1996 Nissan 300zx Convertible Project Car on 2040-cars

Corning, New York, United States

Nissan 300ZX for Sale

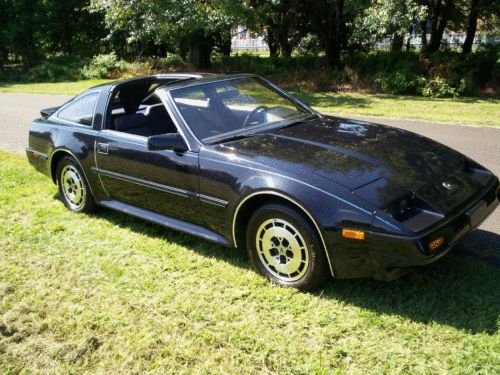

1985 nissan 300zx base coupe 2-door 3.0l(US $3,995.00)

1985 nissan 300zx base coupe 2-door 3.0l(US $3,995.00) 1994 nissan 300zx gs (na) factory convertible 2-door 3.0l - 53,000 orig miles(US $11,250.00)

1994 nissan 300zx gs (na) factory convertible 2-door 3.0l - 53,000 orig miles(US $11,250.00) 91 super fast fairlady 300zx hks(US $12,500.00)

91 super fast fairlady 300zx hks(US $12,500.00) 1986 nissan 300 zx(US $9,995.00)

1986 nissan 300 zx(US $9,995.00) 1984 nissan 300zx turbo coupe 2-door 3.0l(US $4,900.00)

1984 nissan 300zx turbo coupe 2-door 3.0l(US $4,900.00) Unique nissan/datsun 300zx(US $3,200.00)

Unique nissan/datsun 300zx(US $3,200.00)

Auto Services in New York

Websmart II ★★★★★

Wappingers Auto Tech ★★★★★

Wahl To Wahl Auto ★★★★★

Vic & Al`s Turnpike Auto Inc ★★★★★

USA Cash For Cars Inc ★★★★★

Tru Dimension Machining Inc ★★★★★

Auto blog

Question of the Day: Most heinous act of badge engineering?

Wed, Dec 30 2015Badge engineering, in which one company slaps its emblems on another company's product and sells it, has a long history in the automotive industry. When Sears wanted to sell cars, a deal was made with Kaiser-Frazer and the Sears Allstate was born. Iranians wanted new cars in the 1960s, and the Rootes Group was happy to offer Hillman Hunters for sale as Iran Khodro Paykans. Sometimes, though, certain badge-engineered vehicles made sense only in the 26th hour of negotiations between companies. The Suzuki Equator, say, which was a puzzling rebadge job of the Nissan Frontier. How did that happen? My personal favorite what-the-heck-were-they-thinking example of badge engineering is the 1971-1973 Plymouth Cricket. Chrysler Europe, through its ownership of the Rootes Group, was able to ship over Hillman Avanger subcompacts for sale in the US market. This would have made sense... if Chrysler hadn't already been selling rebadged Mitsubishi Colt Galants (as Dodge Colts) and Simca 1100s as (Simca 1204s) in its American showrooms. Few bought the Cricket, despite its cheery ad campaign. So, what's the badge-engineered car you find most confounding? Chrysler Dodge Automakers Mitsubishi Nissan Suzuki Automotive History question of the day badge engineering question

Nissan will restore Craigslist Maxima, display at headquarters [w/video]

Sat, 08 Feb 2014Nissan showed that it had a great sense of humor when it bought Luke Aker's beat-up 1996 Nissan Maxima GLE for $1,400 back in December based solely on the quality of his tongue-in-cheek sales video.

Aker's Maxima had been thoroughly driven. It needed a strap to keep its hood closed, had front end damage, a missing turn signal and shredded leather seats. Of course, like Aker said in his ad, the car was still "fully loaded with an engine, wheels, tires and an automatic transmission." How could Nissan resist?

After buying the car, Nissan teamed up with MotorAuthority to decide what to do with it. The winning idea was to restore the car to its proper condition and display it at Nissan North America headquarters in Franklin, TN, with Aker's video playing nearby. According to MotorAuthority, the car has finally made it there, and its rebirth will begin soon. Nissan is not sure when the car will go on display.

Nissan Note getting a little louder with Nismo versions this fall

Thu, 24 Jul 2014Nissan's Nismo performance division has been getting more chances to shine recently with tuned models like the Juke Nismo RS and GT-R Nismo. But its latest creation moves closer to the bottom of the Japanese brand's lineup to make a hot hatch out of the (Versa) Note.

At least in Japan, the new model is due this fall, and Nismo is keeping a lot of the details about its latest creation a secret for now. What we do know is that it'll be available in two trims - the Note Nismo and the sportier Nismo S. "The development concept of this model was to build a car that makes you want to keep driving, no matter where your destination may be," said the division's chief product specialist, Hiroshi Tamura, in the company's announcement.

Aesthetically, the Note Nismo looks the way a tuned Nissan should, with the division's signature red trim outlining the car. It also wears a new, mesh grille, lower air dam, red side sills and rear spoiler. Inside, the S gets standard sport seats with full Recaro buckets as an option. Nissan didn't release technical specs for either version, but it promises that the S also gets a tuned engine with a five-speed manual.