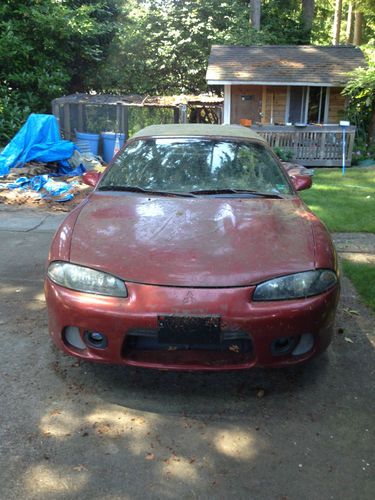

2004 Mitshubishi Eclipse Gts For Parts Clean Ct Title on 2040-cars

East Hartford, Connecticut, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:3.0L 2972CC 181Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Mitsubishi

Model: Eclipse

Trim: GTS Coupe 2-Door

Options: Sunroof, Leather Seats, CD Player

Safety Features: Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 107,400

Exterior Color: Silver

Interior Color: Black

Disability Equipped: No

Number of Cylinders: 6

Got it checked by machenic told me timing belt is broken but it could be anything else. Body is clean only little paint is faded. Passanger side fender is little bend but door works fine and you cant even notice it. Intirior is clean. Seats are in perfact condition. If you need more information massage me.

Mitsubishi Eclipse for Sale

1992 mitsubishi eclipse gsx hatchback 2-door 2.0l

1992 mitsubishi eclipse gsx hatchback 2-door 2.0l 1999 mitsubishi eclipse spyder gs

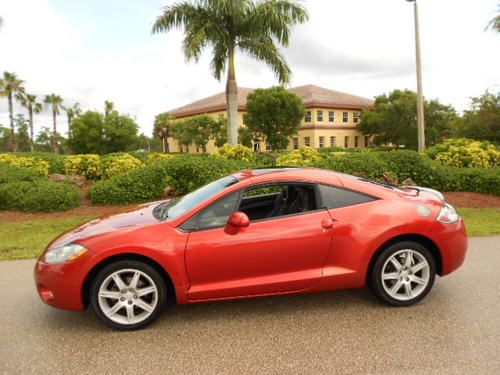

1999 mitsubishi eclipse spyder gs Beautiful 2006 mitsubishi eclipse gt 6-speed! 1-florida owner! new body style!(US $7,425.00)

Beautiful 2006 mitsubishi eclipse gt 6-speed! 1-florida owner! new body style!(US $7,425.00) 1997 mitsubishi eclipse spyder gs convertible 2-door 2.4l: does not run

1997 mitsubishi eclipse spyder gs convertible 2-door 2.4l: does not run 2.4l coupe 2dr 2 door abs ac alloy red cloth black spoiler clean mint we finance

2.4l coupe 2dr 2 door abs ac alloy red cloth black spoiler clean mint we finance 2000 mitsubishi eclipse, no reserve

2000 mitsubishi eclipse, no reserve

Auto Services in Connecticut

Valenti Motors Inc ★★★★★

Tires Plus Wheels ★★★★★

Story Brothers Inc ★★★★★

South Valley Auto ★★★★★

People`s Auto LLC ★★★★★

Pandolfe`s Auto Parts ★★★★★

Auto blog

Mitsubishi leaving US? No, it's doubling its marketing budget

Tue, 12 Feb 2013We rarely hear any major news coming out of the National Automobile Dealers Association (NADA) annual meeting in Orlando, FL, but Mitsubishi executives found this a fitting place to announce a big push for increased advertising here in the US. A report in Automotive News states that the struggling Japanese automaker is returning to advertising in prime time television for the first time since 2005, with the push slated to begin in June and July for the launch of the 2014 Mitsubishi Outlander shown above.

Despite dwindling sales and a shrinking lineup, Mitsubishi's new North American chairman, Gayu Uesugi, has said on multiple occasions that the automaker has no plans to abandon the US market. Spending extra money on marketing and advertising should be a good start to help improve sales, but a lack of fresh and competitive products is also keeping showrooms empty. Aside from the new Outlander, the AN report says that Mitsubishi spokesman Roger Yasukawa said that a "yet-to-be-named subcompact" will arrive this year, which suggests the unnamed hatchback shown below (known elsewhere as the Mirage), could be heading to the US after its North American introduction at the Montreal Auto Show last month.

Mitsubishi MI-TECH concept has four electric motors and a turbine engine range extender

Thu, Oct 3 2019Mitsubishi is bringing a new concept car to this year’s Tokyo Motor Show, and itÂ’s already shaping up to be an exciting proposition. We got a teaser photo of the MI-TECH Concept today, and it looks like a short wheelbase convertible SUV. Not only that, but itÂ’s also a two-seater. All this means itÂ’s likely not anything close to what weÂ’ll see in a production car, but the tech onboard is what really grabbed our attention. ItÂ’s a plug-in hybrid, but itÂ’s different than most youÂ’ve seen before. There are four electric motors, two at each axle to provide the best four-wheel drive one could ask for. Then, instead of a traditional gasoline engine generator as a range extender, Mitsubishi is using a turbine engine generator. The Chrysler and GM turbine cars of the 1960s-70s were just ahead of their time, werenÂ’t they? Mitsubishi says this allows the MI-TECH to drive like a series hybrid when the battery pack is depleted. The four-wheel drive system is supposed to provide fantastic performance offroad and also on tarmac, being able to precisely dole out the exact amount of torque to whatever wheel needs it at any given time. Mitsubishi says the entire plug-in hybrid electric system is compact, so as to fit in a small SUV. Think Eclipse Cross or Outlander Sport size. The company already has a plug-in hybrid powertrain for the larger Outlander, but it wants to hybridize its smaller offerings one day, too. We donÂ’t expect the turbine engine to make it into our hands, but this four-motor electric drive system would be sweet in a production car. An augmented-reality windshield is the highlight on the interior of the MI-TECH. It is able to project a variety of information onto the windshield by using optical sensing technology. Hopefully Mitsubishi expands on that when it fully reveals the car in Tokyo. For now, we have the teaser, and it looks pretty neat. Mitsubishi, feel free to release a production version of a roofless, off-road, electrified SUV. We could use something fun in the lineup, as the Evo hole in our heart grows larger by the year.

Japan calls Ghosn's escape inexcusable and vows tighter immigration checks

Sun, Jan 5 2020TOKYO — Japan's justice minister on Sunday called the flight of former Nissan Chairman Carlos Ghosn as he awaited trial on financial misconduct charges inexcusable and vowed to beef up immigration checks. Justice Minister Masako Mori said she had ordered an investigation after Ghosn issued a statement a few days ago saying he was in Lebanon. She said there were no records of Ghosn's departure from Tokyo. She said his bail has been revoked, and Interpol had issued a wanted notice. Departure checks needed to be strengthened to prevent a recurrence, Mori said. While expressing deep regret over what had happened, Mori stopped short of outlining any specific action Japan might take to get Ghosn back. Japan does not have an extradition treaty with Lebanon. “Our nationÂ’s criminal justice system protects the basic human rights of an individual and properly carries out appropriate procedures to disclose the truth of various cases, and the flight of a suspect while out on bail is never justified,” she said in a statement. MoriÂ’s statement was the first public comment by a Japanese government official after the stunning escape of Ghosn, once a superstar of the auto industry. Tokyo prosecutors issued a similar statement Sunday. They had opposed Ghosn's release on bail, arguing he was a flight risk. First arrested in November 2018, Ghosn was out on bail over the last several months, and more recently had moved into a home in an upscale part of Tokyo. He has repeatedly said he was innocent. His statement from Beirut said he was escaping injustice. Japan's justice system has come under fire from human rights advocates for its long detentions, the reliance on confessions and prolonged trials. The conviction rate is higher than 99%. Even if Ghosn had been found innocent, the prosecutors could have appealed, and the appeals process could have lasted years. Ghosn's trial was not expected to start until April at the earliest. During that time, he had been prohibited from seeing his wife, and was only allowed a couple of video calls in the presence of a lawyer. Ghosn had been charged with underreporting his future compensation and breach of trust in diverting Nissan money for his personal gain. Although the details of his escape are not yet clear, Turkish airline company MNG Jet has said two of its planes were used illegally, first flying him from Osaka, Japan, to Istanbul, and then on to Beirut, where he arrived Monday and has not been seen since.