2012 Ram 3500 on 2040-cars

Waterford, Mississippi, United States

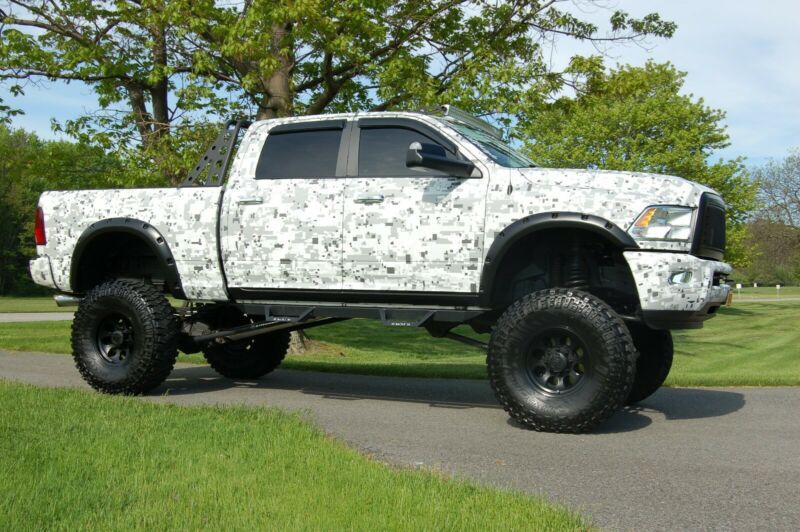

2012 Dodge Ram 3500 Laramie Longhorn Edition Crew Cab 4x4 Dually

Truck has a Ranch Hand legend front bumper

This is a 2 owner truck within the same family that has never been used to haul

a gooseneck trailer and has never been used as a work truck

Truck has normal wear, bumper has a scratch on end from when bumper was shipped

to me new in the box.

My family bought this truck brand new off the showroom floor and it has

only transferred ownership within our family once, so it really is a one owner

vehicle even though the vehicle report says its a two owner truck. it has never

been owned outside of our family.

Ram 3500 for Sale

2012 ram 5500 laramie(US $18,000.00)

2012 ram 5500 laramie(US $18,000.00) Svg chrysler dodge jeep ram in eaton(US $66,432.00)

Svg chrysler dodge jeep ram in eaton(US $66,432.00) 2015 ram 3500 laramie(US $22,050.00)

2015 ram 3500 laramie(US $22,050.00) 2012 ram 5500 laramie(US $15,750.00)

2012 ram 5500 laramie(US $15,750.00) 2017 ram promaster hign roof(US $17,220.00)

2017 ram promaster hign roof(US $17,220.00) 2016 ram 3500 bighorn(US $17,500.00)

2016 ram 3500 bighorn(US $17,500.00)

Auto Services in Mississippi

Wade Auto Repair ★★★★★

Tri-County Auto Repair ★★★★★

Pro Tran ★★★★★

LKQ Self Service Auto Parts ★★★★★

Kcs Exotic Cars ★★★★★

Jerry`s Auto Electric ★★★★★

Auto blog

2020 Ram HD trucks revealed in spy shots, along with interior

Fri, Dec 7 2018It looks like FCA isn't too concerned with keeping its redesigned Heavy Duty trucks under wraps before their reveals. Our spy photographers managed to catch a fleet of 2020 Ram HDs running around completely undisguised. Not only do we get to see exterior design details, but there are also shots of the HD's interior in Laramie trim. Shots of the new Power Wagon went up a few days ago, but now we get to see the truck in both Laramie Longhorn and Limited trims. It's clear the trucks are following in the footsteps of the 2019 Ram 1500 redesign for their inspiration — we like the new Ram, so that's a good thing. The departure from traditional Ram HD styling means the retirement of the crosshair grille. We can see this first in the brown Laramie Longhorn at the top here. Thankfully, Ram didn't go as far as GM did with its crazy grille design on the freshly released Silverado HD. That being said, it's still pretty large. It appears more upright and tough-looking than the similarly styled 1500 Laramie Longhorn, but still adopts the same design language. 2020 Ram 2500 Limited View 12 Photos The 2500 Limited doesn't exactly look finished, but it's clear we're looking at a more luxuriously appointed truck from the photos. There's more chrome, and the grille design is much more complex than the Laramie Longhorn. In fact, there might even be a bit too much chrome for our taste — tow hooks probably aren't in need of any shiny bling. 2020 Ram 2500 Power Wagon Tradesman View 8 Photos Finally, we also get to see the Tradesman trim of a Power Wagon. The red looks good on the big truck, but the trim we saw the other day had a much meaner front-end design. This one would be better for those who want a more discreet Power Wagon. Interior shots surfaced alongside these new trucks too. We wouldn't have imagined much difference between the 1500 and HD interiors, and that seems to be the case. The model we're looking at here has the 8.4-inch screen with Uconnect, but the massive 12-incher will undoubtedly be available too. We expect an "official" debut of this truck early next year, with the Detroit Auto Show being the most likely of places for that to happen. Related video:

Fiat Chrysler and Peugeot boards meet to finalize merger

Tue, Dec 17 2019MILAN/PARIS — The boards of Fiat Chrysler Automobiles and Peugeot will meet separately on Tuesday to discuss finalizing an initial agreement for a $50 billion merger to create the world's number four carmaker, sources said. A source close to FCA said the two companies could announce the signing of a binding memorandum early on Wednesday, followed by a conference call to explain further details later in the day. The two mid-sized carmakers announced plans six weeks ago for a tie-up to help them deal with big challenges in the industry, including a global demand downturn and the need to develop costly cleaner cars to meet looming anti-pollution rules. Ahead of the meetings, entities representing the Peugeot family, Etablissements Peugeot Freres (EPF) and FFP, unanimously approved a proposed memorandum of understanding for the planned merger, a source familiar with the situation said. FCA and PSA have said they would seek to finalize a deal by year-end to create a group with 8.7 million in annual vehicle sales. That would put it fourth globally behind Volkswagen, Toyota and the Renault-Nissan alliance. PSA's Carlos Tavares will be chief executive and FCA's John Elkann — the scion of Italy's Agnelli family, which controls FCA through their holding company Exor — chairman of the combined company. The group will include the Fiat, Jeep, Dodge, Ram, Chrysler, Alfa Romeo, Maserati, Peugeot, DS, Opel and Vauxhall brands, allowing it to serve mass and premium passenger car markets as well as those for trucks and light commercial vehicles. Related Video:    Chrysler Dodge Fiat Jeep RAM Citroen Peugeot

Mopar teases three concepts for SEMA

Mon, Oct 17 2022Chrysler first used the Mopar name in the 1920s, someone getting the idea to combine the words "motor" and "parts" for a service with that specialty. The automaker trademarked the name in 1937, first applying it to a line of antifreeze sold in cans. This makes 2022 the 85th anniversary of the division that now covers everything from service and parts to additional performance and customer care. We already heard the house of the round red M is going to SEMA with "a different flavor" of the battery-electric Dodge Charger Daytona SRT Concept that will begin to demonstrate future EV tuning possibilities. Thanks to a trio of concept sketches, we know Mopar's 15,345-square-foot booth will house a couple of Ram concepts and a fantastical Jeep to boot. We know next to nothing about them. The Jeep can be identified as an EV thanks to its Surge name, the circuit board motif on the sketch, and the EV badge behind the front wheel. The rig in the sketch appears to have no doors, and there's some structure ahead of the cabin that looks like a spare wheel, making us wonder at first if we were looking toward the front or the back. The door shutline and curve of the fender clarify the direction. We'll find out in a couple of weeks if Jeep plans on showing off tuning options for its electric wares same as Dodge. Mopar's press release on the show started with claiming it is "Charged Up" for SEMA. We're guessing that after Jeep's electric charge, Ram's talking about a super charge, one of the concepts being what appears to be a TRX in dayglo colors. The second Ram seems less rowdy, painted in a tri-tone 1970's style with a pinstripe and all, and fitted with what looks like a topper extending below the bed rails. The outdoor and overlanding life hasn't abated any since Ram showed its Rebel OTG Concept at the 2019 SEMA Show, so this could be another entirely fanciful take on overlanding. It's also possible that after Ram filed a patent application to trademark a vehicle built similarly to the Rebel OTG, we could see a bugout truck closer to production possibility.  The Stellantis brands could bask in more attention this year, with Ford, GM, Honda, and Hyundai all having pulled out. We'll find out what Dodge, Jeep, and Ram are all charged up about when SEMA happens from November 1-4 at the Las Vegas Convention Center.Â