1993 Nissan 300zx Turbo Coupe 2-door 3.0l on 2040-cars

Butler, Pennsylvania, United States

|

1993 NISSAN 300 ZX TWIN TURBO IN GOOD CONDITION. PENNSYLVANIA INSPECTION VALID UNTIL MARCH 31, 2015. VERY WELL MAINTAINED. OIL CHANGED EVERY 3000 MILES. NEW PLUGS, INJECTORS AND COILS. NEARLY NEW TIRES. A TRULY CLASSIC CAR. ORIGINAL PAINT. YOU WILL NOT BE DISAPPOINTED.

|

Nissan 300ZX for Sale

1991 nissan 300zx twin turbo 81k original miles t-top coupe

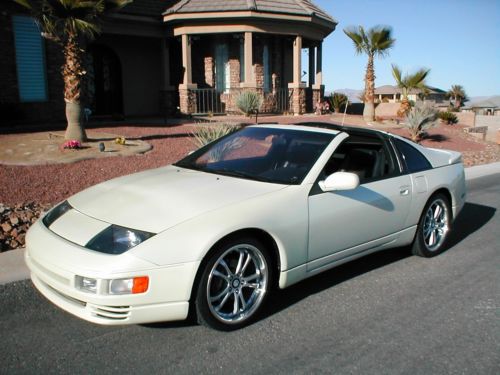

1991 nissan 300zx twin turbo 81k original miles t-top coupe Modified pearl white nissan 300zx turbo

Modified pearl white nissan 300zx turbo 1993 nissan 300zx 2+2 | new paint job | 5 speed manual transmission | 3.0l v6(US $5,500.00)

1993 nissan 300zx 2+2 | new paint job | 5 speed manual transmission | 3.0l v6(US $5,500.00) 1993 nissan 300zx convertible(US $13,900.00)

1993 nissan 300zx convertible(US $13,900.00) 1984 50th anniversary turbo used turbo 3l v6 12v rwd

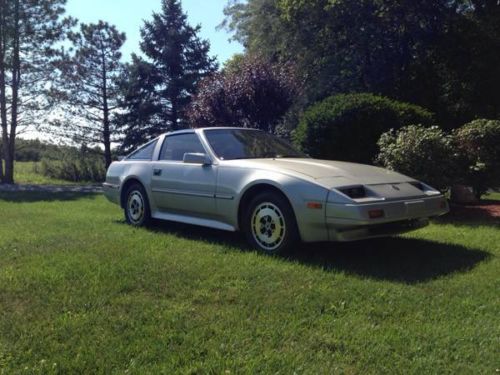

1984 50th anniversary turbo used turbo 3l v6 12v rwd 1986 nissan 300zx

1986 nissan 300zx

Auto Services in Pennsylvania

Wood`s Locksmithing ★★★★★

Wiscount & Sons Auto Parts ★★★★★

West Deptford Auto Repair ★★★★★

Waterdam Auto Service Inc. ★★★★★

Wagner`s Auto Service ★★★★★

Used Auto Parts of Southampton ★★★★★

Auto blog

Nissan NV200 puts on a Bowtie as new Chevy City Express

Tue, 14 May 2013Your eyes do not deceive you - that is, in fact, a Nissan NV200 work van with Chevrolet badging. General Motors and Nissan today announced a partnership where the Japanese automaker will build Bowtie-badged vans for Chevy dealers to sell throughout the United States and Canada. The new van, called the City Express, is expected to go on sale in the fall of 2014.

"Our fleet customers have asked us for an entry in the commercial small van segment, so this addition to the Chevrolet portfolio will strengthen our position with fleets and our commercial customers," Ed Peper, US vice president of GM fleet and commercial sales, said in a press release.

No details have been released regarding specific changes for the new City Express, though from the images released today, it's clear that the vehicle's front fascia has been reworked, and some super-sexy new wheel covers have been added. If we're honest, the NV200 wasn't all that pretty to begin with, and this, well, isn't any better. Not that looks are of primary concern in the commercial truck business, of course.

You'll soon be able to buy an EV in China for just $8,000 after incentives

Sun, Nov 6 2016Renault is eventually looking to sell an electric vehicle in China that will cost as little as $8,000 after government incentives kick in. According to Reuters, Renault-Nissan chief Carlos Ghosn offered the prediction at the New York Times Energy for Tomorrow conference in Paris this week. Granted, China government incentives are approaching $20,000 per vehicle, as China looks to address its cities' notorious pollution problem, so there's some wiggle room with that price. And of course, the devil is in the details, and Ghosn didn't provide any. Still, such a low-priced EV would likely challenge the dominance of China-based EV makers BYD and Kandi. And the effort would likely be lucrative, given that it has been predicted that China will become the world's largest EV market by the end of the decade. In fact, the publication EV Sales said earlier this year that as many as 300,000 EVs will be sold in China in 2016 (by comparison, Americans bought about 100,000 EVs and plug-in hybrids combined through the first 10 months of the year). BYD is expected to sell 75,000 Tang SUV units this year. With such growth expectations in mind, automakers are focusing on China for potential EV development. Earlier this year, Volkswagen Group said it signed a memorandum of understanding with China's Jianghuai Automobile (JAC) for plug-in vehicle production. Mercedes-Benz parent Daimler also stated its goal to broaden plug-in vehicle sales in China. Renault appears to be trying to make an early mark in China. Dongfeng Renault Automobile Co., the Chinese joint venture between Renault and Donfeng, is looking to start testing a self-driving electric vehicle this month. Dongfeng Renault will use a 1.5-mile stretch of road in Beijing's Caidian district for testing purposes. Related Video:

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.