2001 Nissan Maxima Se 20th Anniv (cooper Lanie 765-413-4384) on 2040-cars

Plainfield, Indiana, United States

Vehicle Title:Clear

Fuel Type:Gasoline

Engine:6

For Sale By:Dealer

Transmission:Automatic

Make: Nissan

Model: Maxima

Mileage: 147,644

Disability Equipped: No

Sub Model: SE 20th Anni

Doors: 4

Drive Train: Front Wheel Drive

Nissan Maxima for Sale

05 only 76k miles black xenon leather bose heated power seats moonroof tinted(US $9,980.00)

05 only 76k miles black xenon leather bose heated power seats moonroof tinted(US $9,980.00) 2013 new demo 4265.0 miles call today to save big(US $32,500.00)

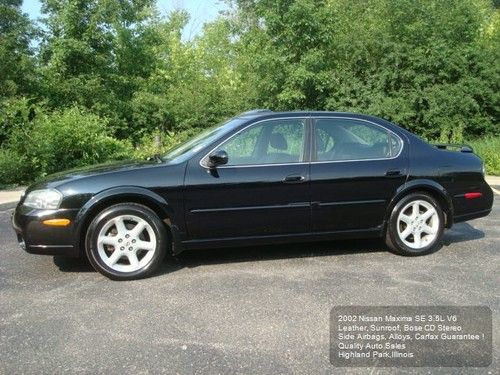

2013 new demo 4265.0 miles call today to save big(US $32,500.00) 2002 nissan maxima se leather auto side airbags cd heated seats well maintained!(US $6,975.01)

2002 nissan maxima se leather auto side airbags cd heated seats well maintained!(US $6,975.01) 2012 nissan maxima 3.5 sv sport sedan sun roof leather only 2k --- free shipping(US $19,450.00)

2012 nissan maxima 3.5 sv sport sedan sun roof leather only 2k --- free shipping(US $19,450.00) 1998 nissan maxima se sedan 4-door 3.0l

1998 nissan maxima se sedan 4-door 3.0l 1995 nissan maxima gle sedan 4-door 3.0l(US $2,750.00)

1995 nissan maxima gle sedan 4-door 3.0l(US $2,750.00)

Auto Services in Indiana

Westfalls Auto Repair ★★★★★

Trinity Body Shop ★★★★★

Tri-County Collision Center & Towing ★★★★★

Tom O`Brien Chrysler Jeep Dodge Ram-In ★★★★★

TJ`s Auto Salvage ★★★★★

Tire Central and Service Southern Plaza ★★★★★

Auto blog

Tesla Model S drivers put way more miles on their cars than Nissan Leaf owners do (we think)

Fri, Dec 19 2014Just a few weeks ago, Nissan announced that its customers have driven over a billion electric kilometers in the four years that the world's best-selling EV has been on the road. That heady milestone means, Nissan says, that the Leaf has saved 180 million kilograms of CO2 emissions around the world. The billion kilometers have been split among the 147,000 Leaf vehicles that Nissan has sold. Well, not really, since the billion kilometer total only counts Leaf EVs registered with CarWings, which Nissan says is 54 percent of the total sales. That's 79,380 cars and results in an average – and it's only a rough average, but what're you gonna do? – of 12,597 miles per car. Let's keep that number in mind for a minute. Today, despite going on sale a year and a half after the Leaf (June 2012 versus late 2010), Tesla Motors Tweeted today that Model S drivers have hit the same numerical milestone. Tesla didn't say how many of its vehicles were involved in its count, but we think that Tesla has sold at least 50,000 Model S electric vehicles globally (about 2,650 in 2012, 22,450 in 2013, 21,821 for 2014 through the end of September), so we'll estimate a rough average for each Model S of 20,000 miles. So, in case anyone ever needs numeric proof that a Model S is more fun to drive than a Leaf – that's the only possible thing this could mean, right? *ahem, longer range* – now you've got the data. {C} This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Nissan says "thanks a billion" to LEAF owners Nissan LEAF drivers registered on CarWings telematics have collectively driven ONE BILLION KILOMETERS worldwide* Globally, Nissan LEAF drivers have saved more than 180 MILLION kilograms of CO2 emissions* Over 147,000 Nissan LEAF vehicles have been sold globally to date ROLLE, Switzerland – Nissan has revealed that owners of the LEAF, its 100% electric car, have collectively recorded an impressive one billion kilometers on the CarWings telematics system worldwide – saving over 180 million kilograms of CO2 emissions* in the process. This incredible achievement comes almost four years since the LEAF was launched in 2010 as one of the first mass-market, pure-electric vehicles. It is now the best-selling electric vehicle in history, with over 147,000 LEAF vehicles sold globally to date, 31,000 of which have been sold in Europe.

GM, UAW poaching Nissan workers in Tennessee

Tue, Sep 8 2015General Motors and the United Auto Workers are going on a recruitment drive at the Spring Hill factory in Tennessee, and they're hoping to poach some skilled workers from Nissan's nearby plant in Smyrna, TN. The General and the union even bought a billboard advertising for industrial electricians near the Japanese automaker's facility, according to the Daily News Journal. The reason for the billboard was simple. "GM was short of electricians," said Tim Stannard, the president of the UAW local at Spring Hill, to the Daily News Journal. The factory currently builds the Chevrolet Equinox but has a contract to assemble the next generation of Ecotec engines and the Cadillac XT5, which replaces the SRX. Thanks to the $185-million deal, employment there is expected to double by May 2016, according to Stannard, with roughly 1,800 additional union jobs. Beyond just several billboards, GM has job postings online for the Spring Hill plant looking for workers with specific skills. There has already been some interest in the positions among Nissan employees, Stannard indicated. According to a recent study by the Center for Automotive Research, the average GM worker currently makes $58 an hour, including benefits. Comparatively, Nissan pays an average of $42 an hour with benefits. The General's number could change in the coming weeks because its contract with the UAW is about to expire, and higher wages are among the major negotiating points.

Watch a pro drifter drive the Nissan Skyline with his feet

Sat, May 16 2015You can't let a few setbacks dissuade you from trying to achieve your goals, and that's as true in motorsports as anywhere else in life. If you want an inspiring example of someone who isn't letting adversity stand in his way, just check out professional drifter Bartosz Ostalowski. He doesn't have arms but still competes with one foot on the wheel. It would be amazing to see someone drift a car using just a foot in any setting. However, the fact that Ostalowski is able to do that during competitions makes the feat even more impressive. To make drifting possible, his car is a custom modified R34 Nissan Skyline with an automatic transmission and a LS V8 from General Motors for power. If you watch the video above, and somehow don't believe what Ostalowski does is possible, the clip shows another example of him at work. This one cuts between interior and exterior views of the same run. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.