4dr Sdn Es Auto Sedan Automatic Gasoline 2.0l Sohc Mpfi 16-valve I White on 2040-cars

Rick Hendrick Toyota Scion, 1969 Skibo Road, Fayetteville, NC 28314

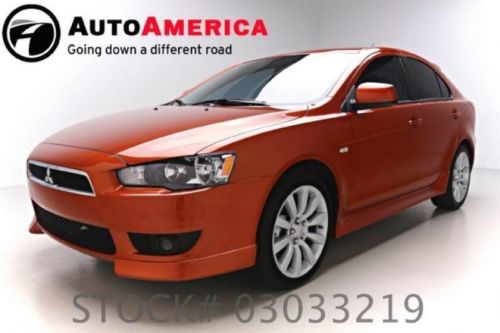

Mitsubishi Lancer for Sale

We finance 11 lancer ralliart twin clutch sst awd clean carfax turbo spoiler 6cd(US $17,000.00)

We finance 11 lancer ralliart twin clutch sst awd clean carfax turbo spoiler 6cd(US $17,000.00) We finance! 35043 miles 2011 mitsubishi lancer sportback gts

We finance! 35043 miles 2011 mitsubishi lancer sportback gts Jawdropping 2008 evolution gsr many upgrades! mitsubishi lancer evo(US $25,991.00)

Jawdropping 2008 evolution gsr many upgrades! mitsubishi lancer evo(US $25,991.00) 2011 mitsubishi lancer evolution mr(US $31,995.00)

2011 mitsubishi lancer evolution mr(US $31,995.00) 2009 mitsubishi lancer gts(US $12,900.00)

2009 mitsubishi lancer gts(US $12,900.00) Evo evolution gsr 5-speed manual 2.0l turbo awd recaro we finance brembo(US $27,789.00)

Evo evolution gsr 5-speed manual 2.0l turbo awd recaro we finance brembo(US $27,789.00)

Auto blog

Mitsubishi reportedly plans to spend billions to get back in the game

Tue, Oct 17 2017Japanese automaker Mitsubishi Motors reportedly plans to inject more than 600 billion yen ($5.35 billion) in capital spending and research and development over the next three years through fiscal 2019 in a bid to turn around its business after recent scandals. The Nikkei newspaper said the new plan calls for spending 5 percent of annual sales on equipment and the same proportion on R&D. Funds will be used by the company for the development of electrified vehicles such as the new e-Evolution concept and for production in China and Indonesia. Mitsubishi Motors will release the specifics of the new medium-term plan on Wednesday, the business daily said. ($1 = 112.1600 yen) Reporting by Sumeet Gaikwad Related Video: Image Credit: Reuters Earnings/Financials Green Plants/Manufacturing Mitsubishi Technology Emerging Technologies Electric research and development nikkei

Nissan Titan Pro-4X, Hyundai Kona and Mitsubishi Outlander PHEV | Autoblog Podcast #621

Fri, Apr 3 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Senior Editor, Green, John Beltz Snyder. They talk about cars they've driven recently, including the 2020 Nissan Titan Pro-4X, Hyundai Kona and Mitsubishi Outlander PHEV. Then they talk news, starting with Volvo's new pick-up and drop-off service. Then they talk about Q1 U.S. sales figures. Lastly, they discuss the possibility of new styles of motorcycle from Harley-Davidson, including a flat-track bike and a cafe racer. Autoblog Podcast #621 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2020 Nissan Titian Pro-4X 2020 Hyundai Kona Ultimate AWD 2020 Mitsubishi Outlander PHEV Volvo Valet U.S. car sales plummet Harley-Davidson cafe racer and flat track motorcycles Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Mitsubishi Mirage G4 sedan debuting in Montreal

Thu, 09 Jan 2014Around this same time last year, Mitsubishi used the Montreal Auto Show for the North American introduction of its 2014 Mirage. This year, the Japanese automaker will reveal the sedan version of the subcompact wearing the Mirage G4 nameplate, according to the auto show's website and a couple of fresh teaser images.

We got our first look at this Mirage sedan as previewed by the Concept G4 at the 2013 Shanghai Motor Show, and the production version of that sedan ended up wearing the Attrage name in Thailand and other global markets. There's no official information from Mitsubishi at this time about the Mirage G4, but we wouldn't be surprised to see the small sedan follow the same path as the hatchback, showing up for a US debut at the New York Auto Show before going on sale in the fall. Check out the teaser images in the gallery below.