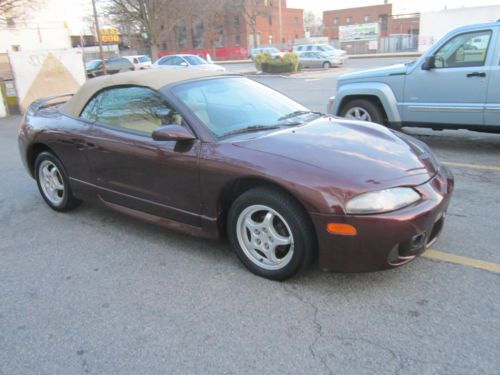

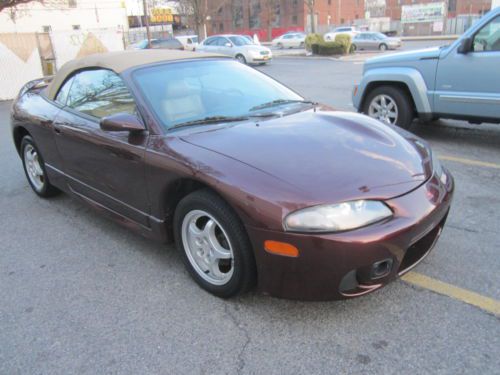

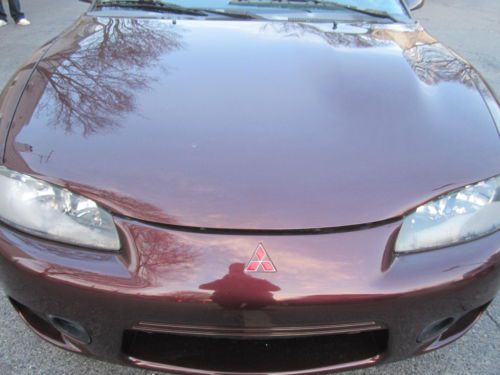

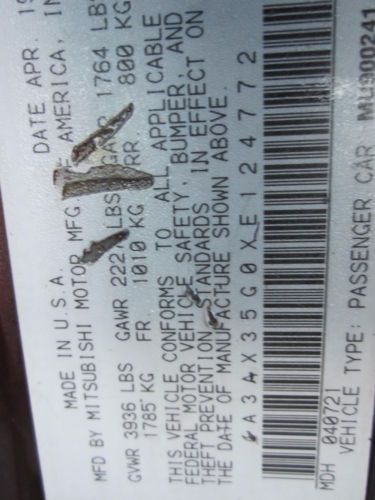

New Trade Converatble 4 Cylinder Auto 125k Looks And Runs Great Warrantee on 2040-cars

Ozone Park, New York, United States

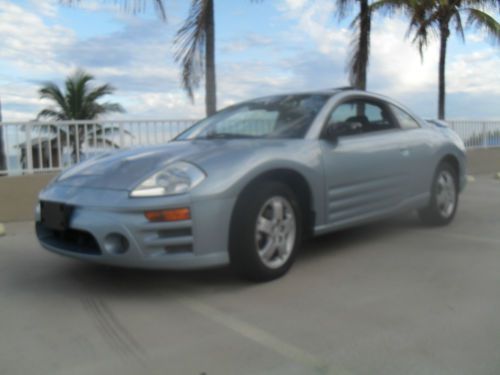

Mitsubishi Eclipse for Sale

2000 mitsubishi eclipse gt 3liter 6cyl w/power moon roof & air conditioning

2000 mitsubishi eclipse gt 3liter 6cyl w/power moon roof & air conditioning 2012 vehicle trim used 2.4l i4 16v automatic fwd coupe 39k miles

2012 vehicle trim used 2.4l i4 16v automatic fwd coupe 39k miles 2003 mitsubishi eclipse gs coupe 2-door 2.4l low milage excellent condition(US $4,600.00)

2003 mitsubishi eclipse gs coupe 2-door 2.4l low milage excellent condition(US $4,600.00) Mitsubishi eclipse spyder gt convertible low km's mint green

Mitsubishi eclipse spyder gt convertible low km's mint green 2008 mitsubishi eclipse gt coupe 2-door 3.8l(US $5,400.00)

2008 mitsubishi eclipse gt coupe 2-door 3.8l(US $5,400.00) 2006 mitsubishi eclipse gt hatchback 2-door 3.8l

2006 mitsubishi eclipse gt hatchback 2-door 3.8l

Auto Services in New York

Tones Tunes ★★★★★

Tmf Transmissions ★★★★★

Sun Chevrolet Inc ★★★★★

Steinway Auto Repairs Inc ★★★★★

Southern Tier Auto Recycling ★★★★★

Solano Mobility ★★★★★

Auto blog

Mitsubishi dealers would really like a truck to sell

Fri, Jan 6 2017While Mitsubishi is switching gears to focus on crossovers, that won't address a market that its dealers would like to be in. While answering questions from the press last night, Don Swearingen, executive vice president and COO of Mitsubishi's North American office, mentioned that its US dealers have a pickup truck high on their "shopping lists." In fact, he said that a truck is pretty much at the top. Mitsubishi does already have a small pickup truck it sells in foreign markets, badged as the Triton or L200. However, Swearingen said that just because dealers want a truck doesn't mean it's going to happen, citing various obstacles to bringing one to market. If, for example, Mitsubishi brought over the Triton, the company would have to go through the long, expensive process of certifying it for US safety and emissions regulations, not to mention making sure it fulfilled American buyers' demands. There's also the Chicken Tax, which levees a steep tariff on trucks built outside of the US and imported in. One possible way Mitsubishi could circumvent all of those issues, though, would be to leverage its new partnership with Nissan. Nissan already sells Frontier small pickups in the US, and Mitsubishi could simply redesign that model to suit its style. It's something that both companies are familiar with as well. Mitsubishi previously sold a restyled Dodge Dakota as the Raider, and Nissan allowed Suzuki to rebrand the Frontier to be sold as the Equator for a short time. It would certainly be a quick way to get into the truck market. However, Mitsubishi would also need to decide if such a product would actually be profitable, in addition to satisfying dealers. Related Video:

Mitsubishi looks to crossovers and EVs for US success

Fri, Jan 8 2016Say what you will about Mitsubishi, but the Japanese automaker is slowly seeing a resurgence here in the United States. December 2015 marked the company's twenty-second consecutive month of year-over-year sales increases, and looking at last year as a whole, Mitsubishi's sales were up 23 percent over 2014. Ken Konieczka, Mitsubishi's vice president of sales operations, says that in order to stay successful, the company will bet big on crossovers and electric vehicles in the coming years. And that means a relatively aggressive product plan here in the US. First up, a brand-new CUV will launch in early 2018, previewed by the eX Concept that debuted at last year's Tokyo Motor Show (pictured). Konieczka says Mitsubishi is making room for this new crossover in its lineup – the Outlander will slowly get bigger, and the Outlander Sport will get smaller. The production version of the eX will slot between those two. Speaking of the Outlander siblings, both will be replaced in the next five years. A new, larger Outlander will arrive in 2019, and the smaller Outlander Sport will arrive in 2020. To fulfill the electric side of the business, Konieczka confirms the next Outlander Sport will sprout an EV variant, and the Outlander plug-in hybrid will launch in the United States later in 2016, as a 2017 model. As for the rest of the company's portfolio, Mitsubishi will offer the updated Mirage hatchback and new G4 sedan later this year. The future for the Lancer, however, looks grim. Konieczka says Mitsubishi still can't find an OEM partner to help create and produce a new Lancer, and our gut says the compact sedan will be phased out in the very near future. "We made a lot of mistakes," Konieczka admits, saying Mitsubishi was "spread too thin [and] had too many models" in the past. This new, more focused approach on EVs and crossovers certainly sounds promising, and will hopefully help Mitsubishi continue its slow growth here in the US market. Still, we won't know for sure until the new products actually reach showrooms. But for now, at least, things are steadily on the rise.

Chrysler de Mexico to sell rebadged Mitsubishi model in shades of Colt deal

Wed, 02 Jul 2014Chrysler and Mitsubishi have had a close relationship since the early '70s. Back then, they partnered up to sell the Japanese brand's models under American names as captive imports in the US. Vehicles like the Dodge Colt, Eagle Summit, and eventually the 3000GT/Stealth twins and lots of other cars and trucks became the fruits of that alliance. In fact, the two companies still maintain a good rapport, as evidenced by reports of a new deal to sell the Mitsubishi Attrage, also known the Mirage G4, in Mexico starting in November.

The Attrage is a small, four-door sedan that borrows many of the mechanical bits from the Mitsubishi Mirage hatchback. According to Automotive News, the deal allows Chrysler to sell the model in Mexico for the next five years. The deal could be a win-win for both companies. Mitsubishi gets to use more capacity at its Laem Chabang, Thailand factory where the car is made, and Chrysler gets a new vehicle for a growing market with almost zero development costs. At this time, there's no indication of the new model's name in Mexico, though.

There's also still a chance the Attrage might make it to the US market as well. The automaker showed off the sedan as the Mirage G4 at the 2014 Montreal Motor Show ahead of promised sales in small-car-friendly Canada. The Mirage hatchback was introduced to the US in a similar way, debuting in Canada first and then crossing the border. While reviews for the Mirage have been pretty atrocious, it would still be interesting to see Mitsubishi further expanding its lineup in North America.