2014 Nissan Maxima Sv on 2040-cars

4150 E 96th ST, Indianapolis, Indiana, United States

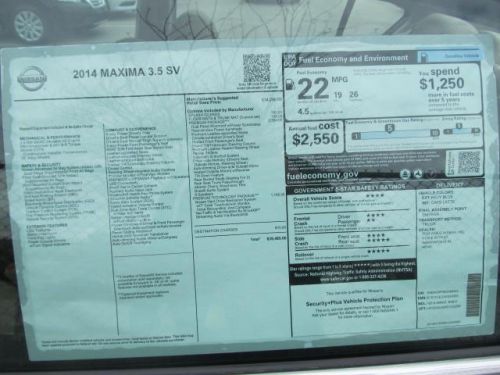

Engine:3.5L V6 24V MPFI DOHC

Transmission:Automatic CVT

VIN (Vehicle Identification Number): 1N4AA5APXEC469425

Stock Num: N18747

Make: Nissan

Model: Maxima SV

Year: 2014

Exterior Color: Navy Blue Metallic

Options: Drive Type: FWD

Number of Doors: 4 Doors

All prices include all current manufacturer rebates and incentives. All prices do not include destination taxes dealer fees title License Fee Registration Fee Dealer Documentary Fee and Finance Charges. Payments and/or finance rates subject to lender approval. See dealer for more details. Tom Wood Nissan is the #1 volume sales leader in the state of Indiana. We are committed to providing the finest automotive experience through superior service. WE WILL MATCH AND BEAT ANY DEAL!! Call now 866-837-6672!! Be sure to ask for our Internet Sales Team.

Nissan Maxima for Sale

2014 nissan maxima sv

2014 nissan maxima sv 2013 nissan maxima sv(US $28,995.00)

2013 nissan maxima sv(US $28,995.00) 2014 nissan maxima sv(US $32,277.00)

2014 nissan maxima sv(US $32,277.00) 2014 nissan maxima sv(US $33,570.00)

2014 nissan maxima sv(US $33,570.00) 2014 nissan maxima sv(US $33,655.00)

2014 nissan maxima sv(US $33,655.00) 2014 nissan maxima sv(US $34,340.00)

2014 nissan maxima sv(US $34,340.00)

Auto Services in Indiana

Wilson`s Transmission ★★★★★

Westside Motors ★★★★★

Tom Roush Mazda ★★★★★

Tom & Ed`s Autobody Inc ★★★★★

Seniour`s Auto Salvage ★★★★★

Ryan`s Radiator & Auto Air Service ★★★★★

Auto blog

Driving the Maserati MC20 and BMW i7 | Autoblog Podcast #802

Fri, Oct 13 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and Road Test Editor Zac Palmer. They're amped up about the BMW i7 and Maserati MC 20 they've all been driving. They also opine about the BMW M3 CS and 2024 Ford Mustang. The Japan Mobility Show (formerly Tokyo Motor Show) is coming up, and there have been some interesting reveals and teasers, including the Nissan Hyper Urban and Hyper Adventure concepts, some neat kei car concepts from Daihatsu, a Miata-inspired EV concept from Mazda and an electric sports coupe concept from Subaru. Finally, they discuss the wild situation surround last weekend's Formula 1 Qatar Grand Prix. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #802 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2023 BMW i7 2023 Maserati MC20 2024 BMW M3 CS 2024 Ford Mustang GT Japan Mobility Show preview Nissan Hyper Urban and Hyper Adventure concepts Daihatsu kei car concepts Possible next-gen Mazda Miata Subaru electric sports car Formula 1 Qatar Grand Prix recap Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Motorsports Podcasts Tokyo Motor Show BMW Ford Maserati Mazda Nissan Subaru

These 'blind' automotive world record stunts have to stop

Wed, Dec 7 2016Drivers setting world records "blind" – wearing a blindfold or with something obscuring the windshield – is the new thing for some reason. First it was an Alfa Romeo Giulia setting a blind lap at Silverstone with help from a spotter trailing behind, and now this: a stunt man doing a J-turn within a narrow path with nothing but a Nissan Juke's cameras guiding him. He matched the "sighted" J-turn record, flipping the car around in a space about 7 inches longer than the car. I have two issues with these stunts. First, there are just too many world records. Yeah, I said it. Are these meaningful? Is someone else likely to ever attempt this feat? No, because it's just marketing, both for the manufacturer and whoever's still trying to sell those annual books. Stuff like the fastest production car is fine with me. Heck, I'll even take unofficial Nurburgring times – the kind where the drivers can actually see. Second, I'm all for stunts, but do something cool! And preferably something that could only be performed with that particular car, if you're going to make an ad out of it. Yes, the Juke has an Around View Monitor system, which stitches together feeds from four cameras to make it look like the car is being filmed by a drone hovering overhead. I happen to love 360-degree cameras – they let you see things that are just not visible from the driver's seat and make parking and low-speed maneuvering really easy. But the Juke isn't the first car to offer one, and the feature isn't even new to the car. Nissan was at least forthright enough to admit that this professional driver (on a closed course!) had a bunch of practice. But this really says more about his precision driving skills than about the car, or the camera. And just so we're clear, you really shouldn't try to park a car without looking out the windows, even if you have fancy cameras. So what's next? Pretty soon there will be a record for blindest blind stunt. Let me know when someone actually does something interesting. Related Video:

Nissan Murano CrossCabriolet being phased out, no replacement planned

Tue, 15 Apr 2014Over the years, I've been given many nicknames - a few of them have even been repeatable around small children. One such moniker is "Mr. Other Makes," a title given to me because of my predilection for sifting through eBay Motors seeking out automotive misfits and orphans. I've got a soft spot for the dreamers and automakers who take big chances on beancounter-enraging flights of fancy.

I count Nissan among that bunch, because for every safe-as-houses Altima or Sentra that rolls out of its factory gates, the Japanese automaker has often secreted away a little funding for white-space niche vehicles that any sane person wouldn't expect to pencil out. Some, like the Juke, have proven to be massive hits. Others, like the GT-R, have become icons. And then there are models like the Murano CrossCabriolet, a segment-bending mashup the likes of which we haven't seen since the AMC Eagle Sundancer.

Yesterday, upon revealing the new third-generation Murano ahead of its New York Auto Show debut, we reported "the writing appears to be on the wall" for the midsize crossover's novel convertible cousin. It appears we were right. Autoblog can now confirm that the CrossCabriolet will die at the end of this model year, and our source at Nissan tells us unequivocally, "there is no plan for a next-generation Murano CC."