1997 Mitsubishi Eclipse Gsx Hatchback 2-door 2.0l on 2040-cars

Cainsville, Missouri, United States

Body Type:Hatchback

Vehicle Title:Salvage

Engine:2.0L 1997CC 122Cu. In. l4 GAS DOHC Turbocharged

Fuel Type:GAS

For Sale By:Private Seller

Make: Mitsubishi

Model: Eclipse

Warranty: Vehicle does NOT have an existing warranty

Trim: GSX Hatchback 2-Door

Options: Sunroof, Leather Seats

Drive Type: AWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 140,000

Exterior Color: Gray

Number of Doors: 2

Interior Color: Gray

Number of Cylinders: 4

Mitsubishi Eclipse for Sale

Sharp 2006 mitsubishi eclipse - loaded and well maintained! $600 below kbb!(US $7,500.00)

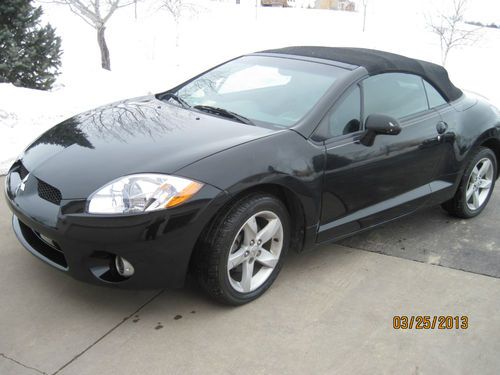

Sharp 2006 mitsubishi eclipse - loaded and well maintained! $600 below kbb!(US $7,500.00) 2007 mitsubishi eclipse spyder gs convertible 2-door 2.4l(US $7,999.00)

2007 mitsubishi eclipse spyder gs convertible 2-door 2.4l(US $7,999.00) 2001 mitsubishi eclipse gt coupe 2-door 3.0l, no reserve

2001 mitsubishi eclipse gt coupe 2-door 3.0l, no reserve 1994 laser rs 5spd many new parts very clean talon eclipse dsm(US $2,750.00)

1994 laser rs 5spd many new parts very clean talon eclipse dsm(US $2,750.00) Manual transmission coupe fwd black leather interior silver alloys sportscar v6(US $10,995.00)

Manual transmission coupe fwd black leather interior silver alloys sportscar v6(US $10,995.00) 2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $8,900.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $8,900.00)

Auto Services in Missouri

Unnerstall Tire & Muffler ★★★★★

Tim`s Automotive ★★★★★

St Charles Foreign Car Inc ★★★★★

Scherer Auto Service ★★★★★

Rogers Auto Center ★★★★★

Rev Diy Automotive Repair ★★★★★

Auto blog

2023 Mitsubishi Triton coming after the Ford Ranger overseas

Sat, Jun 24 2023The next-generation Mitsubishi Triton is coming soon to a trail near you — assuming you live outside of the United States. Known as the L200 in some global markets, the truck was shaped by a new, more rugged-looking design language that Mitsubishi calls "Beast Mode." Dark preview images published by the Japanese brand depict a pickup that has been reinvented from the ground up. While the current Triton features rather unusual proportions characterized by a slanted shut line and a super-sized rear overhang, its successor looks a little more conventional, though we'll make the final call when we see it in the metal. We spot a tall, upright front end with LED accents that Mitsubishi describes as "resembling the sharp gaze of a hawk" and a rectangular grille with both "Mitsubishi" lettering and the company's emblem. 2023 Mitsubishi Triton View 4 Photos We're curious to find out what's under the sheet metal. Mitsubishi recently expanded its European range with badge-engineered Renault models, such as the Clio-based Colt. Nothing suggests that the Triton is a badge-engineered version of another truck, and the current-generation Nissan Navara (which is unrelated to our Frontier) is likely too old to provide its platform. Could it be the other way around? Mitsubishi is part of the Renault-Nissan alliance, and the group strives to achieve economies of scale, so the Triton could also preview the next Navara. Of course, this is pure speculation. Nothing is official at this stage, and Mitsubishi isn't ready to release technical details. It hasn't published images of the interior yet, but a preview video embedded above suggests that upmarket models will receive a free-standing touchscreen for the infotainment system and a dial to select one of the transfer case's different options. Broadly speaking, we're expecting that the next Triton will offer a more SUV-like interior to reflect the fact that, even outside of America, buyers are increasingly using pickups as daily drivers. Mitsubishi will unveil the next-generation Triton in Thailand, where the model will be built, on July 26. The truck will be sold in a long list of nations, including several countries in Latin America and in the Middle East, but it doesn't sound like it will be offered in the United States. Elsewhere, the Triton will compete in an increasingly crowded ring against the Ford Ranger, the Volkswagen Amarok, and the Toyota Hilux. Related Video: This content is hosted by a third party.

2017 Mitsubishi Outlander Sport | Affordable outlier

Wed, Jul 19 2017The $10,000 new car, truck or SUV is long dead, and the $15,000 price point is nearly so. To purchase a new vehicle and enjoy everything buying "new" implies (warranty, reasonably new tech, a long life and affordable financing), you have to spend $20,000, probably more like $25,000. We'll take a look at spending that $20K at a Mitsubishi store. If you've forgotten Mitsubishi, don't blame yourself. A generation ago, Mitsubishi's American arm had a financial meltdown, precipitated by a consumer financing plan offering zero interest and zero payments for way-too-many-months. When it was time to make payments customers simply returned the cars, leaving Mitsubishi holding a very expensive inventory worth substantially less than what was owed. Later, of course, the economy had its own meltdown, from which most of America's automotive industry rebounded. But Mitsubishi, with a sparse lineup and little marketing, is still working on that. A recent infusion of Nissan capital will help, as should Nissan's managerial oversight. Despite Mitsubishi's aging lineup, the Outlander Sport stands out - Mitsubishi continued to build it while other manufacturers were belatedly awakening to the subcompact crossover segment. And while its platform is old and its menu of standard and optional equipment dated, if you're on a tight budget you might find it attractive. Dimensionally, the Outlander Sport is a plus-size relative to Mazda's CX-3 and Honda's HR-V. For a detailed comparison of all three entries, visit Autoblog's comparison tool here. The CX-3 boasts the shortest wheelbase (101.2 inches), while the Honda sits at 102.8 inches and the compact Outlander Sport stretches to 105.1. In overall length the Mitsu is close to both the CX-3 (168 inches for the Mazda, 171.5 for the Outlander Sport and 169.1 inches for the HR-V). Finally, the Outlander Sport's 3,000-pound weight is within a belt notch of the Mazda's 2,900 and the Honda's 2,900 (front-wheel drive/manual). The Mitsubishi sheetmetal and stance is reminiscent of Audi's Q5, and while the similarity is coincidental, it's fun to have an upmarket look in a $20,000 car. Of course, once the Outlander Sport is turned on, that upmarket vibe is gone. For your $20K you'll get a 2.0-liter engine offering 148 horsepower, just north of Mazda's 146 and Honda' s 141.

Mitsubishi Outlander PHEV sales reach 33,000 worldwide

Wed, Jul 30 2014It can be difficult to see from the US, where the Mitsubishi Outlander Plug-in Hybrid is not yet available, but the all-wheel drive SUV is a big hit in Europe and Japan. In fact, we learned at the Plug In 2014 Conference in San Jose, CA this week that Mitsubishi has sold over 33,000 copies of the PHEV around the world. The breakdown is that Mitsubishi has delivered 15,000 units in Japan and 18,000 in Europe. Fuminori Kojima, Mitsubishi Motors North America's senior manager of incentives, told AutoblogGreen that the country with the highest sales rate in Europe is Holland, with about 6,000 units sold that thanks in part to generous incentives for plug-in hybrids there. The Euro-spec version on hand in San Jose has three regen levels (the normal D mode, plus B1 and B2). We got to take a spin around the block, but the battery was mostly depleted (it was a popular attraction in the Ride & Drive) and so we were driving on gas. In the gallery from Plug In 2014, you'll note that the Outlander PHEV requires at least 95 octane (RON) unleaded fuel, which is 91 octane (AKI) premium fuel in the US. We don't know what the US version will need, but we've heard it will be "completely different." The Outlander has a 12-kWh battery and should have an EV range of around 30 miles. Whether or not it will have a CHAdeMO fast-charging port in the US is still undecided, as is the question of whether it will have a 3.3 or 6.6 kW onboard charger. The timeline Kojima gave for the Outlander's US arrival was October or November of 2015, since the SUV still needs to be tested and homologated for the US, Kojima said, but the real problem is that Mitsubishi can't build enough. "The battery production capacity is limited," he said. "So that's why, [the] first [focus is the] domestic market and Europe showed more demand." As as an example, he mentioned not only the incentives but also said that the charging infrastructure is more built up in Europe. "We'd like to have it [in the US ] as soon as possible, of course," he said. According to numbers from the European group Transport And Environment (see press release and sales chart below), overall plug-in vehicle sales have been doubling each year since the new breed was introduced in 2010. Last year, almost 50,000 plug-in vehicles were sold in the EU, with the Renault Zoe EV, Outlander PHEV and Volvo V60 Plug-in at the top of the pack.