1996 3000gt Automatic, Red/tan, Coilovers, 20 Brand New Rims And Tires on 2040-cars

Naranjito, Puerto Rico, United States

Body Type:Coupe

Vehicle Title:Clear

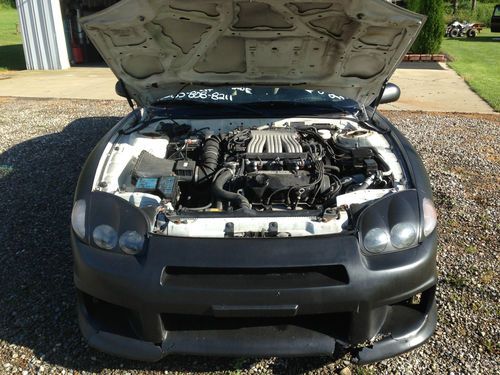

Engine:3.0L 2972CC 181Cu. In. V6 GAS DOHC Naturally Aspirated

For Sale By:Private Seller

Number of Cylinders: 6

Make: Mitsubishi

Model: 3000GT

Trim: SL Coupe 2-Door

Options: CD Player

Drive Type: FWD

Safety Features: Anti-Lock Brakes

Mileage: 200,000

Power Options: Air Conditioning

Exterior Color: Red

Interior Color: Tan

1996 Mitsubishi 3000GT SL no turbo RED/TAN, brand new coilovers and 20 inch rims and tires. Excellent condition. New all wheels hubs.

Mitsubishi 3000GT for Sale

1997 mitsubishi 3000gt vr-4 wrecked good motor and tranny and interior.(US $4,500.00)

1997 mitsubishi 3000gt vr-4 wrecked good motor and tranny and interior.(US $4,500.00) 1995 mitsubishi 3000gt vr-4 coupe 2-door 3.0l(US $10,000.00)

1995 mitsubishi 3000gt vr-4 coupe 2-door 3.0l(US $10,000.00) 1999 mitsubishi 3000gt base coupe 2-door 3.0l(US $5,500.00)

1999 mitsubishi 3000gt base coupe 2-door 3.0l(US $5,500.00) Mitsubishi 3000 gt 1998 v6 automatic no reserve auction!!!!!!(US $3,250.00)

Mitsubishi 3000 gt 1998 v6 automatic no reserve auction!!!!!!(US $3,250.00) 1997 mitsubishi 3000gt base coupe 2-door 3.0l

1997 mitsubishi 3000gt base coupe 2-door 3.0l 1993 mitsubishi 3000 gt sl

1993 mitsubishi 3000 gt sl

Auto blog

Mitsubishi pondering $2B share sale?

Sun, 15 Sep 2013Mitsubishi makes the brilliantly fast, wonderfully fun Lancer Evolution. Outside of that road-going rally car, the rest of the range is pretty poor - the new Outlander isn't bad, but the subcompact Mirage looks like might've been competitive five years ago, while the Galant and Lancer have suffered from serial neglect.

This hasn't just lead to rumors of Mitsu's death in America; the subsidiary of the massive Mitsubishi Group has been in trouble at home, too. It was bailed out by three other Mitsubishi Group companies - Mitsubishi UFJ Financial, Mitsubishi Heavy Industries and Mitsubishi Corporation - between 2004 and 2005, according to Bloomberg. Now, it's attempting to extricate itself from "emergency mode," as analyst Koichi Sugimoto told the financial site, adding that "they're still in the very early stages of recovery."

As part of the bailout, Mitsubishi issued its three saviors billions of dollars of preferred shares, which don't have voting rights. The problem is, Mitsubishi hasn't issued dividend payments since 1998, and these stocks aren't exactly competing with Apple or Google, in terms of value. In other words, they're mostly worthless. With a public offering, Mitsubishi is expecting to raise 200 billion yen, or about $2 billion, in order to reduce the number of preferred shares. If all goes according to plan, it will wipe out preferred shares by March of 2014, or the end of fiscal year 2013.

Mitsubishi expects a massive loss this year due to the coronavirus pandemic

Mon, Jul 27 2020TOKYO — Mitsubishi Motors reported Monday a $1.7 billion (176 billion yen) loss for April-June, and forecast more red ink for the fiscal year, as the coronavirus pandemic slammed auto demand around the world. The Japanese automaker had posted a profit of 9.3 billion yen for the fiscal first quarter the previous year. Quarterly sales shrank 57% to $2.2 billion (229.5 billion yen). The maker of the Outlander sport utility vehicle and I-MiEV electric car expects to chalk up a $3.4 billion (360 billion yen) loss for the fiscal year through March 2021, because of the fallout from the outbreak. This would be MitsubishiÂ’s biggest loss in at least 18 years, according to company financial records dating back to 2002. “To pave the way to recovery, the top priority of all executives is to share a sense of crisis with employees to execute cost reductions,” Chief Executive Takeo Kato told reporters. The shaky results come as Mitsubishi MotorsÂ’ alliance partners Nissan and Renault of France work to recover from the downfall of their former chairman, Carlos Ghosn. Ghosn was out on bail, awaiting trial on various financial misconduct allegations in Tokyo, when he fled late last year to Lebanon. He has said he is innocent of the allegations of under-reporting future compensation and breach of trust. Mitsubishi Motors has denounced Ghosn. Mitsubishi officials, in a news conference relayed in a call to reporters, promised a turnaround, pursuing growth in Southeast Asian markets, where its profitability is relatively strong, and building on its strength in four-wheel drive and “off road performance.” They said they expect the companyÂ’s results to recover next fiscal year, once COVID-19 is brought under control. Product development will leverage “synergies” with alliance partners, and labor costs will be cut through pay cuts, hiring freezes and voluntary retirements, the automaker said. Tokyo-based Mitsubishi also said itÂ’s working on innovative technology, such as improved diesel engines, electric vehicles and autonomous driving. Its electric vehicles are a strength as environmental standards continue to toughen, especially in major markets like China, it said. But it warned the outbreakÂ’s impact on auto demand was worse than what the auto market suffered during the 2008 financial crisis and so a recovery will take time.

Mitsubishi Evo successor on hold?

Fri, 22 Nov 2013Just take one look at Mitsubishi's latest vehicles, both concept and production, and it's obvious that fuel economy - not performance - reigns supreme. With this in mind, it shouldn't be too much of a surprise that Caradvice.com.au is suggesting that Mitsubishi is putting development of future performance models (like the 2013 Lancer Evolution GSR shown above) on hold as the company focuses on electric and plug-in vehicles.

In speaking with Mitsubishi managing director of product projects Ryugo Nakao at the Tokyo Motor Show, the publication says that the entire Lancer redesign is on hold, meaning that the aging Lancer Evo and Ralliart will have to contend with fresh performance models like the Volkswagen GTI and Subaru WRX. That being said, the article doesn't completely shut the door on another Evo - in fact, it goes on to indicate that when a new generation does hit the streets, it will almost certainly do so with some sort of electric-assisted powertrain, an oft-repeated rumor that got its legs as early as 2010.