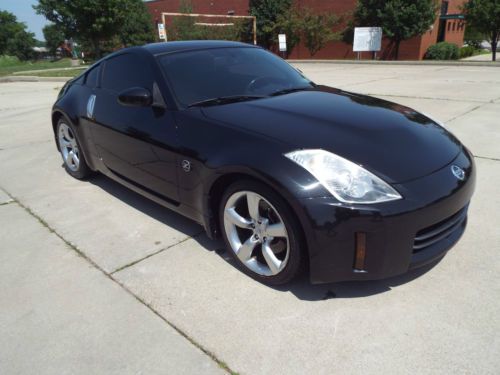

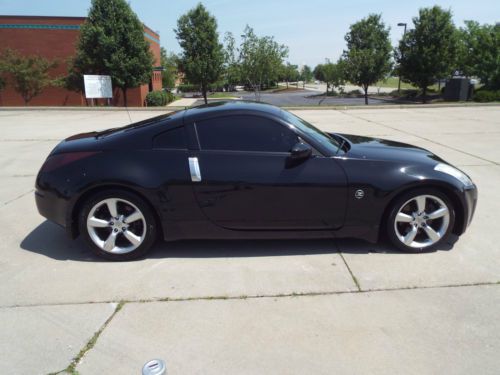

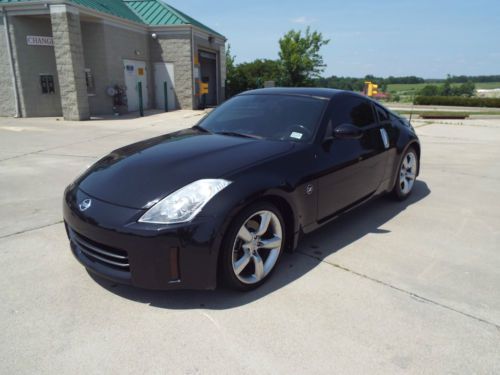

2008 Nissan 350z Enthusiast Coupe 2-door 3.5l on 2040-cars

Covington, Kentucky, United States

|

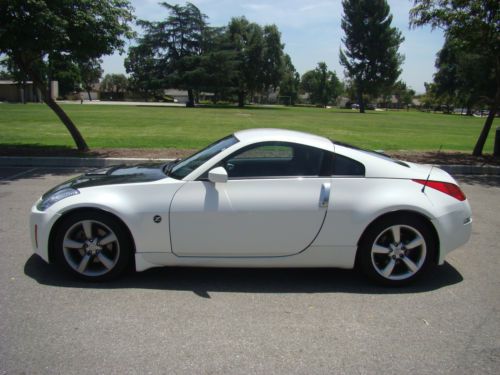

Nissan 350Z for Sale

2007 nissan 350z touring automatic leather bluetooth bose 6cd 44k mi loaded nice(US $10,750.00)

2007 nissan 350z touring automatic leather bluetooth bose 6cd 44k mi loaded nice(US $10,750.00) 2003 nissan 350z base coupe 2-door 3.5l

2003 nissan 350z base coupe 2-door 3.5l Custom nismo widebody wide body kit show winner under 50k original miles

Custom nismo widebody wide body kit show winner under 50k original miles 2005 nissan 350z enthusiast 6 speed 51,000 miles clean car pa inspected(US $14,900.00)

2005 nissan 350z enthusiast 6 speed 51,000 miles clean car pa inspected(US $14,900.00) 2004 coupe used gas v6 3.5l/214 5-speed automatic w/od gasoline rwd leather

2004 coupe used gas v6 3.5l/214 5-speed automatic w/od gasoline rwd leather Nissan 350z nismo navigation(US $21,995.00)

Nissan 350z nismo navigation(US $21,995.00)

Auto Services in Kentucky

Tri-R Auto Service ★★★★★

Thompson`s Tire & Service Center ★★★★★

Tech-Tune Inc Auto Service Center ★★★★★

Simpson Paint ★★★★★

Shafer Auto Body ★★★★★

Ron`s Automotive ★★★★★

Auto blog

These are the cars with the best and worst depreciation after 5 years

Thu, Nov 19 2020The average new vehicle sold in America loses nearly half of its initial value after five years of ownership. No surprise there; we all expect that shiny new car to start depreciating as soon as we drive it off the lot. But some vehicles lose value a lot faster than others. According to data provided by iSeeCars.com, trucks and truck-based sport utility vehicles generally hold their value better than other vehicle types, with the Jeep Wrangler — in both four-door Unlimited and standard two-door styles — and Toyota Tacoma sitting at the head of the pack. The Jeep Wrangler Unlimited's average five-year depreciation of 30.9% equals a loss in value of $12,168. That makes Jeep's four-door off-roader the best overall pick for buyers looking to minimize depreciation. The Toyota Tacoma's 32.4% loss in initial value means it loses just $10,496. The smaller dollar amount — the least amount of money lost after five years — indicates that Tacoma buyers pay less than Wrangler Unlimited buyers, on average, when they initially buy the vehicle. The standard two-door Jeep Wrangler is third on the list, depreciating 32.8% after five years and losing $10,824. Click here for a full list of the top 10 vehicles with the least depreciation over five years. On the other side of the depreciation coin, luxury sedans tend to plummet in value at a much faster rate than other vehicle types. The BMW 7 Series leads the losers with a 72.6% drop in value after five years, which equals an alarming $73,686. BMW's slightly smaller 5 Series is next, depreciating 70.1%, or $47,038, over the same period. Number three on the biggest losers list is the Nissan Leaf, the only electric vehicle to appear in the bottom 10. The electric hatchback matches the 5 Series with a 70.1% drop in value, but since it's a much cheaper vehicle, that percentage equals a much smaller $23,470 loss. Click here for a full list of the top 10 vehicles with the most depreciation over five years.

Nissan reports $4.13B net income for 2012

Sat, 11 May 2013The news for Nissan is good when it comes to the company's results for the 2012 financial year that ended on March 31. Even though the numbers were down in many of the world's major markets, increased sales in the US, Brazil and the Middle East, ten new models and a strong fourth quarter allowed Nissan to hit its target for the year and notch record sales of 4.914 million units globally. On net revenue of $116 billion, Nissan posted net income of $4.13 billion and an operating profit of $6.31 billion.

There are upward-looking projections for this year, Nissan forecasting a 7.8-percent jump in sales to 5.3 million units, with $117.89 billion in net revenue and $4.42 billion in net income. That net revenue number probably won't actually match what's reported next year, though, because Nissan is changing its accounting method and won't include revenue and operating profit results from its joint venture with China's Dongfeng. Net income doesn't change under the new method, but the adjusted net revenue forecast is $109.16 billion.

There's a press release and two videos below with more details for those of you who go gaga for annual reports.

Weekly Recap: The cost of Tesla's ambitious plans for growth

Sat, Feb 14 2015Tesla has ambitious plans for growth, and they won't come cheap. The electric-car maker said this week it plans to spend $1.5 billion in 2015 to expand production capacity, launch the Model X crossover and continue work on its Gigafactory, which is being built outside of Reno, NV. The company is also investing in its stores, service centers and charging network, which is expected to grow by more than 50 percent this year. Plus, it's still working on the Model 3, which is scheduled to arrive in 2017. "We're going to spend staggering amounts of money on [capital expenditures]," Tesla chairman and CEO Elon Musk said on an investor call. He then added: "For a good reason. And with a great ROI [return on investment]." They're bold plans, and Musk is clearly willing to put Tesla's money where his mouth is. That's why the company is projecting a whopping 70-percent increase in deliveries this year, for a total of 55,000 cars. A large chunk of that growth will come from the addition of the Model X crossover to Tesla's portfolio, and the company already has nearly 20,000 reservations for it. More than 30 Model X prototypes have been built, and it is expected to begin shipping to customers this summer. Musk said he's "highly confident" the vehicle, which has experienced delays, will arrive on time. The company also had more than 10,000 orders for the Model S at the start of the year. The big spending plans caused a stir, even though Tesla spent $369 million on capital expenditures in the fourth quarter alone. In a note to investors, Morgan Stanley analysts called the costs required to keep pace with Tesla's demand "eye-wateringly high," and said the $1.5-billion figure was nearly double their expectations. Still, Musk is not thinking small and suggested that his company could be as big in 10 years as Apple is now if Tesla's growth continues. His optimism comes as the company actually reported a $294-million net loss in 2014, more than its $74-million loss in 2013. The money, however, continues to roll in, and total revenues increased to $3.2 billion in 2014, up from $2 billion in 2013 and a dramatic surge from $413 million in 2012. More of the same is expected this year, and the company could reach $6 billion in revenue. As Morgan Stanley noted, it "seems Tesla is preparing to be a much larger company than we have forecasted." It's certainly spending that way.