2008 Mitsubishi Eclipse on 2040-cars

Whitman, Massachusetts, United States

Engine:2.4L 2378CC l4 GAS SOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Year: 2008

Warranty: Vehicle does NOT have an existing warranty

Make: Mitsubishi

Model: Eclipse

Options: 4-Wheel Drive

Trim: GS Coupe 2-Door

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Drive Type: FWD

Number of Doors: 2

Mileage: 137,104

Exterior Color: Blue

Number of Cylinders: 4

Interior Color: Black

Mitsubishi Eclipse for Sale

2001 mitsubishi eclipse gs coupe 2-door 2.4l

2001 mitsubishi eclipse gs coupe 2-door 2.4l Mitsubishi eclipse, convertible, low reserve, cheap

Mitsubishi eclipse, convertible, low reserve, cheap 2003 mitsubishi eclipse gts low mileage nr excellent condition runs drives 100%(US $3,999.00)

2003 mitsubishi eclipse gts low mileage nr excellent condition runs drives 100%(US $3,999.00) 2000 mitsubishi eclipse - fun sports car!!!(US $3,200.00)

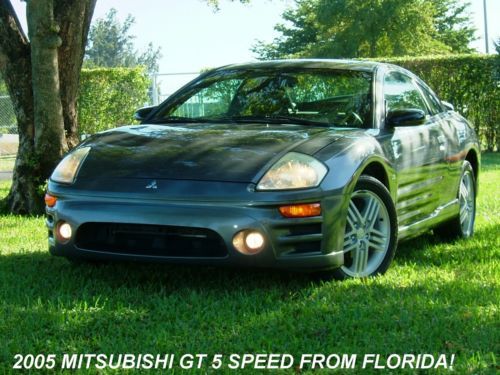

2000 mitsubishi eclipse - fun sports car!!!(US $3,200.00) 2005 mitsubishi eclipse gt 5 speed from florida! asoluely li ke new! one owner!

2005 mitsubishi eclipse gt 5 speed from florida! asoluely li ke new! one owner! Sunset orange gs manual coupe 2.4l 6-cd manual trans sunroof clean

Sunset orange gs manual coupe 2.4l 6-cd manual trans sunroof clean

Auto Services in Massachusetts

Wakefield Tire Center ★★★★★

Tody`s Services Inc ★★★★★

Supreme Auto Center ★★★★★

Stoneham Ford ★★★★★

South Boston Auto Tech, Inc. ★★★★★

Revolution Automotive Services ★★★★★

Auto blog

Mitsubishi Concept G4 leaves us feeling blue

Sat, 20 Apr 2013To say we were unimpressed by the 2014 Mitsubishi Mirage that debuted in New York earlier this year would be one heck of an understatement. So pardon us for not oohing and aahing over the Concept G4 that we're seeing for the first time here in Shanghai. It is, basically, a Mirage sedan. Try to contain your excitement.

Mitsubishi states that it intends to roll out the production version of the G4 Concept globally, powered by a 1.2-liter MIVEC engine mated to a continuously variable transmission that should at least be good for some substantial fuel economy gains. The Mirage, after all, is rated at 37/44 miles per gallon city/highway. We're also told that the car will be very lightweight, and that this should aid in making this thing not drive like a total dud.

We'll wait and see how the relatively sharp lines of the concept transfer to production form, but given that we already know what the Mirage looks like, we have a pretty good feeling that we'll be just as underwhelmed the second time around. Have a look below for the press blast.

Mitsubishi Outlander PHEV selling well in Netherlands

Wed, Jan 22 2014Talk about a Dutch treat. Mitsubishi says sales of its Outlander Plug-in Hybrid are brisk in Europe, helped in a big way by plug-in vehicle tax incentives in the Netherlands that are getting more people there to buy the world's first production plug-in hybrid CUV. The Japanese automaker has taken more than 12,000 orders for the model from Europeans and had delivered about 8,200 of them as of the end of last year, all but 200 of which were to the Netherlands. Mitsubishi will start broader sales throughout the continent this year and is also expected to start sales in the US by next year. The company is looking for plug-ins to account for 20 percent of its global sales by the end of the decade. Mitsubishi, which also sells the model in Norway, Sweden and Switzerland, hopes to reach an annual production rate of 50,000 Outlander PHEVs by the end of the year. Last August, the company resumed full-scale battery production after shutting things down for a few months for a safety probe stemming from a short-circuiting issue. The Outlander PHEV can run for 32 miles on electric power alone and gets a European-rated 124 miles per gallon. Check out Mitsubishi's press release on its Euro sales below. MITSUBISHI OUTLANDER PHEV CY13 SALES – EUROPEAN INAUGURATION With a plan for EVs and EV-derived PHEVs to represent 20% of its global sales by 2020, Mitsubishi Motors Corporation has set itself an ambitious, yet realistic target. More so in Europe, Mitsubishi Motors' largest market for these technologies. 12,000+ orders / 8,000+ deliveries In this respect, the successful sales launch of Outlander PHEV in Europe – MMC's first plug-in hybrid electric vehicle and forerunner of a wider PHEV range – tends to vindicate the Corporation's objectives. First launched in selected markets (The Netherlands, Sweden, Norway and Switzerland) from October 2013,Outlander PHEV has collected over 12,000 orders in Europe and these have already translated into 8,197 deliveries to end-customers by the end of December, of which 8,009 units for The Netherlands, the latter boosted by a tax scheme favourable to eco-friendly technologies such as low-emission vehicles. With more cars currently on their way to Europe, Mitsubishi Motor Sales Netherlands will soon be able to deliver the 11,000+ orders currently in its books and growing.

Next-generation Mitsubishi Outlander spied for the first time

Thu, Sep 26 2019Having been around relatively unchanged since the 2014 model year, it's about time that we're finally seeing a new generation of Mitsubishi Outlander crossover. This is the first prototype we've seen, and it's rather thinly disguised. From what we can tell, it will draw heavily from the Engelberg Tourer concept that was shown at this year's Geneva Motor Show (we still find that name strange, by the way). The next-generation Outlander's grille seems to have the now-trademark broad, metallic grille shared with the Eclipse Cross and recently refreshed Outlander Sport. It also has lights that spear off the top corners of the grille. In this application, they appear to simply be daytime running lights. The main illumination probably comes from the large rounded lamps below them. The grille and the shapes of the lights match the Engelberg concept, too. Mitsubishi Engelberg Tourer concept View 12 Photos Also matching the Engelberg Tourer is the side profile. We can see that the roof panel is separated from the rest of the body, making it perfect for contrasting colors like those on the concept. The glass area kicks up at the rear just before the vertical edge at the rear. This creates a thick, upright D-pillar, just like the concept. The back of the Outlander is pretty clean and simple, and the taillights are thin and wide. The taillights extend forward into sharp points. All of these features are similar to the concept. With so much of the exterior mirroring Mitsubishi's earlier concept, we're expecting the Outlander to use a similar, if not identical powertrain. The concept featured a plug-in hybrid powertrain very much like the current Outlander PHEV, but with a 2.4-liter inline-4 engine rather than a 2.0-liter unit. Electric range was an estimated 43 miles, which also improves on the existing Outlander PHEV's 22 miles. This all seems very plausible for the new production Outlander PHEV. The powertrain for non-hybrid Outlanders is more of a mystery. Base models may get the Eclipse Cross's turbocharged 1.5-liter inline-4. We'll have to wait to see if the V6 option sticks around. This prototype looks pretty far along in development, so we expect to see the production model shown within a year.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.032 s, 7971 u