2012 Vehicle Trim Used 2.4l I4 16v Automatic Fwd Coupe 39k Miles on 2040-cars

Houston, Texas, United States

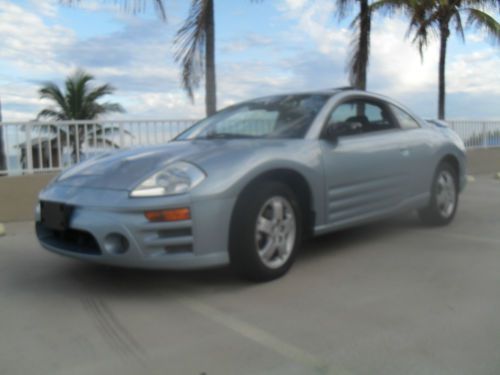

Mitsubishi Eclipse for Sale

2003 mitsubishi eclipse gs coupe 2-door 2.4l low milage excellent condition(US $4,600.00)

2003 mitsubishi eclipse gs coupe 2-door 2.4l low milage excellent condition(US $4,600.00) Mitsubishi eclipse spyder gt convertible low km's mint green

Mitsubishi eclipse spyder gt convertible low km's mint green 2008 mitsubishi eclipse gt coupe 2-door 3.8l(US $5,400.00)

2008 mitsubishi eclipse gt coupe 2-door 3.8l(US $5,400.00) 2006 mitsubishi eclipse gt hatchback 2-door 3.8l

2006 mitsubishi eclipse gt hatchback 2-door 3.8l 1995 mitsubishi eclipse gsx hatchback 2-door 2.0l(US $4,999.00)

1995 mitsubishi eclipse gsx hatchback 2-door 2.0l(US $4,999.00) 1991 mitsubishi eclipse base hatchback 2-door 1.8l

1991 mitsubishi eclipse base hatchback 2-door 1.8l

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

Judge denies bail for men accused of sneaking Carlos Ghosn out of Japan

Sun, Aug 9 2020BOSTON — Two American men wanted by Japan on charges that they helped sneak former Nissan Chairman Carlos Ghosn out of the country in a box have again been denied release from a U.S. jail. U.S. District Judge Indira Talwani on Friday rejected a bid to free Michael Taylor, a 59-year-old U.S. Army Special Forces veteran, and his 27-year-old son, Peter Taylor, on bail while they fight their extradition to Japan. Talwani said a magistrate judge properly found the two men to be a risk of flight. “While the Taylors may well seek to remain in the United States to fight extradition through available legal channels, they have also shown a blatant disregard for such safeguards in the context of the Japanese legal system and have not established sufficiently that if they find their extradition fight difficult, they will not flaunt the rules of release on bail and flee the country,” Talwani wrote. An attorney for the Taylors declined to comment Saturday. Their lawyers have said the men have no plans to flee and argue their health is at risk behind bars because of the coronavirus pandemic. The Taylors have been locked up in a Massachusetts jail since their arrest in May. Authorities say the Taylors helped smuggle Ghosn out of the Japan on a private jet while he was on bail and awaiting trial on financial misconduct allegations. With former the Nissan boss hidden in a large box, the flight went first to Turkey, then to Lebanon, where Ghosn has citizenship but which has no extradition treaty with Japan. Ghosn said he fled because he could not expect a fair trial, was subjected to unfair conditions in detention and was barred from meeting his wife under his bail conditions. Ghosn has denied allegations that he underreported his future income and committed a breach of trust by diverting Nissan money for his personal gain. The Taylors have not denied helping Ghosn flee, but argue they can't be extradited. Among other things, they say that “bail jumping” is not a crime in Japan and, therefore, helping someone evade their bail conditions isnÂ’t a crime either. In a court filing on Friday, federal prosecutors urged Magistrate Judge Donald Cabell to rule that the men can be legally extradited. The U.S. Secretary of State will make the final decision on whether they will be handed over to Japan.

Mexican police seize engine-powered drug cannon

Fri, 01 Mar 2013It seems like we're always hearing about new ways in which people are trying to smuggle things into the US from Mexico - including simply driving over the wall. Case in point? Mexican police have found yet another way criminals are attempting to get drugs over the border. Mexicali police have seized what looks to be either a Mitsubishi Mighty Max or Dodge Ram 50 pickup, equipped with what is essentially an oversized spud gun in the bed used to shoot marijuana over the border.

Constructed from a metal tank and a large plastic pipe, The Guardian reports that this drug cannon actually uses a car engine to build up enough air pressure to launch up to 13 kilos of marijuana at a time. Mexicali police were alerted to this truck when their US counterparts found drug packages on this side of the border. As of yet, there is no word as to how the vehicle was caught and whether any arrests resulted.

2023 Mitsubishi Triton coming after the Ford Ranger overseas

Sat, Jun 24 2023The next-generation Mitsubishi Triton is coming soon to a trail near you — assuming you live outside of the United States. Known as the L200 in some global markets, the truck was shaped by a new, more rugged-looking design language that Mitsubishi calls "Beast Mode." Dark preview images published by the Japanese brand depict a pickup that has been reinvented from the ground up. While the current Triton features rather unusual proportions characterized by a slanted shut line and a super-sized rear overhang, its successor looks a little more conventional, though we'll make the final call when we see it in the metal. We spot a tall, upright front end with LED accents that Mitsubishi describes as "resembling the sharp gaze of a hawk" and a rectangular grille with both "Mitsubishi" lettering and the company's emblem. 2023 Mitsubishi Triton View 4 Photos We're curious to find out what's under the sheet metal. Mitsubishi recently expanded its European range with badge-engineered Renault models, such as the Clio-based Colt. Nothing suggests that the Triton is a badge-engineered version of another truck, and the current-generation Nissan Navara (which is unrelated to our Frontier) is likely too old to provide its platform. Could it be the other way around? Mitsubishi is part of the Renault-Nissan alliance, and the group strives to achieve economies of scale, so the Triton could also preview the next Navara. Of course, this is pure speculation. Nothing is official at this stage, and Mitsubishi isn't ready to release technical details. It hasn't published images of the interior yet, but a preview video embedded above suggests that upmarket models will receive a free-standing touchscreen for the infotainment system and a dial to select one of the transfer case's different options. Broadly speaking, we're expecting that the next Triton will offer a more SUV-like interior to reflect the fact that, even outside of America, buyers are increasingly using pickups as daily drivers. Mitsubishi will unveil the next-generation Triton in Thailand, where the model will be built, on July 26. The truck will be sold in a long list of nations, including several countries in Latin America and in the Middle East, but it doesn't sound like it will be offered in the United States. Elsewhere, the Triton will compete in an increasingly crowded ring against the Ford Ranger, the Volkswagen Amarok, and the Toyota Hilux. Related Video: This content is hosted by a third party.