2014 Nissan Versa Note Sv on 2040-cars

Stroudsburg, Pennsylvania, United States

|

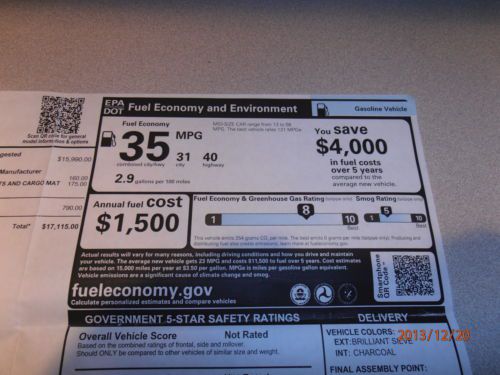

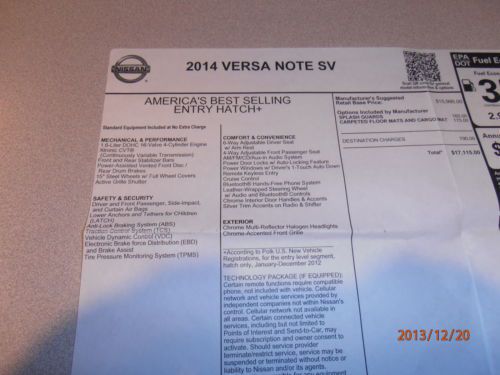

2014 VERSA NOTE SV HATCHBACK LIKE NEW.DETAIS IN PICS FOR EQUIPMENT ALSO HAS REMOTE START.

|

Nissan Versa for Sale

Nissan versa 2010 red(US $7,290.00)

Nissan versa 2010 red(US $7,290.00) 1.6 hb auto 1.6l front wheel drive power steering front disc/rear drum brakes(US $10,944.00)

1.6 hb auto 1.6l front wheel drive power steering front disc/rear drum brakes(US $10,944.00) One owner clean carfax automatic steering controls(US $10,950.00)

One owner clean carfax automatic steering controls(US $10,950.00) 1.8 1.8sl auto conv pkg ac cd full pwr well mntnd great buy!(US $6,896.00)

1.8 1.8sl auto conv pkg ac cd full pwr well mntnd great buy!(US $6,896.00) 2010 used 1.8l i4 16v manual fwd hatchback

2010 used 1.8l i4 16v manual fwd hatchback Sv 1.6l cd front wheel drive power steering front disc/rear drum brakes a/c abs(US $12,500.00)

Sv 1.6l cd front wheel drive power steering front disc/rear drum brakes a/c abs(US $12,500.00)

Auto Services in Pennsylvania

Yardy`s Auto Body ★★★★★

Xtreme Auto Collision ★★★★★

Warwick Auto Park ★★★★★

Walter`s General Repair ★★★★★

Tire Consultants Inc ★★★★★

Tim`s Auto ★★★★★

Auto blog

Nissan to take over for Renault in Formula E

Thu, Oct 12 2017Formula E has generated a lot of news lately, even in the off-season, as major automakers continue to either join the series or express interest in participating. The inclusion of a number of European rivals makes the series particularly interesting. One thing missing from the lineup is a Japanese automaker. That will change, though, as Motorsport reports that Nissan will be taking over its Alliance partner Renault's spot on the starting grid. It's not confirmed when the switch will happen, but with the Renault e.dams Z.E. 17 (seen in testing above) already having been unveiled for next season, it's likely the switch will come in for the 2018/19 season when the series moves away from the practice of swapping cars mid-race. Renault has been a successful part of Formula E from the very beginning, providing (with partner Spark) the cars each team used in the first season, and scoring the series' first Team Championship in 2015, and then again in 2016 and 2017. Nissan, though, has the globally popular Leaf EV, and has been eyeing an entry into Formula E for some time now. Joining the series will not only boost the visibility of Nissan's electrification strategy, it will do the same for its Nismo arm as well (and, as we've already learned, there could be a Leaf Nismo offered in the future). The change would also free up resources for Renault to focus on its F1 efforts. As Motorsport also reports, Formula E CEO Alejandro Agag has said of the Japanese brands Nissan, Honda and Toyota, that "one of those three, maybe two, will end up" in the electric racing series, without elaborating further. Nissan isn't expected to confirm its Formula E entry soon, but it could happen at the Geneva Motor Show next year. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. News Source: MotorsportImage Credit: Formula E Green Motorsports Nissan Renault Green Culture Electric Racing Vehicles Formula E nismo fia formula e championship

Weekly Recap: The cost of Tesla's ambitious plans for growth

Sat, Feb 14 2015Tesla has ambitious plans for growth, and they won't come cheap. The electric-car maker said this week it plans to spend $1.5 billion in 2015 to expand production capacity, launch the Model X crossover and continue work on its Gigafactory, which is being built outside of Reno, NV. The company is also investing in its stores, service centers and charging network, which is expected to grow by more than 50 percent this year. Plus, it's still working on the Model 3, which is scheduled to arrive in 2017. "We're going to spend staggering amounts of money on [capital expenditures]," Tesla chairman and CEO Elon Musk said on an investor call. He then added: "For a good reason. And with a great ROI [return on investment]." They're bold plans, and Musk is clearly willing to put Tesla's money where his mouth is. That's why the company is projecting a whopping 70-percent increase in deliveries this year, for a total of 55,000 cars. A large chunk of that growth will come from the addition of the Model X crossover to Tesla's portfolio, and the company already has nearly 20,000 reservations for it. More than 30 Model X prototypes have been built, and it is expected to begin shipping to customers this summer. Musk said he's "highly confident" the vehicle, which has experienced delays, will arrive on time. The company also had more than 10,000 orders for the Model S at the start of the year. The big spending plans caused a stir, even though Tesla spent $369 million on capital expenditures in the fourth quarter alone. In a note to investors, Morgan Stanley analysts called the costs required to keep pace with Tesla's demand "eye-wateringly high," and said the $1.5-billion figure was nearly double their expectations. Still, Musk is not thinking small and suggested that his company could be as big in 10 years as Apple is now if Tesla's growth continues. His optimism comes as the company actually reported a $294-million net loss in 2014, more than its $74-million loss in 2013. The money, however, continues to roll in, and total revenues increased to $3.2 billion in 2014, up from $2 billion in 2013 and a dramatic surge from $413 million in 2012. More of the same is expected this year, and the company could reach $6 billion in revenue. As Morgan Stanley noted, it "seems Tesla is preparing to be a much larger company than we have forecasted." It's certainly spending that way.

Nissan tries to Sway us with video teaser

Mon, Mar 2 2015Nissan is about to unveil the Sway concept at the 2015 Geneva Motor Show this week, but before it does, it's released this teaser clip to give us a better idea of what to expect. Previewed in a teaser image released last week, the Sway concept is the Japanese automaker's proposal to replace its Micra/March hatchback with something a bit more dynamic. It's said to borrow from the success of the Juke and Qashqai crossovers to give the new European-market Pulsar hatchback a baby brother. It's still a bit early to draw conclusions on the design and its prospects for production, but from what we can tell from this video clip, it looks promising. Watch this space for more. Related Video: