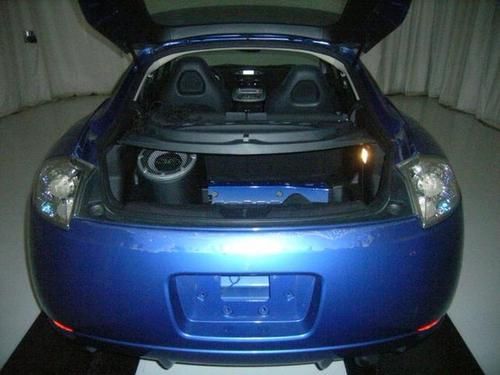

2006 Mitsubishi Eclipse Gs Hatchback 2-door 2.4l on 2040-cars

Hialeah, Florida, United States

Body Type:Hatchback

Vehicle Title:Clear

Engine:2.4L 2378CC l4 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Make: Mitsubishi

Model: Eclipse

Warranty: Unspecified

Trim: GS Hatchback 2-Door

Options: Sunroof, Cassette Player, CD Player

Drive Type: FWD

Power Options: Air Conditioning

Mileage: 86,209

Exterior Color: Blue

Interior Color: Blk

Number of Doors: 2

Number of Cylinders: 4

Mitsubishi Eclipse for Sale

1997 mitsubishi eclipse gst hatchback 2-door 2.0l(US $6,500.00)

1997 mitsubishi eclipse gst hatchback 2-door 2.0l(US $6,500.00) 2008 mitsubishi eclipse gt 3.8l v6 5-speed only 30k mi texas direct auto(US $15,980.00)

2008 mitsubishi eclipse gt 3.8l v6 5-speed only 30k mi texas direct auto(US $15,980.00) 1997 mitsubishi eclipse gsx - excellent condition! - automatic - awd turbo!

1997 mitsubishi eclipse gsx - excellent condition! - automatic - awd turbo! 2011 mitsubishi eclipse no reserve

2011 mitsubishi eclipse no reserve Red automatic

Red automatic 1995, awd, manual, 500+ horsepower, low 11 sec 1/4 mile(US $9,000.00)

1995, awd, manual, 500+ horsepower, low 11 sec 1/4 mile(US $9,000.00)

Auto Services in Florida

Zeigler Transmissions ★★★★★

Youngs Auto Rep Air ★★★★★

Wright Doug ★★★★★

Whitestone Auto Sales ★★★★★

Wales Garage Corp. ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Mitsubishi Eclipse Cross will be crossing over to the US sometime in the fall

Tue, Feb 28 2017Here it is, Mitsubishi's latest effort to take a piece of the CUV pie, the Eclipse Cross. The crossover makes its official debut at the Geneva Show, and it looks just aggressive enough to be unique, but not so strange that it will scare away the average buyer. Most interesting are the aggressive cues cribbed from the XR-PHEV II Concept, like the forward-raked rear hatch, chunky rear fenders, and deep crease along the side. However, the shape is still clearly crossover, and the nose isn't too radical. In fact, it may be the most attractive version of Mitsubishi's shield grille yet. Interestingly, the Eclipse Cross is within an inch or two size-wise compared with the existing Outlander Sport, though this should change down the road when a newer, smaller Outlander Sport is introduced. The interior follows a similar theme to the exterior. The most striking aspect is the center stack, which slants downward toward the shifter and juts out over the climate control buttons. But everything is finished in simple, inoffensive black and aluminum-look trim. The sliding and reclining rear seats should be useful for comfort and cargo space. Next to the shifter is a touch-pad that looks extremely similar to the pad Lexus uses for its systems. A couple of our editors find the Lexus version to be rather awful, so hopefully Mitsubishi has refined and improved it. As a back-up, you can simply use the touch screen perched atop the dash, which may be more handy for using the car's default user interface, or the supported Apple CarPlay or Android Auto. Also on the dash is a pop-up heads-up display similar to that in current Mazdas. View 11 Photos One big selling point for the Eclipse Cross is its standard all-wheel drive. There is also just one engine and one transmission. Power comes from a turbocharged 1.5-liter gasoline inline-four, and it's channeled through a CVT with 8 ratios that can be manually shifted. Mitsubishi has yet to announce output for the four-pot. Other markets will have the option of a 2.2-liter turbocharged diesel four-cylinder with an 8-speed automatic, but it won't make the trip to the States. Europe will be the first to get the Eclipse Cross, where it will show up at dealers this fall. Afterward, it will arrive in other markets, including the US. So expect it to appear sometime at the end of this year, or possibly the start of next year. Pricing has not been announced yet. Related Video:

Recharge Wrap-up: vehicle electrification future, Indonesia biodiesel growth

Tue, Dec 29 2015Navigant Research expects electrified vehicles (including hybrids, plug-in hybrids and battery electric vehicles) to reach 6 million sales in 2024. That's up from 2.6 million sales in 2015. About half of those sales will be plug-in vehicles in 2024, up from 19 percent in 2015. To make its predictions, Navigant took into account automaker strategies, concept vehicles, regulations and incentives, electricity and oil prices, and charging infrastructure expectations over the 10-year timetable. Navigant also says that despite the massive changes in the last five years, the next five years will be "even more impactful to the global automotive and energy industries." Read more from Navigant Research, or at Green Car Congress. Indonesia's biodiesel consumption is expected to rise dramatically over the next year. While the nation used 291 to 317 million gallons in 2015, consumption levels for 2016 could surpass 2 billion gallons, depending on blending regulation enforcement. Indonesia raised the minimum biodiesel content in diesel fuel from 10 to 15 percent in 2015 while increasing biofuel subsidies. It will raise the blend minimum to 20 percent for 2016, and plans to increase it to 30 percent in 2020. Read more at Business Recorder. Scotland's national newspaper, The Scotsman, has awarded the title of Plug-In Vehicle of the Year to the Mitsubishi Outlander PHEV. The paper praised the car for its ability to live up to its "ecocredentials," as well as its all-around practicality. During its long-term test, Scotsman staff enjoyed using the 32.5 miles of electric driving range to commute to and from work. The Scotsman's Steven Chisholm called the Mitsubishi Outlander PHEV, "an exciting prospect for anyone looking for an SUV that's easy on the wallet as well as the environment." Read more at Inside EVs. Featured Gallery Mitsubishi Outlander PHEV Concept-S: Paris 2014 View 12 Photos News Source: Navigant Research, Green Car Congress, Business Recorder, Inside EVsImage Credit: Copyright 2015 Drew Phillips / AOL Government/Legal Green Mitsubishi Alternative Fuels Biodiesel Electric recharge wrapup

Minivan Mania | Autoblog Podcast #675

Fri, Apr 23 2021In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and West Coast Editor James Riswick, and this week, it's (almost) all about vans! James recently wrote a head-to-head comparison of the 2021 Toyota Sienna and 2021 Chrysler Pacifica Hybrid, and he talks us through the results. John recently reviewed the 2022 Kia Carnival, which is replacing the Kia Sedona. After discussing the minivan field as a whole, our editors identify some reasonable minivan alternatives in the SUV and crossover realms. Moving along, they talk about driving the long-term Hyundai Palisade and the new Mitsubishi Outlander before discussing their favorite highlights from the 2021 Shanghai Auto Show. Autoblog Podcast #675 Get The Podcast iTunes¬†Ė Subscribe to the¬†Autoblog¬†Podcast in iTunes RSS¬†¬Ė Add the¬†Autoblog¬†Podcast feed to your RSS aggregator MP3¬†¬Ė Download the MP3 directly Rundown Minivans! 2021 Toyota Sienna vs 2021 Chrysler Pacifica Hybrid 2022 Kia Carnival The rest of the field Ute alternatives Cars we're driving 2022 Mitsubishi Outlander 2021 Hyundai Palisade road trip Shanghai Auto Show Lincoln Zephyr Toyota bZ4X Honda SUV e:prototype Feedback Email ¬Ė Podcast@Autoblog.com Review the show on iTunes Autoblog¬†is now live on your smart speakers and voice assistants with the¬†audio¬†Autoblog¬†Daily Digest. Say ¬ďHey Google, play the news from¬†Autoblog¬Ē or "Alexa, open¬†Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.