2013 Nissan Altima Sv Sedan 4 Door 3.5l Dramatic Discount!! on 2040-cars

Warminster, Pennsylvania, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:3.5L 3498CC V6 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Make: Nissan

Model: Altima

Trim: SV

Options: CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 4

Exterior Color: Black

Interior Color: Black

Warranty: Vehicle has an existing warranty

Number of Cylinders: 6

Number of Doors: 4

Take advantage of heavily discounted brand new, hail-damaged, 2013 Nissan Altima

inventory at O'Neil Nissan. Damaged from a Nissan plant in Mississippi, each vehicle has

been repaired on an individual basis. Any severe paint defects are shown in

pictures. Every Altima has a factory new hood installed.

Each car comes with a full manufacturer's warranty. These vehicles do not have a paint

warranty.

The title on this vehicle is 100% clean

This car has Navigation with a 7" color display

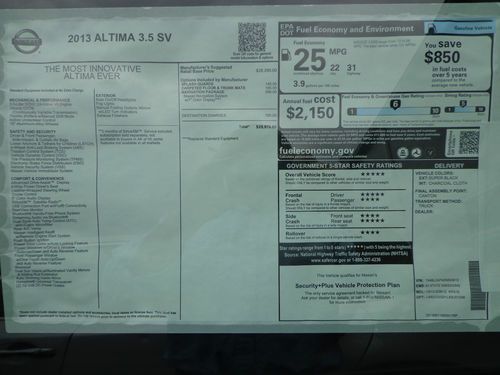

The original MSRP for this vehicle is $29,970

If you have any questions, please contact Chris Connolly at

Cell - 609-332-6285

Direct - 215-674-9300 ext.2238

Nissan Altima for Sale

2013 nissan altima s sedan 4 door 2.5l dramatic discount!!(US $18,579.00)

2013 nissan altima s sedan 4 door 2.5l dramatic discount!!(US $18,579.00) 2013 nissan altima s sedan 4 door 3.5l dramatic discount!!(US $18,204.00)

2013 nissan altima s sedan 4 door 3.5l dramatic discount!!(US $18,204.00) 2013 nissan altima s sedan 4 door 3.5l dramatic discount!!(US $17,841.00)

2013 nissan altima s sedan 4 door 3.5l dramatic discount!!(US $17,841.00) 2013 nissan altima s sedan 4 door 2.5l dramatic discount!!(US $16,483.00)

2013 nissan altima s sedan 4 door 2.5l dramatic discount!!(US $16,483.00) 2007 nissan altima sl sedan 4-door 2.5 - 1 owner - 96k miles(US $9,999.00)

2007 nissan altima sl sedan 4-door 2.5 - 1 owner - 96k miles(US $9,999.00) 2002 nissan altima se sedan 4-door 3.5l(US $5,300.00)

2002 nissan altima se sedan 4-door 3.5l(US $5,300.00)

Auto Services in Pennsylvania

YBJ Auto Sales ★★★★★

West View Auto Body ★★★★★

Wengert`s Automotive ★★★★★

University Collision Center ★★★★★

Ultimate Auto Body Inc ★★★★★

Stewart Collision Service ★★★★★

Auto blog

2016 Nissan Titan endures more torture testing

Fri, Mar 13 2015The burly, next-gen 2016 Nissan Titan XD made its big debut at the 2015 Detroit Auto Show and promised to launch later in the year with multiple bed lengths, several cab configurations and the choice of a Cummins 5.0-liter diesel V8 pumping out 310 horsepower and 555 pound-feet of torque. While we wait for the truck to arrive at dealerships, the brand is continuing to tell the pickup's development story through the Titan Truckumentary series of shorts videos. Nissan has already used the clips to look back at its pickup history, but the latest entry puts the focus directly on the new Titan, specifically, its torture testing during development. One trial bounced the truck around for months on a durability machine to simulate 370,000 miles of rough driving. Although, the true fun comes from watching the real-life evaluations where engineers slam the model into curbs and drive it off ledges to see what it can take.

Ousted Renault CEO Bollore raised concerns over Ghosn investigation

Mon, Dec 16 2019PARIS — Renault's former chief executive Thierry Bollore, who was ousted in October, had sought to flag alleged conflicts of interest and governance problems at the company's Japanese alliance partner Nissan before his departure, Le Monde reported on Monday. Citing a letter from Oct. 7 addressed to Nissan's board, of which he was member, France's Le Monde newspaper said Bollore had raised questions over the firm's internal investigation surrounding former alliance boss Carlos Ghosn. Nissan and Renault were left reeling by Ghosn's arrest in Tokyo a year ago, on financial misconduct charges which he denies. They have since tried to reboot their strained partnership by revamping their management teams, including by purging them of Ghosn allies and removing people in top jobs at the time of the scandal. Bollore — who took a step up at the French carmaker when Ghosn left even though he was known for his close ties to the alliance founder — was eventually pushed out as Renault's CEO on Oct. 11, days after penning his letter. In comments sent to Reuters, Nissan spokeswoman Azusa Momose denied there were any irregularities in its internal investigation of Ghosn's affairs, and added that the company had reviewed its processes once again following Bollore's letter. "Nissan's independent directors confirmed that the investigation was properly conducted and could be relied on," Momose said. Nissan directors had discussed all the allegations raised by Bollore and the company "concluded that Bollore's concerns were not founded and were based for the most part on inaccurate information and speculation," she added. Bollore said in the letter that he was particularly concerned by the revelation that Nissan had a list of 80 managers implicated in financial dealings similar to the ones attributed to Ghosn. He also raised issues with the chain of command at Nissan, saying some key board members were sometimes kept in the dark on internal matters. Renault, which is still searching for a permanent replacement for Bollore as CEO, had no immediate comment. As well as changing its CEO, Nissan recently demoted senior vice president Hari Nada — a key whistleblower against Ghosn and whose role was also questioned in Bollore's letter — although its internal investigation had found no evidence against the executive. Related Video:

Court rejects Carlos Ghosn's request to attend Nissan board meeting

Mon, Mar 11 2019TOKYO — A Japanese court has rejected a request by former Nissan chairman Carlos Ghosn, released on bail last week, to attend the Japanese automaker's board meeting on Tuesday. Nissan dismissed Ghosn as chairman after his Nov. 19 arrest, but he remains on the board. The Tokyo District Court said it rejected Ghosn's request on Monday but did not elaborate on the reasons. It had been unclear whether Ghosn could attend the board meeting. The court's approval was needed based on restrictions imposed for his release on bail. The restrictions say he cannot tamper with evidence, and attending the board meeting could be seen as putting pressure on Nissan employees. Prosecutors had been expected to argue against his attendance. They were not available for immediate comment. Ghosn has been charged with falsifying financial reports in underreporting his compensation and breach of trust in making payments to a Saudi businessman and having Nissan shoulder investment losses. He insists he is innocent, saying the compensation was never decided or paid, the payments were for legitimate services and Nissan never suffered the losses. Since his release on March 6 from Tokyo Detention Center on 1 billion yen ($9 million) bail, he has been spotted taking walks in Tokyo with his family, but he has not made any comments. His attempt to exercise what his lawyer, Junichiro Hironaka, called his "duty" by attending the board meeting signals one way he may be fighting back. Hironaka has said Ghosn will speak to reporters soon. A date for a news conference has not been announced. Nissan said Monday that Renault Chairman Jean-Dominique Senard, Renault Chief Executive Thierry Bollore, Nissan Motor Co. CEO Hiroto Saikawa, and Osamu Masuko, the chairman and CEO of Mitsubishi Motors Corp., will hold a joint news conference Tuesday after the board meeting. Nissan appears determined to highlight new leadership without Ghosn. It is part of an alliance with Renault SA of France, and more recently with Japan's Mitsubishi Motors, that was largely cobbled together by Ghosn, who led Nissan for two decades. Nissan, which makes the March subcompact, Leaf electric car and Infiniti luxury models, has denounced Ghosn for alleged misconduct. A decision at a shareholders' meeting is needed to remove Ghosn from the board. A shareholders' meeting is scheduled for next month.