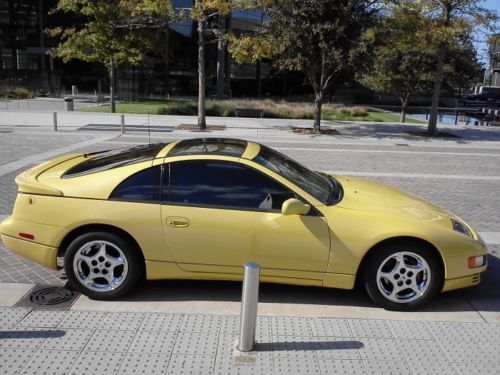

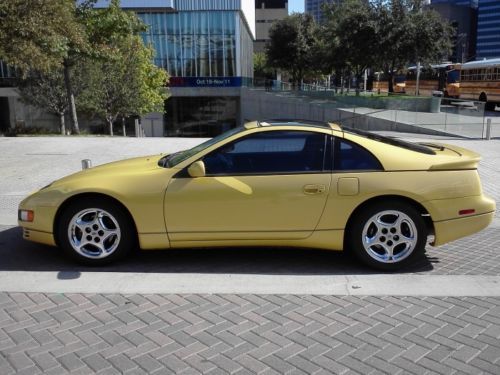

91 Twin Turbo 300 Zx on 2040-cars

Dallas, Texas, United States

|

Well maintained and taken care of 1991 Nissan 300ZX twin turbo. garage kept and never smoked in. All maintenance performed at Nissan. Always used Castrol synthetic oil. All maintenance done ahead of recommended schedule. This includes coolant flush, transmission oil changes, differential with limited slip additive and oil changes done every 2500 miles. Factory air still works. Fairly new tires all the way around. No curb rash on rims. Must see to appreciate. Paint is in immaculate condition. Interior and exterior in excellent condition. Cold oil pressure is approx 90psi (excellent). Purchaser is responsible for shipping. Any questions call 214-901-7555 ask for Preston

|

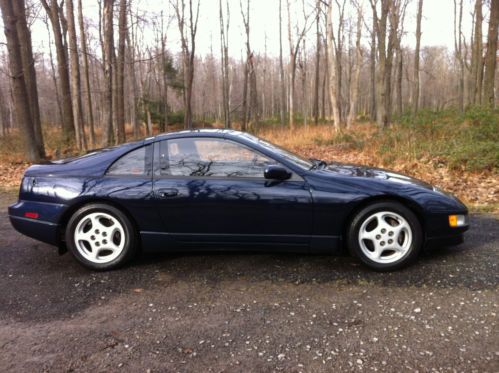

Nissan 300ZX for Sale

1986 nissan 300zx base coupe 2-door 3.0l

1986 nissan 300zx base coupe 2-door 3.0l 1986 nissan 300zx turbo coupe 2-door 3.0l

1986 nissan 300zx turbo coupe 2-door 3.0l 1993 nissan 300zx twin turbo v6 t-tops leather seats bose audio*trades welcome*(US $14,980.00)

1993 nissan 300zx twin turbo v6 t-tops leather seats bose audio*trades welcome*(US $14,980.00) 1996 nissan 300zx

1996 nissan 300zx 1990 nissan 300zx base coupe 2-door 3.0l(US $8,250.00)

1990 nissan 300zx base coupe 2-door 3.0l(US $8,250.00) Orange 300zx na automatic 4 seater, with body kit and a greedy exhaust

Orange 300zx na automatic 4 seater, with body kit and a greedy exhaust

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

Nissan could report first quarterly loss since March 2009

Wed, Feb 12 2020TOKYO — Nissan may report its first quarterly loss in more than a decade on Thursday because of slumping sales, sources familiar with the company said, adding more pressure on efforts to rebuild the company after Carlos Ghosn's ouster. Deteriorating profits underscore the challenges facing Nissan, which is unwinding many of the expansionist strategies championed by ex-Chief Executive Officer and Chairman Ghosn by slashing jobs, production sites and product offerings to save cash and ensure its survival. In addition to slumping sales, production disruptions caused by China's coronavirus outbreak could also drag profits lower. Three senior officials at Japan's No. 2 automaker told Reuters that they anticipate a poor results announcement on Thursday, with one of them calling the figures "dismal". Two of the officials cautioned that there is the possibility of an operating loss, which would be the first quarterly loss since the period ending in March 2009. Nissan said it could not comment on its financial results ahead of its official announcement. The company is likely to report operating profit of 48.6 billion yen ($442.5 million) for the quarter ending in December, less than half the 103 billion yen profit a year ago, according to SmartEstimate's survey of three analysts, who revised their forecasts in January. However, those forecasts were issued before the release of the December vehicle sales figures on Jan. 30, which show third-quarter sales dropped by 11% from the year earlier period, according to Reuters calculations. That is the biggest quarterly slump of its current sales downturn that began two years ago. That sales decline led one auto equities analyst based in Japan to scrap his forecast and also warn that Nissan could post a loss. "It will be a question of whether there will be a profit or a loss. For the quarter, a loss is a possibility," he said, declining to be named as his forecast had not been updated to reflect his latest view. One of the three Nissan officials said there is a risk the automaker may cut its full-year profit forecast of 150 billion yen, which would be an 11-year low. The company announced that forecast in November after an initial 230 billion yen outlook.

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.

Nissan expands US EV test market for e-NV200 to Portland

Sat, Jun 14 2014Of course, it's going to be Portland. Oregon's largest city, known for its green-friendly vibe and policies, will be where Nissan will next test of its all-electric e-NV200 cargo van. And we hope those vans have cup holders for the inevitable java. The Japanese automaker is working with local utility company Portland General Electric (PGE) on a six-week trial program. Nissan and PGE will record data to better measure how the concept of battery-powered driving works within the local services network. The location makes sense, as Portland is one of the five best-selling US cities when it comes to sales of the Nissan Leaf, which shares its powertrain with the e-NV200. Nissan kicked off its "No Charge to Charge" free-charging program for new Leaf owners in April. Nissan, which had already been testing the e-NV200 with FedEx in Germany, Japan and Singapore as of late last year, said at the Washington Auto Show in January that it would start testing the electric van in the Washington, DC, area. Nissan said at the time that it helped install about 570 fast-charging CHAdeMO chargers throughout the US since last year, including 200 in December alone. Check out Nissan's press release about the Portland project below. LEADING EV MARKET PORTLAND BECOMES TEST BED FOR NISSAN E-NV200 ELECTRIC COMMERCIAL VEHICLE PORTLAND, Ore. – Portland, already a top breeding ground for electric vehicle (EV) sales, is now the proving ground for Nissan's prototype electric commercial vehicle – the Nissan e-NV200. Nissan is working in collaboration with Portland General Electric (PGE) on a six-week trial to help determine the viability of an electric commercial vehicle in the U.S market. PGE has assigned the e-NV200 into its fleet of vehicles with an underground crew, replacing a larger, diesel-powered van. "Oregon has been a top five market for Nissan LEAF sales in the U.S. due to proactive policies at the state level to encourage EV adoption, as well as robust charging infrastructure championed by the state and others like PGE," said Toby Perry, Nissan's director of EV Marketing in the U.S. "If we determine that e-NV200 fits into the U.S. commercial vehicle market, we expect that Portland would be a leading driver for sales as well." This year, Nissan is deploying two e-NV200 prototypes with companies such as PGE and FedEx in top U.S EV markets including California, Georgia, Oregon and Washington, D.C.