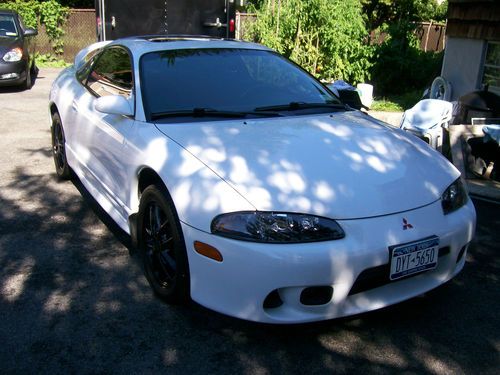

2009 Mitsubishi Eclipse Spyder Gt Convertible 2-door 3.8l on 2040-cars

Columbus, Ohio, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:3.8L 3828CC 230Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Mitsubishi

Model: Eclipse

Warranty: Vehicle does NOT have an existing warranty

Trim: Spyder GT Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 19,500

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Gray

Interior Color: Black

Number of Cylinders: 6

Number of Doors: 2

19k miles

Aftermarket Rims and Tires

Additional Pictures available upon request

Mitsubishi Eclipse for Sale

2001 mitsubishi eclipse gt coupe 2-door 3.0l(US $3,200.00)

2001 mitsubishi eclipse gt coupe 2-door 3.0l(US $3,200.00) 2007 mitsubishi eclipse spyder gt convertible 2-door 3.8l(US $12,999.00)

2007 mitsubishi eclipse spyder gt convertible 2-door 3.8l(US $12,999.00) Carfax 1 owner low miles keyless ent a/t a/c cd stereo mp3 player ipod/mp3 input

Carfax 1 owner low miles keyless ent a/t a/c cd stereo mp3 player ipod/mp3 input 1999 mitsubishi eclipse gsx 100% stock low mileage(US $9,999.00)

1999 mitsubishi eclipse gsx 100% stock low mileage(US $9,999.00) 1995 mitsubishi eclipse gsx awd turbo 5spd 500hp! built 2.3 liter stroker dsm(US $7,975.50)

1995 mitsubishi eclipse gsx awd turbo 5spd 500hp! built 2.3 liter stroker dsm(US $7,975.50) 1998 mitsubishi eclipse gsx hatchback 2-door 2.0l

1998 mitsubishi eclipse gsx hatchback 2-door 2.0l

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

Nissan, Renault reveal how they'll reshape alliance to cut costs, regain profit

Wed, May 27 2020TOKYO — The auto alliance of Nissan and Renault said Wednesday it will be sharing more vehicle parts, technology and models to save costs as the industry struggles to survive the coronavirus pandemic. Alliance Operating Board Chairman Jean-Dominique Senard said the group, which also includes smaller Japanese automaker Mitsubishi, will have each company focusing on geographic regions. “There is no plan for a merger of our companies,” the chairman said. “Our model today is a very distinctive model ... we donÂ’t need a merger to be efficient.” He stressed the alliance needs to adjust to the “unprecedented economic crisis,” to pursue efficiency and competitiveness, not sheer sales volumes. “Now is the time to rebuild,” Senard said, making clear he believed the alliance remained strong. All automakers are suffering from the pandemic, and scaling back or suspending production, but Nissan was reeling before the crisis struck from a scandal involving its former chairman, Carlos Ghosn. Yokohama-based Nissan is due to report its annual results on Thursday and has forecast it will slip into its first yearly loss in 11 years. Under the latest so-called leader-follower initiative, Nissan will focus on China, North America and Japan; Renault on Europe, Russia and South America and North Africa, and Mitsubishi on Southeast Asia and Oceania, for the benefit of the entire alliance. Nissan Chief Executive Makoto Uchida said the alliance planned to pursue fiscal strength together. “The synergy is huge,” he said. The number of vehicles sharing the same platform will double by 2024, saving 2 billion euros ($2.2 billion), according to Senard. The shared technology will also include electric cars and autonomous driving, platforms and car bodies, the executives said. Nissan is a leader in electric cars with its Leaf, but such technology will be available to the other alliance members, they said. The companies gave few details of how the revamp would deliver in the short term, as the car industry grapples with the fallout from the coronavirus pandemic and pressure to develop less polluting vehicles. They said in a joint statement that they aimed to produce nearly half of their vehicles under the new leader-follower approach by 2025 and hoped to cut investment per model in the scheme by up to 40%. The range of vehicles they produce is expected to fall by 20% by 2025 though the firms did not say how many jobs would go as they shift production.

Geely and Renault joint venture will develop internal combustion and hybrid tech

Tue, Jul 11 2023China's Geely Automobile Holdings and French car maker Renault SA on Tuesday said they will invest up to 7 billion euros ($7.71 billion) in a new equally held joint venture to develop gasoline engines and hybrid technology for automobiles. The JV is aimed at manufacturing more efficient internal combustion engines and hybrid systems at a time when the focus of much of the automobile industry has been on the capital-intensive transition to purely electric vehicles. "We are pleased to be embarking on this journey to become a global leader in hybrid technologies, providing low-emission solutions for automakers around the world," said Eric Li, Geely Holding Group chairman. The new company will employ 19,000 people at 17 engine plants and five research and development hubs, Renault said. At launch, it is expected to supply to multiple industrial customers including Volvo, Proton, Nissan, Mitsubishi Motors, and PUNCH Torino. The JV aims to have an annual production capacity of up to five million internal combustion, hybrid and plug-in hybrid engines and transmissions, Renault added. Reuters reported in March that the new venture will see 15 billion euros ($16.53 billion) in annual revenue. Saudi Aramco, which signed a letter of intent with Renault and Geely in March, is evaluating a strategic investment in the new company, Renault said. The Saudi oil producer has been involved in advanced discussions to take a stake of up to 20% in the JV, sources said earlier this year. Big oil firms have worked with automakers to develop sustainable fuels and hydrogen engines in recent years. But a deal here would make Aramco the first major oil producer to invest in the car business. The joint venture is expected to be launched in the second half of 2023. Earnings/Financials Green Mitsubishi Nissan Volvo Renault

Renault-Nissan-Mitsubishi pool $200 million to invest in tech startups

Fri, Jan 5 2018PARIS — The Renault-Nissan-Mitsubishi alliance is setting up a $200 million mobility tech fund, three sources said, in the latest move by major carmakers to adapt to rapid industry change by investing in startups through their own venture capital arms. The fund, due to be unveiled by Chief Executive Carlos Ghosn at the CES tech industry show in Las Vegas next Tuesday, will be 40 percent financed by Renault, 40 percent by Nissan and 20 percent by Mitsubishi. "It will allow us to move faster on acquisitions ahead of our competition," one of the alliance sources told Reuters. Frederique Le Greves, a spokeswoman for the Renault-Nissan-Mitsubishi alliance, declined to comment. The traditional auto industry model based on individual ownership is threatened by pay-per-use services such as Uber, as well as ride- and car-sharing platforms, a challenge heightened by parallel shifts towards electrified and self-driving cars. Wary carmakers are struggling to embrace changes and technologies that some of their executives are only beginning to grasp. To accelerate the process, many are investing directly in the new services — and gaining access to intellectual property — via their own corporate venture capital (CVC) funds. BMW has purchased stakes in a plethora of ride-sharing, smart-charging and autonomous vehicle software firms through its 500 million euro ($600 million) iVentures fund, the biggest such in-house facility belonging to a carmaker. Among others that have been increasingly active are General Motors' GM Ventures, with $240 million, and Peugeot-maker PSA Group's 100 million-euro investment arm. CVC funds, a familiar feature of innovative sectors such as tech and pharmaceuticals, have become more commonplace among carmakers since the 2008-9 financial crisis. They let companies skip some of the formalities otherwise required for new investments, and pounce more swiftly on promising startups. The Renault-Nissan-Mitsubishi venture will also obviate the current need to thrash out the ownership split for each new alliance acquisition. It represents a further step in the integration of the carmakers as they pursue 10 billion euros in annual synergies by 2022. France's Renault holds a 43.4 percent stake in Nissan, which in turn controls Mitsubishi. Ghosn heads Renault and chairs all three.