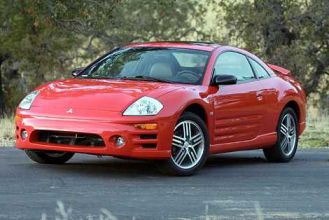

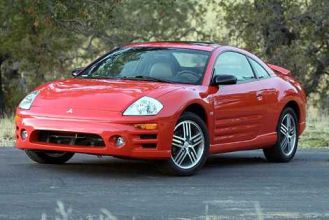

2003 Mitsubishi Eclipse Gs on 2040-cars

3659 Dixie Hwy, Hamilton, Ohio, United States

Engine:2.4L I-4 MPI

Transmission:Automatic

VIN (Vehicle Identification Number): 4A3AC44G73E071193

Stock Num: MR26

Make: Mitsubishi

Model: Eclipse GS

Year: 2003

Exterior Color: Red

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 147268

car comes with 3 months warranty,all cars are clear titles actual miles,mostly trades from local new car dealers,for more info and pics visit our website((( www.mrauto.com )))we have many cars to choose from (over 100) cars,best prices in tri-state area.

Mitsubishi Eclipse for Sale

2003 mitsubishi eclipse gts(US $2,500.00)

2003 mitsubishi eclipse gts(US $2,500.00) 2000 mitsubishi eclipse gt(US $3,995.00)

2000 mitsubishi eclipse gt(US $3,995.00) 2007 mitsubishi eclipse spyder gs

2007 mitsubishi eclipse spyder gs 2006 mitsubishi eclipse gs(US $8,995.00)

2006 mitsubishi eclipse gs(US $8,995.00) 2008 mitsubishi eclipse spyder gs(US $12,379.00)

2008 mitsubishi eclipse spyder gs(US $12,379.00) 2008 mitsubishi eclipse se(US $15,995.00)

2008 mitsubishi eclipse se(US $15,995.00)

Auto Services in Ohio

Williams Auto Parts Inc ★★★★★

Wagner Subaru ★★★★★

USA Tire & Auto Service Center ★★★★★

Toyota-Metro Toyota ★★★★★

Top Value Car & Truck Service ★★★★★

Tire Discounters Inc ★★★★★

Auto blog

Chrysler de Mexico to sell rebadged Mitsubishi model in shades of Colt deal

Wed, 02 Jul 2014Chrysler and Mitsubishi have had a close relationship since the early '70s. Back then, they partnered up to sell the Japanese brand's models under American names as captive imports in the US. Vehicles like the Dodge Colt, Eagle Summit, and eventually the 3000GT/Stealth twins and lots of other cars and trucks became the fruits of that alliance. In fact, the two companies still maintain a good rapport, as evidenced by reports of a new deal to sell the Mitsubishi Attrage, also known the Mirage G4, in Mexico starting in November.

The Attrage is a small, four-door sedan that borrows many of the mechanical bits from the Mitsubishi Mirage hatchback. According to Automotive News, the deal allows Chrysler to sell the model in Mexico for the next five years. The deal could be a win-win for both companies. Mitsubishi gets to use more capacity at its Laem Chabang, Thailand factory where the car is made, and Chrysler gets a new vehicle for a growing market with almost zero development costs. At this time, there's no indication of the new model's name in Mexico, though.

There's also still a chance the Attrage might make it to the US market as well. The automaker showed off the sedan as the Mirage G4 at the 2014 Montreal Motor Show ahead of promised sales in small-car-friendly Canada. The Mirage hatchback was introduced to the US in a similar way, debuting in Canada first and then crossing the border. While reviews for the Mirage have been pretty atrocious, it would still be interesting to see Mitsubishi further expanding its lineup in North America.

Nissan and Renault shelve merger plans, will repair their alliance

Tue, May 26 2020Renault and Nissan have shelved plans to push towards the full merger former leader Carlos Ghosn craved and will instead fix their troubled alliance to try to recover from the coronavirus pandemic, five senior sources told Reuters. Nissan has long resisted Renault's proposals for a full-blown merger as executives felt the French carmaker was not paying its fair share for the engineering work it did in Japan, sowing discord that some feared could wreck the partnership. Now, with carmakers around the world reeling from the pandemic, the partners are planning to overhaul an alliance that largely failed to convert its global scale into a competitive advantage beyond the joint procurement of parts. Both struggling carmakers are set to announce mid-term restructuring plans this week that will serve as a peace treaty designed to resolve the long-standing tensions, five people familiar with the overhaul told Reuters. "After the rain, the earth hardens," said one senior Nissan source, citing a popular Japanese proverb that means relationships become stronger after a period of strife. All five sources within the alliance, which also includes Mitsubishi, declined to be named because they are not authorized to speak with media. Nissan and Renault are each planning substantial restructuring and cost cuts that could affect tens of thousands of jobs, with the Japanese company to announce its measures on May 28 and its French partner likely to follow the next day. Before that, Mitsubishi, Nissan and Renault are holding a joint news conference on May 27 during which they are expected to outline the philosophy behind their new "leader-follower" approach to the alliance. The sources said the companies were unlikely to disclose many details at the events this week of how the new approach will be used to share costs as the companies were still working on specific projects. However, the crisis at both carmakers has accelerated efforts to resolve the disagreements that have stymied collaboration and cost-sharing in technology and product development for five years, the sources said. Mitsubishi, Nissan and Renault all declined to comment officially about alliance plans. 'Leader-follower' The alliance has steadily ramped up output over the years, delivering over 10 million vehicles for the first time in 2017, the first full year after Mitsubishi joined the partnership.

Renault-Nissan-Mitsubishi pool $200 million to invest in tech startups

Fri, Jan 5 2018PARIS — The Renault-Nissan-Mitsubishi alliance is setting up a $200 million mobility tech fund, three sources said, in the latest move by major carmakers to adapt to rapid industry change by investing in startups through their own venture capital arms. The fund, due to be unveiled by Chief Executive Carlos Ghosn at the CES tech industry show in Las Vegas next Tuesday, will be 40 percent financed by Renault, 40 percent by Nissan and 20 percent by Mitsubishi. "It will allow us to move faster on acquisitions ahead of our competition," one of the alliance sources told Reuters. Frederique Le Greves, a spokeswoman for the Renault-Nissan-Mitsubishi alliance, declined to comment. The traditional auto industry model based on individual ownership is threatened by pay-per-use services such as Uber, as well as ride- and car-sharing platforms, a challenge heightened by parallel shifts towards electrified and self-driving cars. Wary carmakers are struggling to embrace changes and technologies that some of their executives are only beginning to grasp. To accelerate the process, many are investing directly in the new services — and gaining access to intellectual property — via their own corporate venture capital (CVC) funds. BMW has purchased stakes in a plethora of ride-sharing, smart-charging and autonomous vehicle software firms through its 500 million euro ($600 million) iVentures fund, the biggest such in-house facility belonging to a carmaker. Among others that have been increasingly active are General Motors' GM Ventures, with $240 million, and Peugeot-maker PSA Group's 100 million-euro investment arm. CVC funds, a familiar feature of innovative sectors such as tech and pharmaceuticals, have become more commonplace among carmakers since the 2008-9 financial crisis. They let companies skip some of the formalities otherwise required for new investments, and pounce more swiftly on promising startups. The Renault-Nissan-Mitsubishi venture will also obviate the current need to thrash out the ownership split for each new alliance acquisition. It represents a further step in the integration of the carmakers as they pursue 10 billion euros in annual synergies by 2022. France's Renault holds a 43.4 percent stake in Nissan, which in turn controls Mitsubishi. Ghosn heads Renault and chairs all three.