2012 Ram 1500 Sport Crew Pickup 4dr 5.7l, Rebuilt Title, No Reserve, 10k Miles on 2040-cars

Gallipolis, Ohio, United States

|

2012 Ram 1500 Sport Crew Cab 4x4 with only 10,200 miles!!!

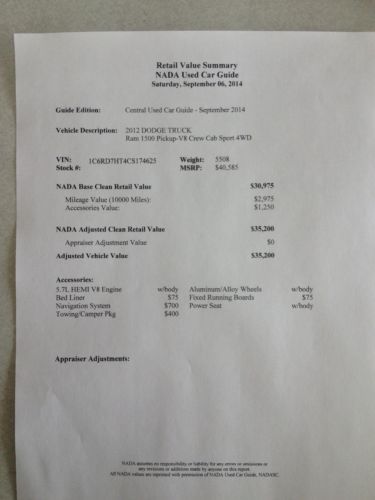

NADA retail on the truck is $35,200 with a good title but this one has a rebuilt/salvage title so you can save thousands on a great truck!!!!! NO RESERVE Please feel free to ask any questions through ebay and I will answer them. The VIN# says this truck is a "Quad cab" but I assure you it is a "Crew Cab" with a 6'4" bed on it. I bought this truck from a local guy who rebuilds vehicles professionally with 2,000 miles, when rebuilding the truck the builder intended to keep it for himself and opted to make it a Crew rather than the smaller Quad. I manage a Dodge dealership in Gallipolis, OH and my service department says that he did an AMAZING job at building the truck. I recently bought a bigger boat so I upgraded to a diesel Ram and don't need 2 trucks. I will be selling the truck with NO RESERVE!!!! The title is at my bank and all I have to do is pick it up when the funds are paid and clear (if it is a check). This truck may have a few more miles than shown as I do drive it around town but not more than 100 or so by auctions end. 5 day auction! Note that EVERYTHING on this truck works as it should and it has VERY LOW MILES! Please see pics for condition but this is one of the best looking trucks in town and has the following options: Navigation HD radio Partial leather sport seats Power sliding rear window Bedliner Chrome Running boards Sport console Remote keless with remote start Climate control 20" chrome wheels towing package Dual exhaust Dual power seats and much more! Please make sure you have cash in hand or financing pre-arranged as a lot of banks and finance companies will NOT loan on salvage title although there are many banks that will. High bidder will need to make arrangements to pay for and pickup within 24 hours of auction close. I would like buyer to pick it up within a week but I'm flexible as long as buyer is legit. I am located in southeast Ohio on the beautiful Ohio River in Gallipolis, OH 45631. On Sep-06-14 at 11:45:39 PDT, seller added the following information: I wanted to include that ALL airbags in the truck are good. |

Ram 1500 for Sale

$10,000 off msrp!!! 5.7 hemi, 8 speed auto 3.92 axle nav bluetooth 8.4 screen(US $30,535.00)

$10,000 off msrp!!! 5.7 hemi, 8 speed auto 3.92 axle nav bluetooth 8.4 screen(US $30,535.00) Are you looking for one of the rarest truck around .. here it is ..(US $32,995.00)

Are you looking for one of the rarest truck around .. here it is ..(US $32,995.00) 5.7 himi lifted trucks custom camera bluetooth v8 suv 1500 4x4 red conversion

5.7 himi lifted trucks custom camera bluetooth v8 suv 1500 4x4 red conversion Sherrod pro master leather swivel buckets 3rd row dvd mp3 camera bluetooth

Sherrod pro master leather swivel buckets 3rd row dvd mp3 camera bluetooth 2013 big horn mint condition 4x4

2013 big horn mint condition 4x4 Lone star hemi bed liner nerf bars mp3 sirius xm alloy wheels cruise

Lone star hemi bed liner nerf bars mp3 sirius xm alloy wheels cruise

Auto Services in Ohio

Zink`s Body Shop ★★★★★

XTOWN PERFORMANCE ★★★★★

Wooster Auto Service ★★★★★

Walker Toyota Scion Mitsubishi Powersports ★★★★★

V&S Auto Service ★★★★★

True Quality Collision ★★★★★

Auto blog

Ram ProMaster City getting facelift courtesy of Fiat Doblo?

Thu, 13 Mar 2014Our intrepid spy photographers have caught prototypes for a new Fiat Doblo. Now we know what you might be thinking (particularly if you didn't take note of the headline): why would we care about an automaker conducting a facelift on a European cargo van? Normally we wouldn't, only the Fiat Doblo has another name, under which it will be shortly be sold here in America: Ram ProMaster City.

Announced just months ago, the ProMaster City is the smaller counterpart to the Ram ProMaster, which itself is also a rebadged cargo van from Fiat Professional. Think of it as a Chrysler version of the Ford Transit and Transit Connect lineup - European vans being brought Stateside by automakers that operate on both sides of the Atlantic.

But despite the official announcement of the vehicle's pending arrival, we still haven't seen the PMC yet. The disguised Doblo prototypes pictured here appear to be wearing a completely new front end and some cosmetic revisions to their tail ends, too. We can't see anything in the interior, but the fact that it was completely covered up suggests that Fiat is working on overhauling that, as well.

2019 Ram 1500 pickup is keepin' it steel — well, mostly

Thu, Aug 10 2017The 2019 Ram 1500 pickup was ready for its close-up — an extreme close-up — from one of our spy photographers, who recently was able to walk around the entire truck, testing each body panel with a magnet. The result? He determined that the pickup will remain almost entirely steel, except for an aluminum hood and tailgate. This breaks from Ford's weight-saving move to aluminum on the F-150, and now in the coming Expedition, which has been the fodder of Chevy ads. Other details of the Ram 1500 facelift we already think we knew: The truck will get new front and rear facias. Coil springs with optional air suspension are likely to continue. It will get a larger cab. And a hybrid and turbocharged four-cylinder are possibilities. Predictably, a more powerful V8 and a Raptor fighter are rumored. Demon Ram, anyone? Meanwhile, here's a look at some Ram packages being offered for 2018. The 2019 Ram 1500 could debut as soon as January's Detroit Auto Show. Related Video: Featured Gallery 2019 Ram 1500 spy shots aluminum hood Related Gallery 2019 Ram 1500 Dealer Leak Spy Shots Image Credit: Brian Williams Spy Photos RAM Truck aluminum weight reduction

Ram 1500 Rebel TRX reveals hood scoop-mounted marker lights

Tue, Mar 24 2020Now that the Ram 1500 Rebel TRX is testing with production bodywork, the company has been doing a thorough job of covering up the off-road super truck. But fortunately lights still show through the thick coverings, and we're finally able to see the truck's wide vehicle-denoting marker lights. As you can plainly see, they're mounted to the inside of the hood scoop. This differs from the original Ram TRX concept that had its lights mounted on the roof like a traditional heavy duty pickup truck. It also differs from the Ford F-150 Raptor's grille-mounted marker lights. Both the Raptor and the TRX have these lights not just for style, but because they're wide enough to require the amber marker lights with three in the middle and one on either side of the truck. We can't quite spot the outside marker lights for the Ram. They could be integrated into the headlights, since it seems like the turn signal is particularly wide on this truck compared with regular models. The position of these lights also matches a recent report, lending some more credibility to other claims in it. We expect the Ram 1500 Rebel TRX to be revealed by the end of the year, perhaps as soon as the Detroit Auto Show, which is still scheduled for June. We know it will have a supercharged V8, since we've heard it ourselves, and reports say it will make at least 707 horsepower like the Charger and Challenger Hellcat. It has thoroughly modified suspension for high-speed off-roading, just like the Raptor. And of course it will have four-wheel drive. Â