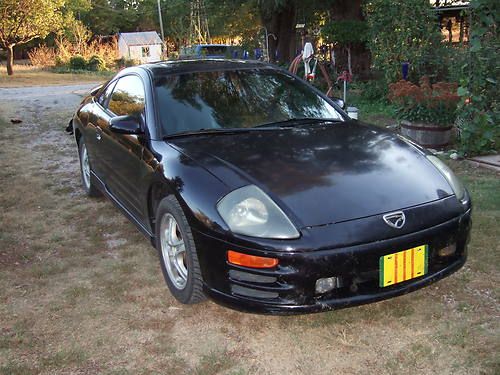

1998 Mitsubishi Eclipse Gst Hatchback 2-door 2.0l on 2040-cars

Manahawkin, New Jersey, United States

|

I am looking to sell my 1998 Eclipse GST. I have owned this car for about 4-5 years and spent a lot of time bringing it to where it should be. I no longer have the time to invest into it so now it's up for sale.

The car has 88k miles on it and the interior is clean an totally re-done. It does need some TLC so I will mention that stuff first. The paint needs work and this as my 3rd phase which I was never able to get to. It's not horrible but it does need some work. The other things it needs is a new oil pan/gasket sealer. There is a smaller drip coming from the pan. It's another one of those things I just never had the time to get into. Those are the only 2 major things that come to mind as what I would consider major things. Do remember the car is 15 years old so that averages out to 5800 miles a year, this thing has been babied in retrospect.

Here is some vehicle specific info 1998 Eclipse GST 88,000 Miles 2.0L Turbo 5 Spd Power Locks/Windows/Sunroof Performance & Custom Stuff - Extreme PSI Intake Kit - NGK Premium Wire Set - NGK Copper Spark Plugs - Megan Racing SS Turbo Outlet(O2) Housing - Mishimoto Fan & Aluminum Shroud Kit - Mishimoto Radiator - Mishimoto Radiator Hoses (Blue) - 1G OEM Bypass Valve (BOV) - Megan Racing Coilover Damper Kit - Megan Racing Front Strut Bar - Punishment Racing FMIC Kit - Triple Pillar Pod - Prosport Evo Series Electrical Boost Gauge, Electrical Oil Pressure Gauge, Wideband Air Fuel Ratio Gauge - 14B 1G Turbo - Megan Racing Short Shifter - HKS Turbo Timer Type-1 - Hallman PRO Boost Controller Kit - Sparco R100 Racing Seats (with mounts and sliders) - Megan Racing Turbo Cat Back Exhaust - Brand New OEM 2G Downpipe - Custom Black Interior (including Sparco floor mats and shift boot) In addition I also have the following which would be included - Additional set of 4 wheels/tires - 2nd spoiler (aftermarket) - 2G OEM rear bumber - 14B Turbo - 2G OEM seats - Other additional 2G OEM parts (nuts/bolts/paneling) Please feel free to reach out to me with any questions you may have. I am also pretty firm on the price but there is some wiggle room for serious buyers. I would rather keep this car for my daughter then give it away just because I have no time to work on it anymore.

If you want a fun project that is drive-able now, look no further. |

Mitsubishi Eclipse for Sale

2000 mitsubishi eclipsegt 2door powermoonroof 3liter 6cylinder w/airconditioning

2000 mitsubishi eclipsegt 2door powermoonroof 3liter 6cylinder w/airconditioning 2001 mitsubishi eclipse(US $5,995.00)

2001 mitsubishi eclipse(US $5,995.00) 2007 mitsubishi eclipse gt coupe 2-door 3.8l no reserve

2007 mitsubishi eclipse gt coupe 2-door 3.8l no reserve 2007 mitsubishi eclipse gt coupe 2-door 3.8l(US $11,059.00)

2007 mitsubishi eclipse gt coupe 2-door 3.8l(US $11,059.00) 1995 mitsubishi eclipse gst 4g63 turbo import tuner 2g dsm project car 107k mi

1995 mitsubishi eclipse gst 4g63 turbo import tuner 2g dsm project car 107k mi 2001 eclipse gt

2001 eclipse gt

Auto Services in New Jersey

World Jeep Chrysler Dodge Ram ★★★★★

VIP HONDA ★★★★★

Vespia`s Goodyear Tire & Svc ★★★★★

Tropic Window Tinting ★★★★★

Tittermary Auto Sales ★★★★★

Sparta Tire Distributors ★★★★★

Auto blog

Mitsubishi and Renault-Nissan expand partnership, US will get new sedan

Tue, 05 Nov 2013Mitsubishi and Renault-Nissan have just inked an alliance that might, hopefully, reverse the ailing fortunes of the Mitsubishi brand in the US market. The big chunk of news is that Mitsubishi will produce two Renualt-based models for sale in the US market, and that they'll be built at the Renault-Samsung factory in Busan, South Korea.

The plans call for a D-segment sedan to be followed by a C-segment offering. Based on the cars built at the Busan factory, that means Mitsubishi will be getting the SM5 and the SM3, a pair of handsome sedans that are based on Renault-Nissan's D and C platforms, respectively. These same platforms underpin a number of US market Nissans (not to mention a number of cars from Renault), namely the Pathfinder, Maxima, Quest and Murano for the D platform and the last-generation Rogue and Sentra for the C platform.

Besides the sedan production, Nissan and Mitsubishi will be expanding their joint-venture company, NMKV, which produces Kei cars for the Japanese market. A new, all-electric offering will be born from the partnership, likely based on a Kei car platform. The partnership between the three brands will also lead to increased sharing of technology, particularly relating to electric cars.

Mitsubishi CEO vows to stay in US on heels of Suzuki's departure

Wed, 07 Nov 2012By now, you're surely aware that Suzuki is pulling out of the US market. It was a bit of a foregone conclusion to most who've been paying attention to the automotive realm, but it still sent a small shockwave through the industry. And one of the most oft-heard retorts goes something like this: "Next up: Mitsubishi."

It's easy to understand why many question Mitsubishi's existence in the States. After all, now that Suzuki is gone, Mitsubishi is the Japanese automaker with the fewest sales in America. Furthermore, the automaker's market share has dropped from .7 percent to just .4 percent after seeing sales fall 29 percent to 50,103 units through October.

In any case, Mitsubishi fans needn't worry. Speaking to Automotive News, Mitsubishi President Osamu Masuko said, "We have no intention whatsoever of withdrawing from the US market." That's about as clear as clear can get. It's also worth mentioning that Gayu Uesugi was just named chairman of Mitsubishi Motors North America, and his main responsibility will be to revitalize the brand in the US.

Mitsubishi's new Outlander could herald the return of Ralliart

Tue, Aug 3 2021Mitsubishi is on the cusp of reviving its dormant Ralliart performance line, and a new report suggests the label will return on a sportier version of the latest Outlander PHEV. The model could make its debut in late 2021. Ralliart's unexpected revival was announced during a presentation made to investors in May 2021, though no further details were released. Japanese magazine Best Car learned from unnamed sources that the new Outlander PHEV (pictured) expected to break cover in the coming months will be the first Ralliart-branded model in several years. How Mitsubishi will make the Outlander PHEV worthy of a name rooted in rallying remains to be seen. The transformation will include a race-inspired body kit, according to Best Car, and we're hoping more power from the electrified powertrain is part of the equation as well. While the Ralliart label could merely denote a sporty-looking trim level, like Mercedes-Benz's AMG Line designation or F Sport in Lexus-speak, there's a chance it will sooner or later be linked to racing. Mitsubishi boss Takao Kato revealed his team is considering returning to the rallying scene in the coming years to renew ties with the company's racing heritage. He stressed a rally program hasn't been approved yet, partly because racing is expensive, and he clarified that a new Lancer Evolution is not in the cards even though shareholders are requesting one. Interestingly, we should have seen the Outlander Ralliart already; it was reportedly scheduled to be unveiled at the 2021 edition of the Tokyo Motor Salon but the event was canceled due to pandemic-related concerns. Mitsubishi could keep the model under wraps until the 2022 show opens its doors, or it might introduce it elsewhere a little earlier. Regardless, if the report is accurate we won't have to wait long to find out how Ralliart has been reinvented. As for the next Outlander PHEV, it will land in late 2021 first in Japan and arrive in U.S. showrooms halfway through 2022. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.