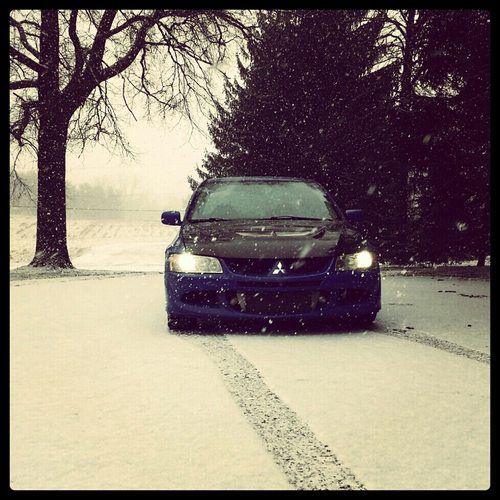

2008 Mitz Lancer Gts Carfax Certified 1-owner W/service Records Manual Trans on 2040-cars

Jersey City, New Jersey, United States

Engine:2.0L 1998CC 122Cu. In. l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Transmission:Manual

Fuel Type:GAS

Make: Mitsubishi

Options: Sunroof, Compact Disc

Model: Lancer

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Trim: GTS Sedan 4-Door

Power Options: Air Conditioning, Cruise Control, Power Windows

Drive Type: FWD

Doors: 4 doors

Mileage: 114,389

Engine Description: 2.0L L4 FI DOHC 16V

Sub Model: GTS

Number of Doors: 4

Exterior Color: Silver

Interior Color: Black

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

Mitsubishi Endeavor for Sale

One-owner clean carfax 35k miles! navigation,rockford fosgate,18alloys,xenons(US $28,795.00)

One-owner clean carfax 35k miles! navigation,rockford fosgate,18alloys,xenons(US $28,795.00) No reserve 2004 mitsubishi endeavor ls sport utility 4-door 3.8l(US $6,000.00)

No reserve 2004 mitsubishi endeavor ls sport utility 4-door 3.8l(US $6,000.00) 2006 mitsubishi lancer evolution mr sedan 4-door 2.0l

2006 mitsubishi lancer evolution mr sedan 4-door 2.0l No reserve very clean new bridgestone tires factory paint great condtion 6cd 3l

No reserve very clean new bridgestone tires factory paint great condtion 6cd 3l 2003 mitsubishi evo evolution **only 79k miles**

2003 mitsubishi evo evolution **only 79k miles** 2003 mitsubishi lancer evolution sedan 4-door 2.0l(US $11,500.00)

2003 mitsubishi lancer evolution sedan 4-door 2.0l(US $11,500.00)

Auto Services in New Jersey

West Automotive & Tire ★★★★★

Tire World ★★★★★

Tech Automotive ★★★★★

Surf Auto Brokers ★★★★★

Star Loan Auto Center ★★★★★

Somers Point Body Shop ★★★★★

Auto blog

Mitsubishi recalling 2013 Outlander Sport for suspension issue

Mon, 22 Jul 2013Just 305 units of the 2013 Mitsubishi Outlander Sport are the subject of a recall over a potential suspension issue. Crossovers made from January 17-25 of this year might suffer from a bad weld on the front left strut's stabilizer link. If it fails, damage to the brake hose or tire could result, in turn making steering or braking control of the compact CUV more difficult.

When the recall begins, owners can take their Outlander Sports to Mitsubishi dealers for inspection and replacement of the strut assembly if necessary. The National Highway Traffic Safety Administration bulletin below has more information.

Limited-edition Mitsubishi 311RS Evo X coming to Minneapolis Auto Show [w/video]

Fri, 08 Mar 2013It's not terribly often that we have news to report coming out ahead of the Minneapolis Auto Show. We say that not to disparage the Twin Cities, which are lovely, but new product reveals are few and far between for the show. This year, however, it seems that event will play host to the debut of a rather special limited edition Mitsubishi Lancer Evolution X. Though not coming directly from the Mitsu factory, we think the 311RS shows loads of potential for Evo fanatics.

The 311RS is the brainchild of circuit racer Ryan Gates, who has apparently spent the last three years developing what he believes is an Evo perfect for both racing and road driving. Starting life as a bog-standard Evo X, the Gates team has swapped out the factory intake, intercooler and exhaust system for more potent AMS pieces; resulting in output figures of 353 horsepower and nearly 359 pound-feet of torque. A new suspension from JRZ, brakes from Girodisc and 18-inch custom Rays wheels shod with high-performance Nitto tires represent significant updates to the underpinnings, as well.

Of course, the 311RS is also rocking a full body kit, too, with a more aggressive front air dam and a subtle lip added on to the stock rear wing. The blue and white racing livery, with matching blue wheels, looks racy without being too childish, we think.

Ex-Green Beret arrested in Ghosn's escape has lived a life of danger

Thu, May 21 2020This Dec. 30, 2019, image from security camera video shows Michael L. Taylor, center, and George-Antoine Zayek at passport control at Istanbul Airport in Turkey. Taylor, a former Green Beret, and his son, Peter Taylor, 27, were arrested Wednesday in Massachusetts on charges they smuggled Nissan ex-Chairman Carlos Ghosn out of Japan in a box in December 2019, while he awaited trial there on financial misconduct charges. / AP  Decades before a security camera caught Michael Taylor coming off a jet that was carrying one of the world’s most-wanted fugitives, the former Green Beret had a hard-earned reputation for taking on dicey assignments. Over the years, Taylor had been hired by parents to rescue abducted children. He went undercover for the FBI to sting a Massachusetts drug gang. And he worked as a military contractor in Iraq and Afghanistan, an assignment that landed him in a Utah jail in a federal fraud case. So when Taylor was linked to the December escape of former Nissan CEO Carlos Ghosn from Japan, where the executive awaited trial on financial misconduct charges, some in U.S. military and legal circles immediately recognized the name. Taylor has “gotten himself involved in situations that most people would never even think of, dangerous situations, but for all the right reasons,” Paul Kelly, a former federal prosecutor in Boston who has known the security consultant since the early 1990s, said earlier this year. “Was I surprised when I read the story that he may have been involved in what took place in Japan? No, not at all.” Wednesday, after months as fugitives, Taylor, 59, and his son, Peter, 27, were arrested in Massachusetts on charges accusing them of hiding Ghosn in a shipping case drilled with air holes and smuggling him out of Japan on a chartered jet. Investigators were still seeking George-Antoine Zayek, a Lebanese-born colleague of Taylor. “He is the most all-American man I know,” TaylorÂ’s assistant, Barbara Auterio, wrote to a federal judge before his sentencing in 2015. “His favorite song is the national anthem.” Kelly, now serving as the attorney for the Taylors, said they plan to challenge JapanÂ’s extradition request “on several legal and factual grounds.” “Michael Taylor is a distinguished veteran and patriot, and both he and his son deserve a full and fair hearing regarding these issues,” Kelly said in an email.