1999 Nissan Altima Gxe One Owner Repairable Clean Clean Title on 2040-cars

Shippensburg, Pennsylvania, United States

Body Type:Sedan

Engine:2.4

Vehicle Title:Clear

Fuel Type:Ethanol - FFV

For Sale By:Private Seller

Model: Altima

Trim: GXE

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: CD Player

Mileage: 143,799

Safety Features: Driver Airbag, Passenger Airbag

Sub Model: GXE

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

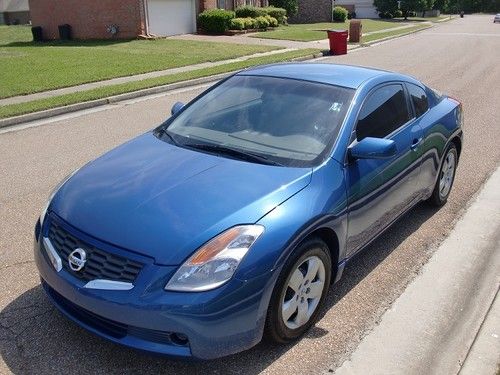

Exterior Color: Blue

Interior Color: Gray

Number of Cylinders: 4

Nissan Altima for Sale

No reserve 2008 nissan altima se v6 6-speed manual nav, back-up camera

No reserve 2008 nissan altima se v6 6-speed manual nav, back-up camera Navigation bluetooth back up camera fuel efficient heated seats leather seats

Navigation bluetooth back up camera fuel efficient heated seats leather seats 2009 nissan altima sl s heated leather sun roof clean bose history report 08 10(US $14,990.00)

2009 nissan altima sl s heated leather sun roof clean bose history report 08 10(US $14,990.00) 2008 nissan altima s coupe 2-door 2.5l

2008 nissan altima s coupe 2-door 2.5l 2007 altima 2.5 s exceptionally maintained!!!(US $12,988.00)

2007 altima 2.5 s exceptionally maintained!!!(US $12,988.00) 2007 nissan altima base sedan 4-door 2.5l(US $8,000.00)

2007 nissan altima base sedan 4-door 2.5l(US $8,000.00)

Auto Services in Pennsylvania

Wood`s Locksmithing ★★★★★

Wiscount & Sons Auto Parts ★★★★★

West Deptford Auto Repair ★★★★★

Waterdam Auto Service Inc. ★★★★★

Wagner`s Auto Service ★★★★★

Used Auto Parts of Southampton ★★★★★

Auto blog

Recharge Wrap-up: Renovo Coupe at CES, Aussies tour US in Tesla Model S

Tue, Dec 23 2014Australians review the Tesla Model S in a Seattle to LA road trip video. The folks from CarAdvice drive the P85+ along the West Coast of the US, testing out the car, trying the Superchargers, stopping by some notable sites along the way and even making use of roadside assistance. While the video shows what it's like to take the Tesla on a US road trip, it gives viewers Down Under a glimpse of their own future. Tesla just began sales in a country that, while on the other side of the globe, also features long distances between cities and a new Supercharger network. Check out the video below or read more at Inside EVs. A UK taxi company is introducing the Nissan e-NV200 to its fleet. C&C Taxi, which has been using six Nissan Leafs in its Cornwall taxi service since early December, has added the passenger-ready e-NV200 Combi to its stable of cabs. Mark Richards, manager of C&C's fleet, is happy with its performance and money saved after over 1,000 miles of service so far, and plans to replace the rest of the diesel fleet with EVs. The Nissan e-NV200 Combi "does everything the Leaf does but is much bigger and offers more space," says Richards. "We'll definitely be ordering more." Learn more in the video below or read more at Hybrid Cars. Learn more about Nissan's fleet EVs at the company's website. The US Department of Energy has released a new report on EV charging behavior and its impact on the grid. The report, which covers grant projects from six different utilities, includes data from over 270 public chargers and 700 residential charging units. Most at-home charging took place at night during off-peak hours. There were some reports of problems with chargers and smart meters working together. Most public charging took place during peak hours, but was low compared to home charging. This means a longer cost recovery period due to the high cost of installation. See the report at the DOE website or read more at Green Car Congress. The Renovo Coupe will be on display at the NVIDIA booth at the 2015 Consumer Electronics Show (CES) for its first public viewing. Renovo Motors CEO Christopher Heiser says, "These are very exciting times for Renovo and we think our new technology, coupled with NVIDIA's breakthroughs in automotive applications, has the potential to make a tremendous impact across the entire automotive industry." The Shelby Daytona-bodied Renovo offers 500 horsepower and 1,000 pound-feet of torque from two electric motors.

Nissan unveils ZEOD RC at Nismo HQ in Japan [w/videos]

Thu, 17 Oct 2013At Le Mans this past summer, Nissan unveiled the first prototype for the ZEOD RC, a new hybrid racecar which it intends to field at the famous French endurance race next year. Four months have passed since then, totaling eight month of development, and now Nissan has revealed the final form at the headquarters of its Nismo racing division.

The updated Nissan ZEOD RC benefits from a more streamlined shape with optimized cooling and improved aerodynamics. Although billed as an electric vehicle and not a hybrid, the ZEOD RC pairs a 1.6-liter turbo four with a pair of electric motors. Its regenerative braking system is derived from the Leaf RC, and after 11 laps, it's said to be capable of taking another around the Circuit de la Sarthe under electric power alone, making it the first racecar capable of doing so. Nissan has further stated that it hopes the lessons it garners from this project will help in its development of a new LMP1 to challenge for overall victory at Le Mans in the near future.

The ZEOD RC will be on display at Fuji Speedway this weekend during the six-hour FIA World Endurance Championship race there, after which it will continue its development at the hands of former GT1 champion Michael Krumm and gamer-turned-racer Lucas Ordonez, who will be getting it ready for (and possibly drive it at) next year's 24 Hours of Le Mans. There it will compete - faster than most GTE sportscars, says Nissan - in the Garage 56 spot that once was awarded to the DeltaWing, which Nissan sponsored and to which the ZEOD RC looks conspicuously similar.

A realistic approach to fixing Mitsubishi

Tue, May 24 2016There are going to be a lot of words written about what Nissan needs to do with Mitsubishi in the coming months and years in the interest of turning the brand around. After Nissan's purchase of a controlling stake in the diamond star brand, there's been more interest in Mitsubishi thanks to the potential of platform sharing and plenty of cash from Nissan-Renault to get the juices flowing again. But, while some have been doing their best to advocate for the return of the 3000GT, Evolution, and even the Starion - Many of these posts forget the reality of the market we live in today. As much as we like to look back fondly at the sports coupes of the '90s, a byproduct of the insane cash flows all the Japanese manufacturers had at the time, the reality of today puts a much greater emphasis on what is most-boring; Crossover SUVs, alongside mid-size and compact sedans. We do need to ask a fundamental question, how much Mitsubishi is enough to be able to continue to call the cars Mitsubishis? Aside from slight product revisions and reconfigurations, Mitsubishi (at least in North America) has been largely dependent on the same GS platform and 4B1 engines that date back to their long-time partnership with Chrysler (and Hyundai) in the mid '00s. Admittedly, the chassis and engines have served the company well, underpinning a wide variety of vehicles sold around the world, and seeing quite a few revisions to at least attempt to keep products competitive. But, the GS chassis is old, heavy, and severely out of date - and when matched to the underpowered 4B1 series engines - make for largely uncompetitive offerings in the market. While something like the Outlander Sport is indeed interesting compared to a Honda CR-V, it is by no means the smart choice in the segment. So, going forward, unless Mitsubishi has had a skunkworks of sorts developing their chassis and engine replacements over the past few years, what exactly are they planning to do for their bread-and-butter models? I think the straightforward answer is without a doubt the Nissan North America parts bin. With so many of their models selling well, and for the most part, are reasonably well-reviewed, it would be quite simple to adapt the chassis and powertrain to Mitsubishi's liking to create a high-volume alternative to what is currently available now.