Power Options: --

Exterior Color: Silver

Interior Color: Lt Frost Beige/Mountain

Warranty: Unspecified

Model: 3500

Ram 3500 for Sale

2023 ram 3500 tradesman(US $70,888.00)

2023 ram 3500 tradesman(US $70,888.00) 2024 ram 3500 laramie longhorn(US $91,126.00)

2024 ram 3500 laramie longhorn(US $91,126.00) 2024 ram 3500 limited longhorn(US $98,415.00)

2024 ram 3500 limited longhorn(US $98,415.00) 2024 ram 3500 tradesman(US $59,499.00)

2024 ram 3500 tradesman(US $59,499.00) 2024 ram 3500 big horn(US $82,280.00)

2024 ram 3500 big horn(US $82,280.00) 2024 ram 3500 tradesman(US $68,955.00)

2024 ram 3500 tradesman(US $68,955.00)

Auto blog

2021 Ram TRX, BMW 5 Series and the end of the Alfa Romeo 4C | Autoblog Podcast #657

Fri, Dec 18 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski. They kick things off discussing the brand-new 2021 Ram 1500 TRX, discussing how it compares with its main rival, the Ford F-150 Raptor. They move on to the latest BMW 5 Series before a quick overview of the Buick Enclave. The podcast wraps up by saying goodbye to the Alfa Romeo 4C, which leaves the world after the 2020 model year. Autoblog Podcast #657 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown What we're driving2021 Ram 1500 TRX 2021 BMW 540i 2020 Buick Enclave Other news Goodbye, Alfa Romeo 4C Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Goodbye Chevy Bolt, hello baby Ram and electric Chrysler 300 replacement? | Autoblog Podcast # 779

Fri, May 5 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor Jeremy Korzeniewski. They kick things off this week with some news. The Chevy Bolt and Bolt EUV will be discontinued. The McLaren 750S gets revealed and a four-door new flagship McLaren are rumored. Did Chrysler show dealers an electric 300 replacement, did we spy a new compact Ram, and are we closer to a production version of the Genesis X Convertible? Also, Greg recently visited Michigan Central Station, which Ford is revitalizing. In this week's fleet, your hosts discuss driving the Genesis Electrified GV70, Chevy Tahoe RST Performance Edition and the Polaris RZR XP. Finally, they take to Reddit for this week's "Spend My Money" segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast # 779 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Chevy Bolt EV and EUV, two of the most affordable EVs, ending production McLaren 750S revealed, adding power and lightness to the old 720S McLaren reportedly confirms four-door model and next flagship supercar Chrysler reportedly showed its dealers an electric 300 replacement Ram small pickup truck spy photos show scaled-down 1500 looks Are we closer to a production version of the Genesis X Convertible? Bill Ford's dream takes shape: Historic Detroit building turns tech incubator Cars we're driving 2023 Genesis Electrified GV70 2023 Chevy Tahoe RST Performance Edition 2024 Polaris RZR XP Spend My Money: Swap a 2023 Kia Stinger GT2 AWD for a 2022 Audi SQ5 Prestige? Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Podcasts Chevrolet Chrysler Ford Genesis McLaren RAM Truck Convertible Coupe Crossover SUV Electric Future Vehicles Luxury Performance Supercars Sedan

Recharge Wrap-up: Ram 1500 EcoDiesel earns RMAP Truck of the Year, GM earns Energy Star awards

Thu, Apr 9 2015Jas Hennessy & Co, maker of Hennessy Cognac, has taken delivery of 45 electric vehicles from Renault at its headquarters in Cognac, France. The 23 Zoes and 22 Kangoo ZEs are to be used by employees traveling between the company's sites, and replace 80 percent of the company's internal combustion fleet. "For many years now, Jas Hennessy & Co has been actively working to reduce its environmental impact," says Hennessy Operations Manager Marc Sorin. Hennessy also recently bought an electric boat to take visitors across the Charente River to the company's aging cellars. Read more from Renault. General Motors has earned two Energy Star awards from the EPA. The automaker earned the Energy Star Partner of the Year award for Sustained Excellence for efforts in energy efficiency and greenhouse gas emissions. For example, GM has achieved a global reduction of energy intensity by six percent, and has invested $34 million in energy, water and carbon reduction projects at its facilities. GM also earned the EPA Energy Star Climate Communications award for its outreach to employees, customers and stakeholders about energy efficiency and climate change. Read more from General Motors. The 2015 Ram 1500 EcoDiesel has been named Truck of the Year by the Rocky Mountain Automotive Press Association. The Ram truck beat out the Chevrolet Silverado Heavy Duty and GMC Canyon to earn the honors at the Denver Auto Show. The Ram 1500 EcoDiesel boasts a fuel economy of 21 mpg in the city, 29 mpg highway and 24 mpg combined. Ram attributes the truck's efficiency to features like its eight-speed transmission, stop-start system and active aerodynamics. Rocky Mountain Automotive Press Association Names 2015 Ram 1500 EcoDiesel 'Truck of the Year' and 2015 Chrysler 200 'Car of the Year' AUBURN HILLS, Mich., April 8, 2015 /PRNewswire/ -- - Denver-based journalist organization announces the awards at the Charity Preview for the Denver Auto Show - Winners are chosen from a field that includes every significant new car and truck introduced in the last year - Each eligible vehicle is evaluated and voted on by the members of the Rocky Mountain Automotive Press - The 2015 Ram 1500 EcoDiesel, America's most fuel-efficient pickup, earned a 29 mpg rating from the U.S.