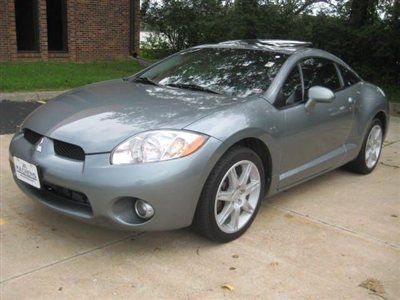

2007 Mitsubishi Eclipse Gt V6 Automatic Leather, Sunroof, Rockford Fosgate on 2040-cars

Columbia, Missouri, United States

Engine:3.8L 3828CC 230Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Make: Mitsubishi

Options: Sunroof, Leather, Compact Disc

Model: Eclipse

Safety Features: Anti-Lock Brakes, Passenger Side Airbag

Trim: GT Coupe 2-Door

Power Options: Air Conditioning, Cruise Control, Power Windows

Drive Type: FWD

Doors: 2

Mileage: 77,570

Engine Description: 3.8L V6 FI SOHC

Sub Model: GT

Number of Doors: 2

Exterior Color: Gray

Interior Color: Gray

Number of Cylinders: 6

Warranty: Vehicle has an existing warranty

Mitsubishi Eclipse for Sale

2005 mitsubishi eclipse gt coupe 2-door 3.0l(US $4,000.00)

2005 mitsubishi eclipse gt coupe 2-door 3.0l(US $4,000.00) Mitsubithi eclipse 71,000 miles

Mitsubithi eclipse 71,000 miles 2006 mitsubishi eclipse gs hatchback 2-door 2.4l(US $7,250.00)

2006 mitsubishi eclipse gs hatchback 2-door 2.4l(US $7,250.00) 1997 mitsubishi eclipse gst hatchback 2-door 2.0l(US $6,500.00)

1997 mitsubishi eclipse gst hatchback 2-door 2.0l(US $6,500.00) 2008 mitsubishi eclipse gt 3.8l v6 5-speed only 30k mi texas direct auto(US $15,980.00)

2008 mitsubishi eclipse gt 3.8l v6 5-speed only 30k mi texas direct auto(US $15,980.00) 1997 mitsubishi eclipse gsx - excellent condition! - automatic - awd turbo!

1997 mitsubishi eclipse gsx - excellent condition! - automatic - awd turbo!

Auto Services in Missouri

Wright Automotive ★★★★★

Wilson auto repair & 24-HR towing ★★★★★

Waggoner Motor Co ★★★★★

Vanzandt?ˆ™s Auto Repair ★★★★★

Valvoline Instant Oil Change ★★★★★

Todd`s & Mark`s Auto Repair ★★★★★

Auto blog

Mitsubishi slashes annual profit forecast on slowing car sales

Wed, Nov 6 2019TOKYO — Mitsubishi Motors on Wednesday cut its full-year profit outlook by 67% as it expects sluggish demand in North America and China will continue, while a strong yen and research and development costs will also hurt the automaker's bottom line. Japan's sixth-largest automaker now expects operating profit to come in at 30.0 billion yen in the year to March, down from a previous forecast for 90.0 billion yen. The new outlook would be Mitsubishi's lowest profit since the year ended March 2017. The downgrade comes after Mitsubishi, in which Nissan holds a controlling stake, reported a 78% plunge in operating profit during the July-September quarter to 6.3 billion yen, lower than a mean forecast for 16.26 billion yen from analysts polled by Refinitiv. It joins a growing number of Japanese automakers which are bracing for lower profitability. Earlier on Wednesday, Subaru lowered its annual profit forecast due to a stronger yen and a cut in domestic output due to a major typhoon last month. Mazda and Suzuki have also cut their respective outlooks within the past month due to slowing demand for their cars. Earnings/Financials Mitsubishi

Nissan, Renault in talks to merge as one company

Thu, Mar 29 2018Nissan and Renault have been tied together as an alliance for nearly 20 years, but now the Japanese and French automakers are discussing whether to merge. Bloomberg, citing unidentified sources familiar with the confidential talks, reports that the idea is to form a larger, single publicly traded company to better compete against giants like Toyota and Volkswagen. It would also mark the end of the alliance that first began in 1999 and also includes Mitsubishi, in which Nissan acquired a controlling interest in 2016. A full merger would help the companies pool resources to develop electric vehicles, autonomous vehicles and car-sharing services. It would involve Nissan giving Renault shareholders stock in the new company, with Nissan shareholders also gaining shares in the new company, Bloomberg reports. The new company would be run by Carlos Ghosn, the current chairman of both companies. But any such merger, as you might expect, would be complicated, in part by geopolitics. The French government owns a 15-percent stake in Renault, and both the French and Japanese governments might be reluctant to let go of their respective home-grown brands. Currently, Renault owns a 43-percent stake in Nissan, while Nissan owns 15 percent of its French partner. Reuters reported recently that Ghosn proposed buying most of the French government's stake in Renault as part of plans for a closer tie-up. The Renault-Nissan-Mitsubishi alliance already has been working to establish a $200 million mobility tech fund to invest in startups, a reflection of how seismic changes in the auto industry have left many legacy companies scrambling to stay current. Nissan in 2016 paid a reported $2.3 billion to acquire 34 percent of Mitsubishi in order to share platforms, technology, manufacturing and other resources. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Image Credit: Patrick T. Fallon/Bloomberg Earnings/Financials Government/Legal Green Mitsubishi Nissan Renault car sharing merger

Japan could consolidate to three automakers by 2020

Thu, Feb 11 2016Sergio Marchionne might see his dream of big mergers in the auto industry become a reality, and an analyst thinks Japan is a likely place for consolidation to happen. Takaki Nakanishi from Jefferies Group LLC tells Bloomberg the country's car market could combine to just three or fewer major players by 2020, from seven today. "To have one or two carmakers in a country is not only natural, but also helpful to their competitiveness," Nakanishi told Bloomberg. "Japan has just too many and the resources have been too spread out. It's a natural trend to consolidate and reduce some of the wasted resources." Nakanishi's argument echoes Marchionne's reasons to push for a merger between FCA and General Motors. Automakers spend billions on research and development, but their competitors also invest money to create the same solutions. Consolidating could conceivably put that R&D money into new avenues. "In today's global marketplace, it is increasingly difficult for automakers to compete in lower volume segments like sports cars, hydrogen fuel cells, or electrified vehicles on their own," Ed Kim, vice president of Industry Analysis at AutoPacific, told Autoblog. Even without mergers, these are the areas where Japanese automakers already have partners for development. Kim cited examples like Toyota and Subaru's work on the BRZ and FR-S and its collaboration with BMW on a forthcoming sports car. Honda and GM have also reportedly deepened their cooperation on green car tech. After Toyota's recent buyout of previous partner Daihatsu, Nakanishi agrees with rumors that the automotive giant could next pursue Suzuki. He sees them like a courting couple. "For Suzuki, it's like they're just starting to exchange diaries and have yet to hold hands. When Toyota's starts to hold 5 percent of Suzuki's shares, this will be like finally touching fingertips," Nakanishi told Bloomberg. "I absolutely do believe that we are not finished seeing consolidation in Japan," Kim told Autoblog. Rising development costs to meet tougher emissions regulations make it hard for minor players in the market to remain competitive. "The smaller automakers like Suzuki, Mazda, and Mitsubishi are challenged to make it on their own in the global marketplace. Consolidation for them may be inevitable." Related Video: