1989 Porsche 911 Factory Turbo Look Targa - 1 Of Only 17 Made on 2040-cars

Fort Lauderdale, Florida, United States

Engine:3.3L 3294CC H6 GAS SOHC Turbocharged

For Sale By:Private Seller

Exterior Color: Red

Make: Porsche

Interior Color: Tan

Model: 911

Trim: Turbo Carrera Targa 2-Door

Options: Leather Seats, CD Player

Power Options: Air Conditioning, Cruise Control, Power Windows, Power Seats

Drive Type: RWD

Mileage: 9,999

Porsche 911 for Sale

1998 porsche 911 carrera s coupe 2-door 3.6l(US $55,000.00)

1998 porsche 911 carrera s coupe 2-door 3.6l(US $55,000.00) 2012 yellow porsche 911 turbo s, low miles, heated seats, black wheels, xm radio

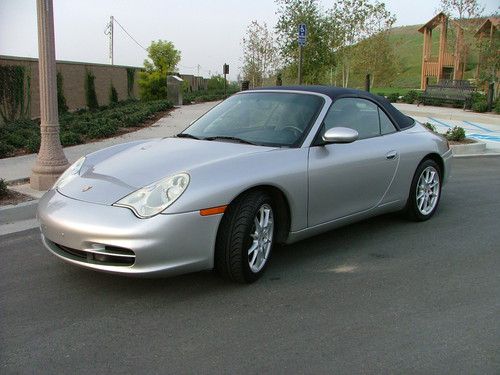

2012 yellow porsche 911 turbo s, low miles, heated seats, black wheels, xm radio 2002 porsche carrera 911 cabriolet(US $28,000.00)

2002 porsche carrera 911 cabriolet(US $28,000.00) 2010 porsche 911 turbo cabriolet certified pdk carbon fiber(US $118,999.00)

2010 porsche 911 turbo cabriolet certified pdk carbon fiber(US $118,999.00) '83 sc coupe, 70k miles, absolutely superb(US $32,500.00)

'83 sc coupe, 70k miles, absolutely superb(US $32,500.00) Turbo s coupe*$172k new*carfax cert*warranty*we finance/trade*1 owner*fla(US $124,890.00)

Turbo s coupe*$172k new*carfax cert*warranty*we finance/trade*1 owner*fla(US $124,890.00)

Auto Services in Florida

Workman Service Center ★★★★★

Wolf Towing Corp. ★★★★★

Wilcox & Son Automotive, LLC ★★★★★

Wheaton`s Service Center ★★★★★

Used Car Super Market ★★★★★

USA Auto Glass ★★★★★

Auto blog

Porsche 911 GT1 Evo up for grabs in Monaco valued at $3M

Thu, Mar 10 2016On paper, Porsche didn't do a flagship supercar in between the 959 and the Carrera GT. In reality, it did. Sort of. It was the strassenversion of the 911 GT1, a homologation special based on a spectacularly successful racing car. And RM Sotheby's has a standout example consigned for its upcoming sale in Monaco. What you're looking at is a 911 GT1 Evolution that served as the mid-point in the GT1's development, following the original and followed in turn by the GT1-98 that won the 24 Hours of Le Mans that year. One of just fourteen 911 GT1s held in public hands, chassis number GT1 993-117 won the Canadian GT Championship three years running, and is the only GT1 Evo that was ever registered for use on public roads. RM Sotheby's anticipates that it will fetch between $2.9 and $3.25 million when it crosses the auction block in May, marking the first time that this particular example has come up for auction. That would make it considerably more valuable than the GT1 Evo Gooding & Company sold at Amelia Island in 2012 for $1.26 million, according to Sports Car Market. Of course, the Porsche isn't the only notable item the auction house has lined up for the sale during the Grand Prix de Monaco Historique weekend. There's a pair of 1930s German convertibles – one Mercedes 540 K and one Horch 670 – valued at about the same level as the 911 GT1, a Tucker 48 (~$1.6m), and Niki Lauda's debut March 711 grand prix racer (~$550k). Those are some tempting sets of wheels, and we'll be watching to see how they fare two months from now.

2015 Porsche Cayenne S Quick Spin

Mon, May 11 2015There are sporty SUVs, but until the Macan came along, the Porsche Cayenne was arguably the only pure definition of a 'sports SUV, a la sports car. The second-generation Cayenne is now five years old, but still looks fresh. It's handsome without obvious effort, especially with the optional 21-inch 911 Turbo wheels. The Cayenne S replaces the old, 400-horsepower, 4.8-liter V8 with the brand-new, Porsche-developed 3.6-liter twin-turbo V6. This engine is quickly proliferating through the range – it powers the current Panamera S and the Macan Turbo. That former 4.8-liter started life as a 4.5-liter with 350 horsepower way back in 2002, specifically developed for the Cayenne, and to the end it remained a potent engine. We tried the new forced-induction V6 with 420 hp earlier this year in the Panamera S, and other than a soggy exhaust note it maintained the character of the former V8 sport sedan, with lusty power and hasty delivery. So, how's it do in the Cayenne? Driving Notes The Cayenne S version of the TT V6 gets 420 hp and 406 pound-feet of torque. That means there's 37 more lb-ft than the previous V8, and 22 more lb-ft than in the new Panamera S. Yet the 607-pound difference in curb weight between the Panamera and Cayenne means the V6 has a heavier load to lift here. And it shows – the instant response is dulled. Stomping the right foot gets the eight-speed transmission rappelling through gears to provide a little kick, but real gumption doesn't come until the turbos kick in. We're maybe talking about a second of pause compared to the Panamera, but a noticeable second. Perhaps a small price to pay for slightly better fuel economy, if you really care about such in your 420-hp SUV. Part of why we notice that second is that the Cayenne S is so right-now everywhere else that any perceived hesitation gets extra attention. It offers a specific adjustability that many sports cars don't have, with one button adjusting the three-mode air suspension and a separate Sport button tweaking the steering, throttle, gear changes, and traction control. With Sport keeping all the horses at the ready and the optional Porsche Torque Vectoring holding things steady, you don't need to step up to the GTS trim to get immediate acceleration, crisp steering, flat cornering at very un-SUV-like speeds, and tremendous stopping power from a total of 20 brake pistons. That said, the exhaust note here could also use a shot of Bruce Banner's gamma rays.

Horn, Hackenburg, Hatz to be fired as VW diesel scandal deepens

Thu, Sep 24 2015Volkswagen will sack three more high ranking executives, including the head of its US division, as the company's diesel scandal deepens. Reuters reported Thursday morning that the executives are: Michael Horn, who has led VW's US operations since January 1, 2014; Ulrich Hackenberg, who oversaw Audi's research and development; and Wolfgang Hatz, who was in charge of R&D for Porsche. A VW spokesman wouldn't comment in response to an Autoblog email. The moves come in the wake of longtime VW chief executive Martin Winterkorn stepping down on Wednesday. Volkswagen's board said at the time that it expected more personnel changes to follow. Volkswagen's board is scheduled to meet Friday, and Porsche CEO Matthias Muller has reportedly been named as Winterkorn's successor. The German auto giant was plunged into crisis last Friday when the EPA charged that the company manipulated software in its diesel-powered cars to pass US emissions tests. About 482,000 vehicles in the US are affected, and VW estimates 11 million around the world could have the rigged software. The revelations have prompted outcry from governments and regulatory agencies, and in the US, Volkswagen could face a fine of up to $18 billion. The departure of Horn, Hackenberg, and Hatz is a stunning downfall for three of the company's top and most visible executives. Horn had led US operations for less than two years, taking over from Jonathan Browning, who was well-respected but failed to reach VW's ambitious sales targets. Before overseeing Audi R&D, Hackenberg was hailed as a visionary for work in developing VW's modular architectures, which allow the company to save time and money by building many vehicles off the same chassis. Hatz had led Porsche R&D since 2011 and also was in charge of engines and transmission development for all of Volkswagen. Related Video: News Source: ReutersImage Credit: Getty Images Government/Legal Green Hirings/Firings/Layoffs Audi Porsche Volkswagen Emissions Diesel Vehicles vw diesel scandal vw diesel ulrich hackenberg michael horn wolfgang hatz