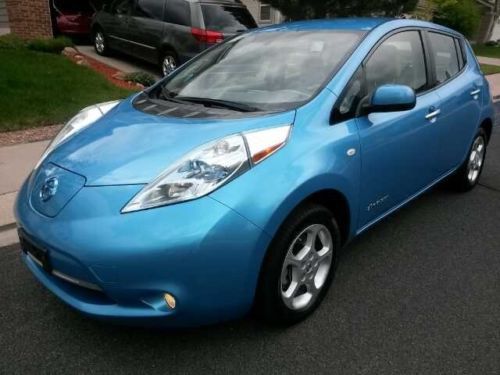

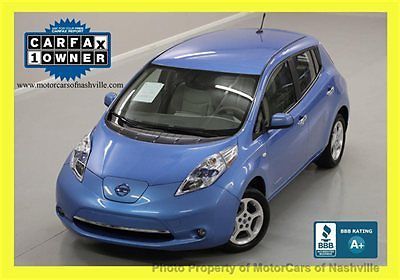

2013 Nissan Leaf Sv Super Black / 8,696 Miles / Like New / Must See on 2040-cars

Ontario, California, United States

Nissan Leaf for Sale

2013 nissan s

2013 nissan s No reserve nissan leaf sl quick charge nav bluetooth new tires rear view cam

No reserve nissan leaf sl quick charge nav bluetooth new tires rear view cam Pre-owned 2014 leaf sl with premium, still qualifies for tax credit, 14 miles

Pre-owned 2014 leaf sl with premium, still qualifies for tax credit, 14 miles 2011 nissan leaf sl zero emission electric nav only 39k texas direct auto(US $16,780.00)

2011 nissan leaf sl zero emission electric nav only 39k texas direct auto(US $16,780.00) Nissan leaf all electric red pearl metallic new tires navigation carpool access!(US $14,990.00)

Nissan leaf all electric red pearl metallic new tires navigation carpool access!(US $14,990.00) 4dr hb sl low miles hatchback 80kw ac synchronous elect blue ocean

4dr hb sl low miles hatchback 80kw ac synchronous elect blue ocean

Auto Services in California

Yoshi Car Specialist Inc ★★★★★

WReX Performance - Subaru Service & Repair ★★★★★

Windshield Pros ★★★★★

Western Collision Works ★★★★★

West Coast Tint and Screens ★★★★★

West Coast Auto Glass ★★★★★

Auto blog

Nissan slashes profit forecast as Ghosn arrest hurts brand appeal

Wed, Apr 24 2019TOKYO — Nissan cut its profit forecast for the fiscal year through March on Wednesday to reflect slowing sales, higher costs and the fallout from a criminal investigation of its former chairman, Carlos Ghosn. Nissan Motor Co. expects to post a 319 billion yen ($2.9 billion) profit for the fiscal year, marking a 22% drop from its earlier 410 billion yen ($3.7 billion) forecast. Nissan said the downgrade reflects higher costs in the U.S. from a warranty extension campaign for some vehicles and falling sales due to "corporate issues," alluding to the Ghosn scandal. Ghosn was arrested in November and is facing charges of underreporting his income and breach of trust. He says he is innocent. He was released on bail in March and is awaiting another court decision on bail after his re-arrest on April 4. Nissan, which is allied with Renault SA of France, has seen sales lag in France and Japan, where Ghosn is widely known. In the U.S. and China, buyers aren't as affected by the scandal, but the markets there overall have slowed. Other factors contributed to the revision, such as production not keeping up with demand for the Note, an extremely popular model in Japan. But the high-profile scandal has weakened the brand appeal of the maker of the Leaf electric car, Infiniti luxury model and X-trail sports utility vehicle. Nissan said it expects to sell 5.5 million vehicles in this fiscal year. Earlier it predicted it would sell 5.6 million. The company sold nearly 5.8 million vehicles in the fiscal year that ended in March 2018. The automaker reduced its sales outlook by 0.2% for the fiscal year through March 2019 to 11.5 trillion yen ($103 billion), compared to its previous forecast. It was Nissan's second downgrade for its outlook following one in February that cited faltering sales in China and the U.S. At that time, Nissan also logged costs about 9.2 billion yen ($83 million) related to the alleged underreporting of Ghosn's compensation. Nissan has promised to strengthen its corporate governance to prevent a recurrence of what it says is serious wrongdoing by Ghosn. Ghosn was sent by Nissan's French alliance partner, Renault SA, to help turn the Japanese automaker around when it was near bankruptcy 20 years ago. The future of the alliance is one of many questions clouding Nissan's future following Ghosn's ouster since he was the main liaison for the alliance, which includes smaller Japanese automaker Mitsubishi Motors.

Nissan, Renault break up the Ghosn-style almighty chairmanship

Tue, Mar 12 2019YOKOHAMA, Japan — Japan's Nissan Motor and France's Renault said they would retool the world's top car-making alliance to put themselves on more equal footing, breaking up the all-powerful chairmanship previously wielded by ousted boss Carlos Ghosn. The removal of Ghosn, credited for rescuing Nissan from near-bankruptcy in 1999, had caused much uncertainty about the future of the alliance and some speculation the partnership could even unravel. The companies, together with junior ally Mitsubishi Motors, on Tuesday said the chairman of Renault would serve as the head of the alliance but — in a critical sign of the rebalancing — not as chairman of Nissan. "This is a very special day for the alliance," Renault SA's chairman, Jean-Dominique Senard, told reporters after a meeting at Nissan's Yokohama headquarters. He spoke to reporters along with Renault's chief executive, Thierry Bollore; Nissan CEO Hiroto Saikawa; and Osamu Masuko, CEO of the smaller Japanese alliance partner Mitsubishi Motors Corp. Those four executives will meet every month in Paris or Tokyo and oversee various projects, helping to make the companies' operations more efficient, they said. Nissan has said that Ghosn wielded too much power, creating a lack of oversight and corporate governance. It was not clear who would become Nissan's chairman, vacant since Ghosn was arrested in Japan in November. But the automakers gave no indication of any immediate change in their cross-shareholding agreement, one which has given smaller Renault SA more sway over Nissan. The alliance did not announce any changes in mutual stake holdings. The so-called Restated Alliance Master Agreement that has bound them together so far remains intact, they said. "We are fostering a new start of the alliance. There is nothing to do with the shareholdings and the cross-shareholdings that are still there and still in place," Renault Chairman Senard said. "Our future lies in the efficiency of this alliance," he told reporters at Nissan's headquarters in Yokohama. Senard also said he would not seek to be chairman of Nissan, but instead was a "natural candidate" to be vice-chairman. Former Nissan chairman Ghosn was released on a $9 million bail last week after spending more than 100 days in a Tokyo detention center.

Nissan, Infiniti will each show a next-gen concept EV in Detroit

Wed, Nov 28 2018The chief designer for Nissan and Infiniti said Wednesday that both brands will debut concept electric vehicles at the 2019 North American International Auto Show in Detroit in January that will likely show off Nissan's next-generation electric drive systems and the evolution of the brands' EV design direction first hinted at with Infiniti's stunning Q Inspiration. Alfonso Albaisa, senior vice president of global design for Nissan, said the concepts will reflect a similar departure from standard vehicle proportions as the Q Inspiration. He would not say exactly what segment or segments the concepts would represent, but he dropped some hints at a couple possible powertrains for the concepts. Similar additional concepts will follow later in the year at the Tokyo Motor Show, he said. "The Q Inspiration kind of hinted at it and we avoided discussing too much about what's driving that car. Of course, we talked about VC-Turbo, which is also possible," he said in an interview with Autoblog. "But if you really look at the car, Q Insipiration shifted the cabin forward. It was the first one to break the [mold] of Infiniti. So how to still have this artistry and this sense of carrozzerie" (Italian for coachbuilding) "of Infiniti without kind of the stereotypical long hood and the cabin shifted back and the windshield has to go through the center of the front wheel, these golden rules." Infiniti debuted the Q Inspiration concept sedan in Detroit in January, with a swoopy, ghost-like design influenced by an archer shooting an arrow through the air, and innovative design features like an elongated cabin that expands interior space, a relative lack of chrome, and other features. It's powered by a compact variable compression turbocharged engine, which can change compression ratios on the fly to maximize efficiency and power, depending on the situation. But Albaisa said the two concepts for Detroit could feature Nissan's e-Power series hybrid technology, which has mostly featured in Japan, and which features small, isolated gasoline engines that exist only to charge the batteries, not drive the wheels. They will also feature a new generation of battery packs, which he calls a "magic carpet." "It's getting denser, it's getting thinner, the cars are able to get a little bit bigger, more space, we can really do much more," he said.