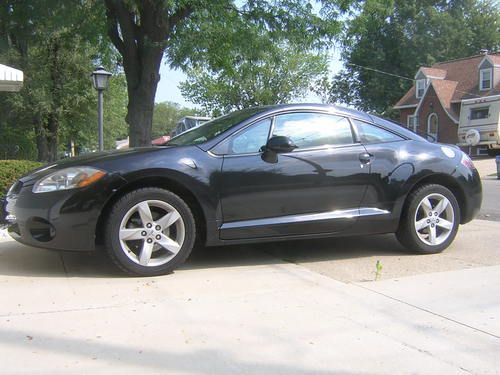

2003 Mitsubishi Eclipse Rs Coupe 2-door 2.4l Silver on 2040-cars

Beaver Dam, Kentucky, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:2.4L 2351CC l4 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Mitsubishi

Model: Eclipse

Trim: RS Coupe 2-Door

Options: CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Power Locks, Power Windows

Mileage: 103,000

Sub Model: RS

Exterior Color: Silver

Number of Doors: 2

Number of Cylinders: 4

Mitsubishi Eclipse for Sale

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,850.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,850.00) 2003 mitsubishi eclipse gs coupe 2-door 2.4l

2003 mitsubishi eclipse gs coupe 2-door 2.4l 1999 mitsubishi eclipse gs hatchback 2-door 2.0l(US $3,500.00)

1999 mitsubishi eclipse gs hatchback 2-door 2.0l(US $3,500.00) 2003 mitsubishi eclipse gs coupe 2-door 2.4l(US $2,500.00)

2003 mitsubishi eclipse gs coupe 2-door 2.4l(US $2,500.00) 2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $9,000.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $9,000.00) 2004 mitsubishi eclipse spyder gs convertible 2-door 2.4l(US $5,100.00)

2004 mitsubishi eclipse spyder gs convertible 2-door 2.4l(US $5,100.00)

Auto Services in Kentucky

Volunteer Auto Parts ★★★★★

Vasquez Auto Sales ★★★★★

United Van & Truck Salvage ★★★★★

Tru-Align Automotive ★★★★★

Tire Discounters Inc ★★★★★

Team Automotive ★★★★★

Auto blog

Race Recap: 2014 Pikes Peak Hill Climb

Mon, 30 Jun 2014The weather didn't interrupt the Pikes Peak International Hill Climb this year, the sun staying out to shine throughout a mildly cloudy day. The crowds didn't interrupt the race, either. Last year there were incidents like the woman who leaned so far into the road that her camera tore a hole in a speeding Shelby Cobra and she had to be sent to the hospital. This year the organizers shrank the number of spectator viewing areas and put others behind fences, such that long stretches of the route were uninhabited by anything other than varmints.

The only unexpected visitor was a dusty track and what some competitors said were slightly higher temperatures that changed the amount of grip and increased times. Yet the calm let a couple of teams, like that sun, break through the clouds of past misfortune and claim victories they'd been targeting for years.

Mitsubishi teases world premiere of new PHEV concept ahead of Geneva

Wed, Jan 28 2015It was a little disappointing to find out that Mitsubishi's "return of a legend" for the 2015 Chicago Auto Show would simply be the North American debut of the GC-PHEV concept. The crossover has a chunky, rugged design that's somewhat attractive, but it's not exactly new to the motoring world. Apparently, the Japanese brand understands the desire to see what's next because the company is now teasing the world premiere of a concept for the 2015 Geneva Motor Show in March. Mitsubishi promises that the still-unnamed concept "is a 'declaration of intent'" for the company's future. The only real hints that the brand drops about the vehicle is that it features a next-gen, two-wheel-drive plug-in hybrid powertrain and is a crossover. Judging from Mitsubishi's two teaser images, the design appears to be cribbing a lot from the brand's own XR-PHEV concept. Up front, the angular nose and headlight design look almost identical, and the pointed rear with integrated taillights seems basically the same, as well. Hopefully, the Japanese brand has something clever going on here and isn't just slightly tweaking a previous design. MITSUBISHI MOTORS AT GENEVA MOTORSHOW 2015 CONCEPT CAR WORLD PREMIERE – A DECLARATION OF INTENT 27/01/15 TOKYO - "A future-oriented attitude: powerful, fast and dynamic". This is the theme of the 85th International Geneva Motor Show official poster in perfect synergy with Mitsubishi Motors Corporation's (MMC's) confident presence this year; from a new dramatic booth design to the sharpness of an all-new concept car. A world premiere in Geneva, the striking concept car is a 'declaration of intent' for MMC's future directions -a powerful embodiment of its next generation 2WD plug-in hybrid electric ("PHEV") technology as well as its bold design renaissance, all contained in Mitsubishi Motors' favorite format of the SUV crossover. The all new Mitsubishi Motors concept - a smart combination of engineering, fluency with a high-output electric motor, low environmental impact, dynamic agility and athletic design. -ENDS -

Fiat introduces new Fullback pickup

Wed, Nov 11 2015Fiat has unveiled its first foray into the mid-size pickup truck market, the Fullback, at the Dubai Motor Show. It's not an entirely new product, confirming earlier reports. It's closely related to the Triton pickup (also known as the L200) that Mitsubishi builds in Thailand for markets in Europe, Asia, and Africa. Moreover, it's not likely ever to make it to North American showrooms. Riding on a 118-inch wheelbase, it measures 208 inches long, 71 inches wide and 70 inches tall. Those are identical measurements to the Mitsu, and give it roughly similar dimensions to the Chevy Colorado/GMC Canyon we get here. The Fullback can carry up to 2,300 pounds, and is powered by a 2.4-liter turbo diesel engine available in either 150- or 180-horsepower states of tune, and mated to a six-speed manual or five-speed automatic transmission. Fiat Professional will roll out the Fullback in markets across Europe, the Middle East, and Africa, where it will compete against the likes of the Toyota Hilux, Ford Ranger, and Volkswagen Amarok. FIAT PROFESSIONAL DEBUTS NEW FULLBACK PICK-UP TRUCK AT THE DUBAI INTERNATIONAL MOTOR SHOW - New FIAT Professional pick-up truck to be named Fullback – a name derived from the cornerstone position in rugby and American football - Available in the UK in autumn 2016, the FIAT Fullback will combine a practical double-cab body style with a spacious load area and competitive payload of 1,045kg - Powered by a 2.4-litre turbo-diesel engine, with 150hp or 180hp outputs, the FIAT Fullback will have four-wheel drive as standard, combined with a manual or automatic transmission - More details, including pricing and final specifications, will be announced closer to the launch of the FIAT Fullback in the UK FIAT Professional has unveiled the all-new FIAT Fullback pick-up truck at the 2015 Dubai International Motor Show. The new, medium-duty pick-up will join the award-winning FIAT Professional range in autumn 2016 and will be available only with a practical double cab body style configuration in the UK making it an ideal vehicle for both commercial and leisure time activities. Measuring up to 1,780mm in height, 1,815 mm in width and 5,285mm in length, with a wheelbase of 3,000mm, the new FIAT Fullback will offer a competitive payload of 1,045 kg and will be powered by a 2.4-litre, aluminium, turbo-diesel engine with a power output of either 150hp or 180hp.